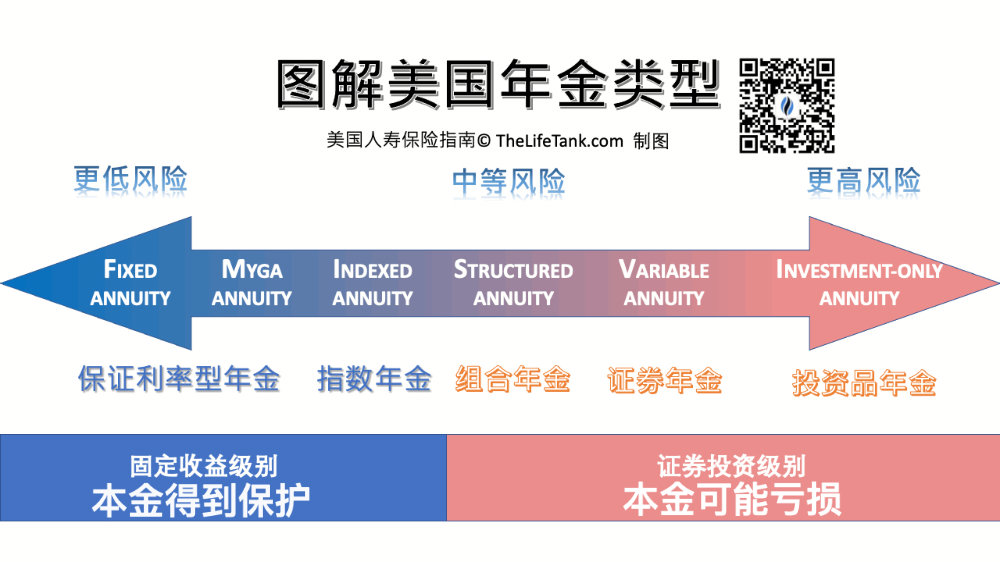

The content of my popular science today is to introduce a class used to "protect funds",at the same time"Pursue the growth potential of the market”; a special type of insurance product that is functionally bounded between “index annuity” and “security annuity”—combination annuity, also known as structured annuity, or buffer BUFFER annuity insurance.

What is a composite annuity?

Combination annuity is a brand-new insurance product, the English abbreviation is RILA.

It is an insurance account that provides long-term financial management for retirement and has a tax-deferred function.Compared with index annuities, it has the following two advantages.

#1 VS Indexed Annuity Cash Value Accumulation Potential

In the current interest rate environment,Some excellent index annuity accounts give a capped rate of return (CAP) of 500% to 7% for S&P10 accounts.

The portfolio annuity uses a certain amount of risk in exchange for benchmarkingS&P 500 Indexcapped yield, providing a higher thanIndex Annuity Insuranceannual capped yield.

(>>>Recommended reading:Gadget|Which specific annuity insurance is suitable for me?What is the latest interest rate indicator?)

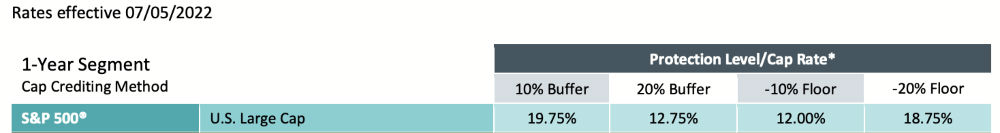

Take the United States2021Q4VA sales champion——Example of portfolio annuities under Jackson National Life Insurance Company,The cap yield (CAP) corresponding to -10% loss protection is 19.75%.

(©️Jackson National official websitepublic statement)

(©️Jackson National official websitepublic statement)

(>>>Related reading:What does the capped yield Cap in index insurance mean?)

#2 VS Indexed Annuity Asset Protection Choices

AndIndex Annuity InsuranceUsually provide exclusive 0% principal protection,Portfolio annuity accounts can choose from different levels of protection.

