With the significant benefits brought about by the successful signing of the first phase of the Sino-US trade negotiation agreement on January 2020, 1, the US stock market has generally risen and expanded the gains.Byron Wien, a wealth management expert at the Blackstone Group, pointed out thatS&P 500 IndexThis year is expected to rise above 3500 points.

With the significant benefits brought about by the successful signing of the first phase of the Sino-US trade negotiation agreement on January 2020, 1, the US stock market has generally risen and expanded the gains.Byron Wien, a wealth management expert at the Blackstone Group, pointed out thatS&P 500 IndexThis year is expected to rise above 3500 points.

As the U.S. stock index rises, the income of index insurance is bound to rise.Understanding the actual benefits of index insurance policies and mastering the management methods of insurance policies is bound to becomeU.S. Index InsuranceA lesson that policyholders must learn.

American Life Insurance GuideTwo readers of, provided us with the annual policy statement sent by the insurance company to her/theirs, and agreed to authorize the release.

insurGuru™️In this article, we will refer to these twoAmerican Insurance CompanyTake the account statement as an example to illustrate how the credit of index insurance is calculated, and how much can the income of the insurance policy be?And, as an insured person, how to check the balance of the policy account and manage the policy.

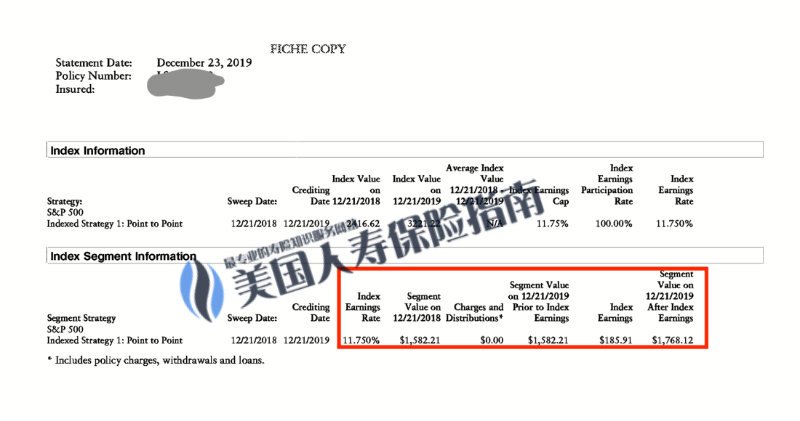

1. 11.75% income statement of index account

In the above annual interest calculation statement of the policy account, we hide the information of the policyholder as required.The policyholder pays monthly premiums, and the bill shows the income of this premium in December 2018.

From the bill, we can see that on December 2018, 12,S&P 500 IndexIt is 2416.62 points.one year later,S&P 500 IndexIt was 3211.22 points, an actual increase of 32.88%.The insurance company’sCapped CAP interest rate valueIs 11.75%, therefore,The account rate of return for this premium in December was 12%.

紅框部分標明了,保單賬戶里的這筆錢,在2018年12月21日至2019年12月21日之間,獲得了11.750%的收益。

Before interest calculation, the account amount on December 2018, 12 was $21.After accruing interest, a gain of US$185.91 was obtained. The accumulated balance of the insurance policy account for this premium in December was US$12.The next interest calculation date for this money is December 2020, 12.

It is worth noting thatThe maximum return limit of each index insurance company is different.受美聯儲在2019年的3次降息的影響,上述這家保險公司在2019年年中後,將保單封頂CAP利率值從11.75%調整到了9.75%。

