(American Life Insurance Guide 08/03/2020 Irvine)American AIG Insurance(American International Financial Group) recently adjusted the benefits of index policy policyholders——The back cover rate of return for the S&P 500 account has been adjusted to 10.20%, and the policyholders of the MLSB and PIMCO index strategy accounts are given an additional 10% interest-bearing income.

The first insurance group to increase benefits in the epidemic

along withCOVID-19 outbreakThe continued impact on the U.S. economy, the asset management capabilities and risk control capabilities of different insurance companies,Is going through a huge test.

Before the American Life Insurance Guide ©️News reportIn, some well-known life insurance company brands have adoptedStop selling, increase prices, reduce policy benefits (reduced income/dividends)Measures to deal with this problem.

AIG Insurance willS&P500 Index Strategy AccountThe back cover rate of return has been reduced from 11.25% to 10.20%, which is still 0.20 percentage points higher than the industry average.Simultaneously,Under the circumstances that the outlook for the new crown pneumonia epidemic in the United States is not clear, it is the first time that the insured person’s participation in dividends and benefits has been increased..

This time, AIG's welfare adjustments have decreased and increased, contrary to the operation of some insurance companies that "only decrease but not increase".The new CEO BrianAIG Life DepartmentDrastic reforms and more rigorous risk management have shown results in the new crown epidemic.

(>>>Recommended reading:What is the capped rate of return of an index policy?How does it affect the growth of my policy account?)

(>>>Recommended reading:How does index insurance calculate interest? How much is it?How does our index account get profit?)

Volatility index yield leads the market

OnNew Coronary Pneumonia OutbreakIn the early days,American Life Insurance Guide©️ The policy index strategy that is more common in the Chinese community has been carried outEvaluation, The performance of the ML Strategic Balanced account in the AIG index insurance policy is very impressive in the global pandemic in 2020.

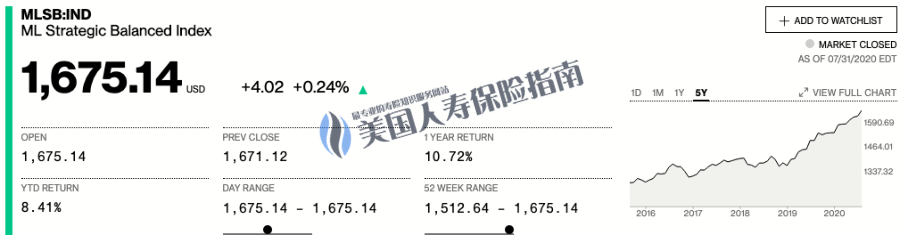

As you can see from the figure below, as of the end of July 2020,The one-year return of the index was 1%, and the YTD return reached 10.72%.

Taking the market closing on 7/31 as an example, if our policy is settled annually on this day, then the policy account’sThe one-year yield is 10.72%,As shown in FIG.

After AIG adjusted and increased the policy’s interest calculation method this time, policyholders holding the policy index account will receive10% addedTherefore, the policyholder will get 10.72% x 1.1 = 11.792% of annual policy accounts accrue interest, Higher than the 500% capped return rate of the S&P10.20 index strategy account.

Can I enjoy this interest accrual upgrade?

In the Chinese community, many families hold AIG index account insurance policies, so whether we can get the new interest-bearing income this time has become a topic of our concern.

American Life Insurance GuideThe person in charge called AIG to confirm,As long as the policyholder’s premium is deposited after July 2020, 7, It will correspond to the earning interest accrual upgrade that takes effect this time.And if you are alreadyAIGIndex Policy AccountFor the holder of the policy, the policy is already in effect, and the interest accrual on the income is calculated based on your premium payment method. (Finish)

(>>>Recommended reading:Graphic evaluation!Counterattack 2020, which is the best performing IUL index strategy and insurance company?)

(>>>Recommended reading:The business experience of life insurance companies during the epidemic in the United States, how should we, as consumers, choose?)

(>>>Recommended reading:How about AIG Life Insurance Company? AIG company credit rating and product insurance evaluation )