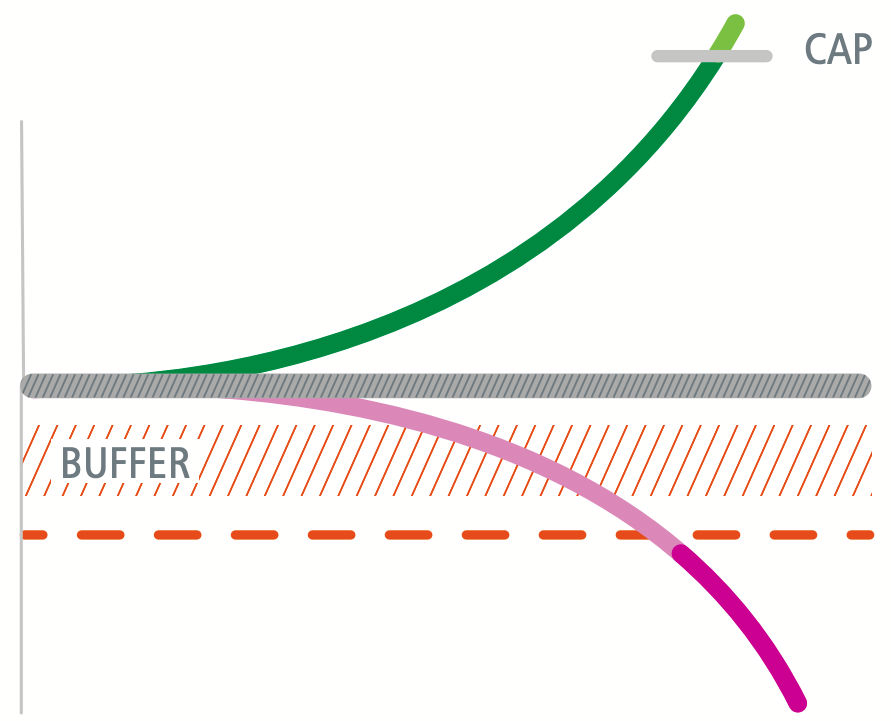

The most common protection method for portfolio annuities,It is the BUFFER loss protection function.As shown in the purple curve in the figure below, if the market falls after a year, as long as it does not fall below the orange dotted horizontal line in the BUFFER area, the funds in the account will be protected.

As I write this article today,S&P 500 IndexYTD fell by -17.93%. If the BUFFER of our combined annuity account is 20%, then our money will not suffer losses due to this, thus achieving the purpose of asset protection and protecting the principal of the policy account.

The advantages of the composite annuity are also its disadvantages- If the market performance drops significantly, say, the S&P 500 drops 30% in a year, then minus our 20% protection, the funds in the account will be subject to a -10% drop.

At the same time, a higher protection interest rate requires more costs to be paid, and the corresponding peak yield will be lower.

(>>>Related reading:"Never lose money", what does the FLOOR core function of asset-based life insurance mean?)

Article summary

“For every risk, there is a possibility of reward.”

Portfolio annuity insurance relative toIndex Annuity InsuranceGenerally speaking, policyholders take the initiative to bear some market risks, but in exchange for higher capped yields and income potential.

As the risk coefficient changes, the attributes of annuity insurance products have also moved from stable fixed-income accounts to the more risky securities investment field.

More BUFFER protection functions make portfolio annuity insurance completely different from pure securities investment annuity insurance.

Therefore, composite annuities are suitable for those

1. Neither meeting the cap rate of return of the index annuity;

2. They don't like the market risk fully borne by securities annuities;

of this type of group.

Finally, let us carefully review the pictures at the beginning of the article, compare the map distribution of different annuity insurance types, and combine our risk tolerance and return potential preference to make a choice that suits our hearts. (End of full text)

(>>>Related Products:【Jackson Market Link Pro℠】Jackson National Life Insurance Jackson National Life Combination Annuity Insurance| Insurance Guide_User Evaluation_Product Manual)

(>>>Recommended reading:Gadget|Customize my lifelong pension/annuity account plan by yourself)

(>>>Related reading:"Exclude the possibility of asset return being '0'", another new option for US dollar asset insurance)