Bloomberg Businessweek predicts that starting from 2020, economic growth in the United States will level off.In the past two years in the industry media, the concept of "the world is entering an era of sustained negative interest rates" has long been hyped.With the help of various self-media, it seems that the global "economic recession" is a foregone conclusion.

For the direction of the market, there are XNUMX Hamlets in the eyes of XNUMX people.Although the future is full of various uncertainties,How to not lose money in a "bear market" environment is the common goal of all those who seek financial freedom.insurGuru™️Insurance AcademyThis article willWill share how to use the "index" strategy and recommended design solutions to combat the market downside risk brought by the "bear market".

What does "bear market" mean?

A bear market, called "Bear Market" in English, refers to a situation where the index of a major stock market has fallen by more than 20%.

The most famous bear market in American history began during the Great Depression in 1929. Since then, bear markets have occurred almost every five years.By the 5s, the bear market had fallen by 1960%, while in the early 29.3s, the bear market had fallen by 1970%.

Today, the American people are still in a 10-year bull market with rapid economic growth. When this bull market will end and when the bear market will come, we have no answer.But according to the laws of history, what should come will definitely come.

How does the "bear market" affect us?

Each bear market brings painful memories.The deepest memory of the bear market in American history is that since 1929, in three years, the S&P 3 has fallen by 500%, and almost every family’s wealth has been emptied.

According to statistics, the average duration of a bear market is one and a half years.This does not sound very long, but the balance of our stock market account needs to be restored to the number before the bear market, butAt least 5 years.

In reality, this is by no means as simple as "the market has fallen 10%, as long as it rises by 10%, there is no loss".If you lose 50% of your stock, you need a 100% increase in your stock to recover your capital; if you lose 90%, you need your stock to increase 900% if you want to recover your capital.

For example, if you have $10 in your stock account, and then go through a bear market, and you want to recover to $10 in your account, you need to wait at least 5 years.

And in the American Life Insurance Guide NetworkRetirement income columnLi pointed out that a famous question raised by CBS:"What kind of retirement income plan is it that will allow millions of people to lose 30-50% of their life savings when they are approaching retirement?" People who have experienced the stock market bear market in 2000 and 2008 will never want to put the wealth they have accumulated hard to waste in the face of a bear market.

Therefore, although we do not know when the bear market will reappear, we can take action to prepare for a potential recession.

One of the solutions is to use "indexes."

What is the index?

An index is a comprehensive price figure that contains a basket of stocks and is calculated in some way.For example, the earliest Dow Jones Index was composed of the stocks of 12 listed companies.Index insuranceCommon inS&P500 Index, Is a price index that records the stocks of 500 major listed companies in the United States.

Using an index, we do not directly invest in a specific stock or stocks, but diversify the risk, and the return is determined by the trend of the index.

(Related Links:How much money can I earn by buying the S&P500 index?What is the average rate of return on the U.S. stock market?)

The use of index insurance

We introduceIndex insuranceThe reason is that this type of insurance product provides the technical advantages of both "index" and "insurance".

On the one hand, our cash value account has been guaranteed upside potential, and given the index's capped interest rate, participation rate and spread guarantee.On the other hand, this part of insurance can provide a guaranteed minimum return value, such as 0%, 1%, to cope with the sharp decline in the market brought about by the bear market.

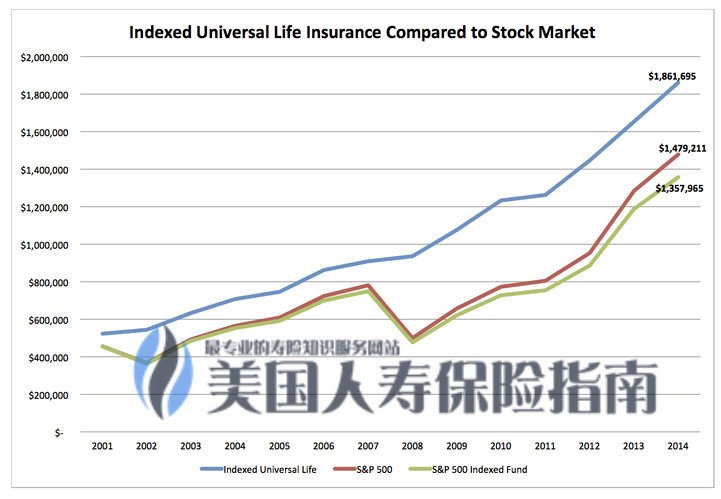

Therefore, in essence, by using the "index strategy" of the US insurance policy, we can share the fruits of rising stock market yields until the capped interest rate is reached, and at the same time avoiding the market down losses caused by the bear market.

Therefore, in essence, by using the "index strategy" of the US insurance policy, we can share the fruits of rising stock market yields until the capped interest rate is reached, and at the same time avoiding the market down losses caused by the bear market.

This is a method used to hedge the risk of a bear market.

(Recommended reading:How do financial insurance companies make only profits but not loses through asset management?)

The other side of index insurance

Any kind of thing has two sides.The other side of index insurance is that it is a lifetime life insurance product, so it has all the costs and charges of this type of life insurance product.

The various costs of index insurance are mainly concentrated in the first 5-10 years of the policy’s effectiveness, including various categories such as policy fees, management fees, etc., and the specific charging situation, insurGuru™️Insurance CollegeColumn: "IUL Index Insurance Fees Description"There is a specific introduction in the article. After 10 years of the policy’s effectiveOther costsWill drop very significantly.

At the same time, the index policy also has a penalty period ranging from 5 to 10 years.Therefore, it is not suitable for groups who want to get significant cash value growth within 5 or 10 years.But it is precisely because of this characteristic that an index policy can help most people form the habit of long-term regular savings.

Exponential policy risks and recommended solutions

Finally, the biggest risk of buying index-type insurance policy financing may come from unreasonable insurance policy design.

Each index policy is tailored according to the applicant's body, age, and financial situation.If you use an index policy for financial management,Our recommended design method is to use the minimum death compensation of this policy allowed by the IRS, and at the same time, deposit the upper limit of the insurance premium allowed by the IRS, so that the index policy can be used 100% growth potential.

The reason for this design is that life insurance has a cost for death compensation. We use a very small part of the insurance premium to purchase the minimum death compensation, and most of the remaining funds will go to the cash value account. Exponential strategy for growth.

如果Exponential policyIf the insured amount is too large, then the cost of the insurance policy for death compensation will be higher, and the comprehensive cost of the first 5 to 10 years will also increase, so that the less funds will enter the cash value account for growth.The reality is that salespeople are more willing to push up the insurance coverage of the policyholders, so that they can get more personal benefits.

In view of these characteristics of index insurance, choose a person who understands the U.S. life insurance industryProfessionalsInstead of "sales" personnel, it is very important to design insurance policies based on our interests. (Finish)

(Recommended reading:4 golden rules for buying U.S. IUL index insurance)