OnAmerican Life InsuranceThe last column of the guide:List of Children's Education Fund Plans (XNUMX)In this article, I introduced some outdated education fund plans to help you avoid these “dinosaur pits” that are easy to accidentally open online accounts.In today’s article, I will continue to analyze two more flexible plans that are more suitable for the current tuition growth rate, and compare them at the end of the article, hoping to help parents clarify their choices.

5. Introduction to 529 Plan (Qualified Tuition Plan)

With the annual increase in tuition fees, the state government began to introduce tax incentivesEducation Fund Project, In order to encourage families to save for their children’s education in advance, and to a certain extent retain the natives of the state to continue to receive higher education in the state.529 planSince 2001, it has gradually become the most widely accepted education fund savings plan on the market and the most familiar to young Chinese parents.

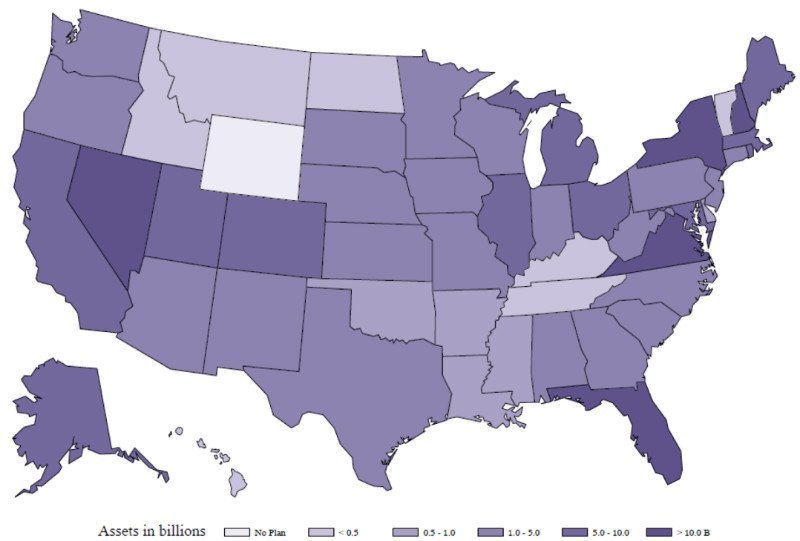

529 planIt is operated independently by the government of each state and the higher education institutions in the state, so many states will have some tax concessions and scholarship preferential treatments for state residents.