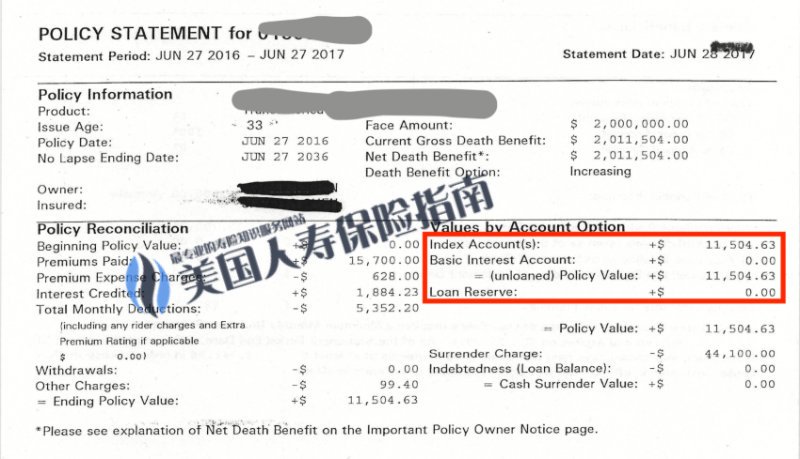

2. 15.00% income statement of index account

第二份人壽保險年度對賬單的信息比第一份更加全面。從這一份的人壽保險年度對賬單中,我們可以得知這是一份基礎保額$200萬美元的保單。投保人按年進行保費繳存,對賬單顯示的是2016年6月至2017年6月的全年保費在賬戶里運行情況。

This part of the red box indicates thatThe policyholder paid a lump-sum annual premium of $15,700, In deductionInsurance costs and related expensesAfter that, the remaining premiums will enter the index account and be used as principal for interest calculation.

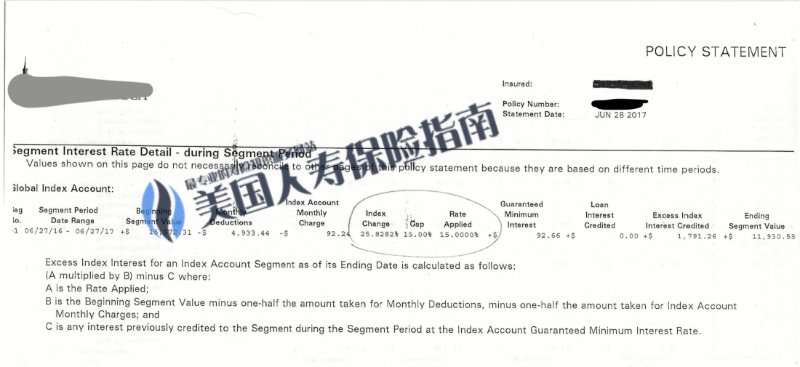

圖二展示了這筆進入指數賬戶的錢的具體收益情況。圈出來的部分展示了在2016年6月27日,至2017年6月27日之間,該保險公司掛鈎的市場指數,實際上漲了25.8282%。該保險公司在當年的Capped CAP interest rate valueIt is 15%, and it has been maintained to this day (as of press date).Therefore, the annual account rate of return for this policy is 15%.

In the policy information in Figure XNUMX,Pointed out that the actual income of the policy account for the year was $1884.23.DeductedAll costs, And after accruing interest, the annual balance of the policy account is $11504.63.The next interest calculation date for this money is June 2018, 6.

How to view our policy income statement?

Insurance companyAfter the insurance application is approved and the lifetime policy is issued, a policy "cash value" account will be opened for the policyholder, and the annual policy income andRelated insurance costs, Will be calculated or deducted from this account.

The insurance company will send annual statements to policyholders every year.This annual statement is an important document for checking the health of the policy account, and it is also the basis for the annual policy review work.

The more commonly used way to manage policy accounts is similar to the "online banking system". Insured persons can also access the corresponding insurance company's website or App with the policy number, and perform policy account management queries after registration and login.

DeadlineAmerican Life Insurance GuideAccording to statistics, among the many U.S. insurance companies facing the Chinese market, onlyGlobal Atlantic(AbbreviatedGA.Accordia Life) This insurance company,Internet access to insurance policies and account management methods have not yet been provided (as of the date of publication).The policyholders of the company's products can only inquire about policy information by calling.

Article summary

Through the annual policy account statement display,insurGuru™️Insurance AcademyIn this article, the analysis points out how to calculate the credit of index insurance, how much the specific income of the insurance policy may be, and three common problems as an insured, checking the balance of the policy account and the method of managing the policy.

Life insurance policy account holders, especiallyIndex insurancePolicy account holders need to manage the policy account regularly and communicate withProfessional Brokerage AdvisorConduct an annual review to check whether the operation of the cash value of the policy deviates from the predicted value of the policy design plan at the time of insuring, so as to truly achieve the financial goal of preventing and managing policy risks.

20210405 update:

>>>Interview with policyholders|"I thought the decimal point (return rate) was wrong", 2021 index insurance posted the bill, the rate of return set a new record

>>>Popular science posts | What are the 4 most common index strategies in the US index insurance and retirement annuity?

>>>2020 U.S. Insurance Company Ranking: The Best Index-Based Insurance Company Ranking Top3