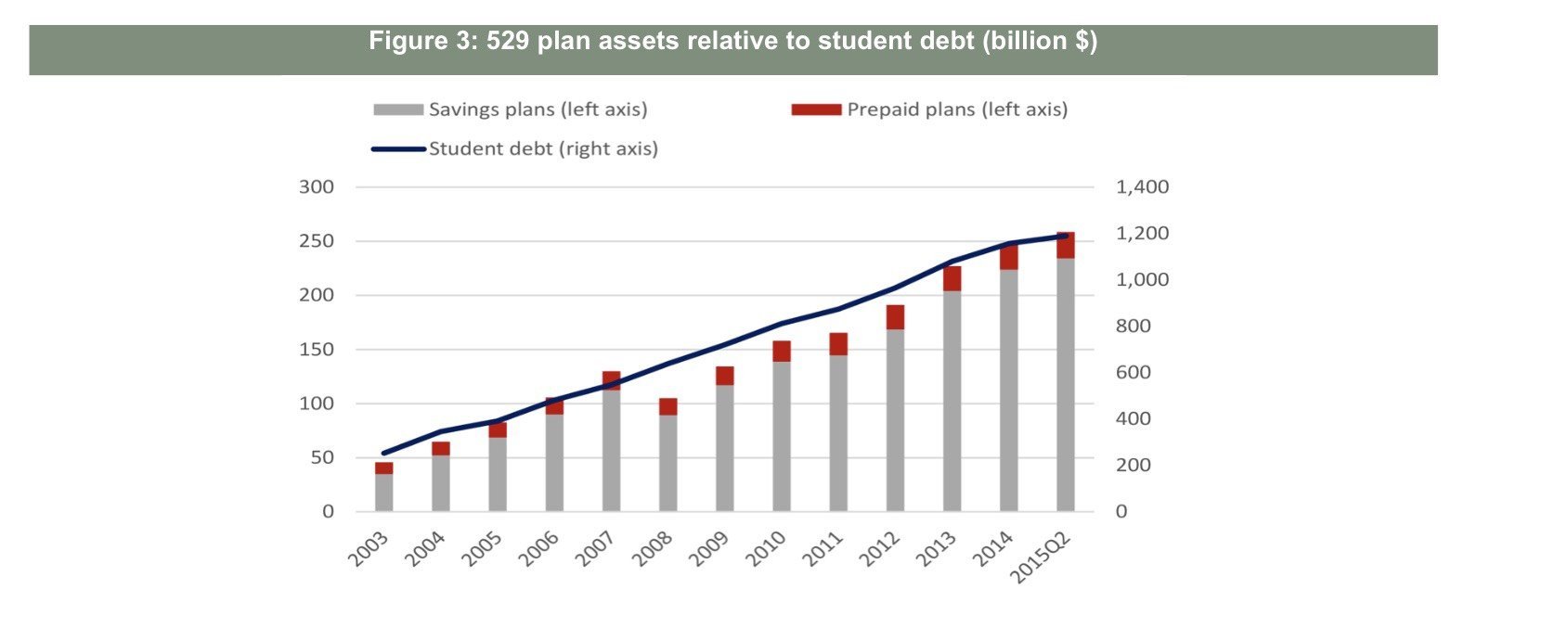

529 planDivided into two categories, prepaid tuition plans and savings plans. According to 2015 Federal Reserve data, there are 108 different types of529 plan, The savings plan accounted for 80%.The three states of New York, Virginia, and Nevada accounted for529 plan35% of total assets.The latest data shows that529 accountThe average deposit in China is about 6 US dollars, which is almost the sum of the tuition and miscellaneous expenses for a year in private universities.529 Education FundAs a parent's asset, it will have an impact on the child's future application for scholarships.

National 529 plan funding data

Let’s talk about two categories in detail below529 planSpecific operations.

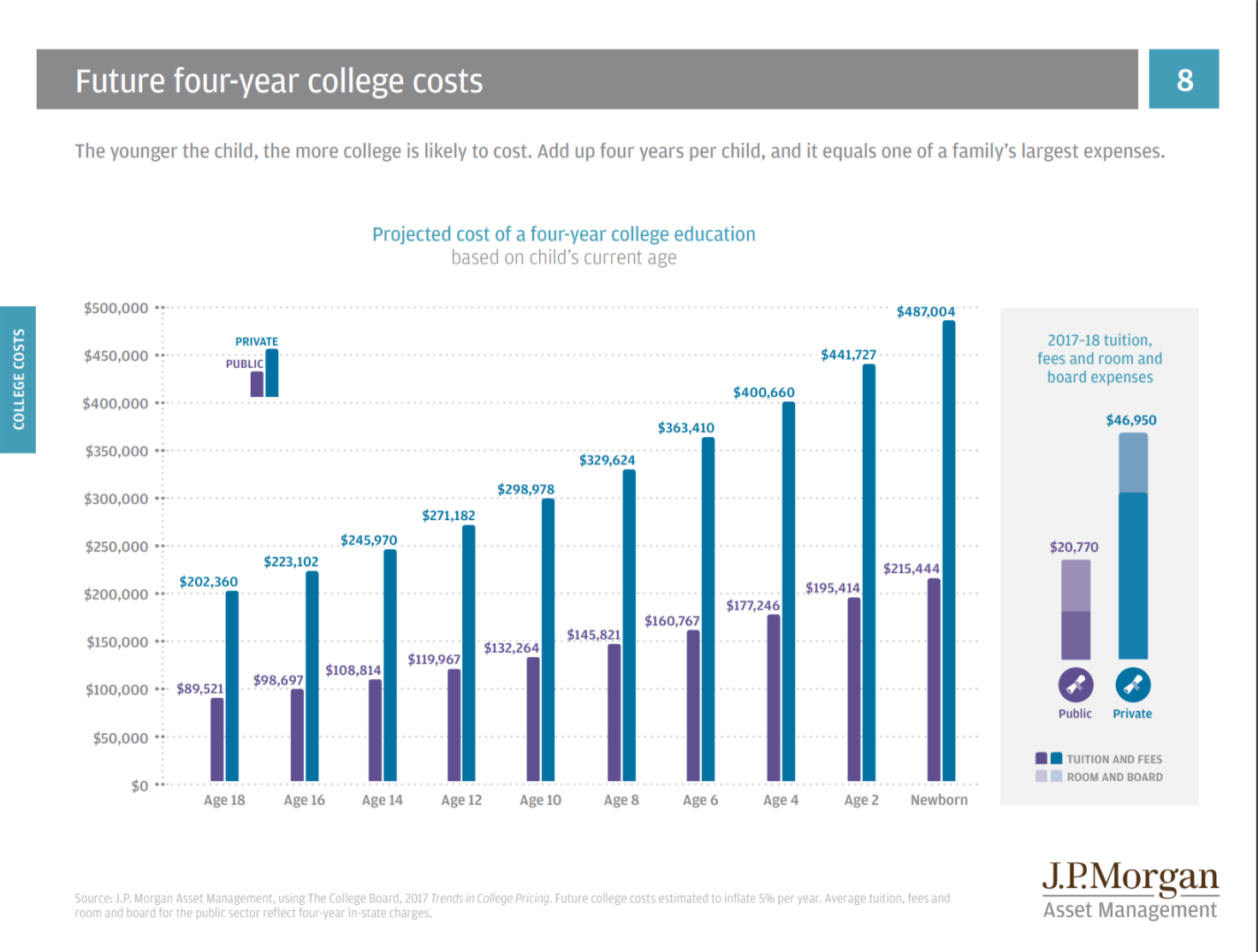

- Prepaid tuition: As the name suggests, the credit fees of public and private universities in the state were purchased in advance to resist the increase in tuition fees.For example, Xiao Ming is two years old, 16 years before college.As shown in the figure below, by the time he goes to university, the public tuition fee will be nearly 20 for four years, and the private tuition will be nearly 45.Xiao Ming's parents, grandparents, and grandparents helped him purchase credits 16 years later from a qualified university in the state at the cost of credits at the age of two.

This money is managed by the state government and invested in mutual funds or bonds in state government trusts.The limitation of this plan is that if Xiao Ming is admitted to an out-of-state or a school not included in the plan's partner colleges in the future, the pre-deposited tuition will be discounted.

JP Morgan University Tuition Forecast Data Sheet

JP Morgan University Tuition Forecast Data Sheet

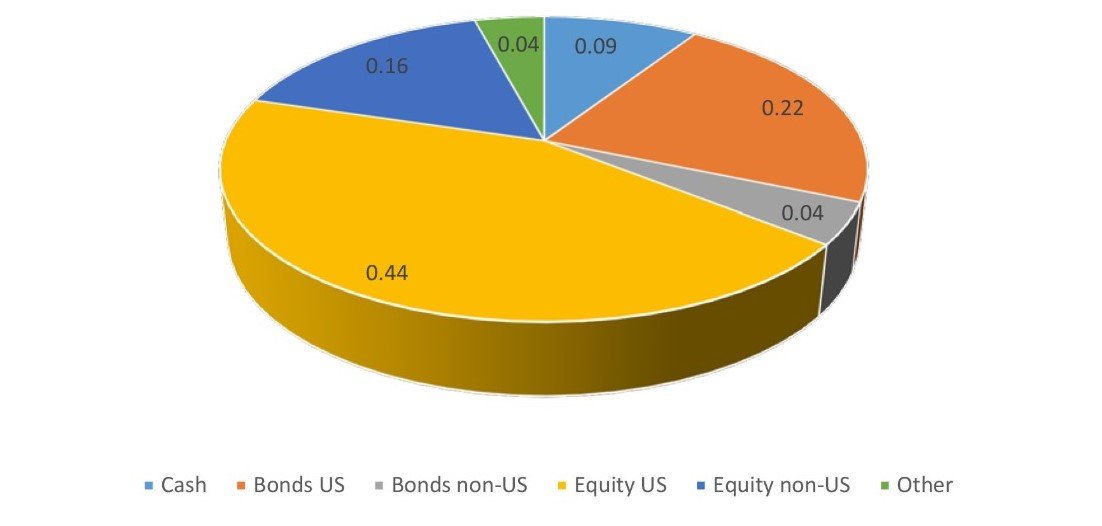

- Savings plan: The second type of plan is equivalent to a Roth IRA for higher education.The funds put into the savings plan will be invested by the state government in designated mutual funds and bonds. Strictly speaking, individuals are not allowed to invest and can only choose the proportion of investment in the plan.

According to data provided by the financial services company Morningstar, the existing529 planAmong them, the selected investment portfolios under each account range from 5 to 345, and the average investment portfolio for each account is around 20.More than 60% of the investment is in the stock market.There are also a small amount of bonds and cash.

How to choose and buy a 529 plan?

529 planIt can be purchased directly from the state government, or from a bank or financial planner.

In terms of fees, due to529 planWith a wide range of distribution channels and a large number of investment portfolios to choose from, there is no uniform standard.

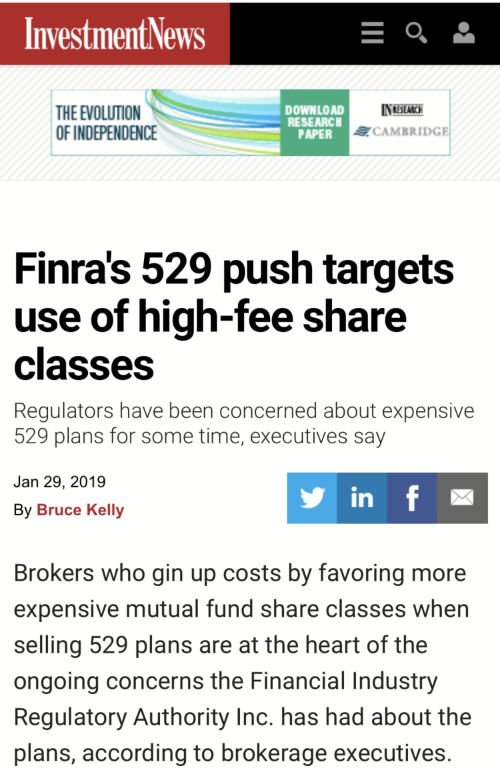

For the direct purchase plan, various service fees and expenses account for between 0.13% and 1.05% of the total amount, and the account opening fees of third-party institutions account for between 0.58% and 1.88% of the total amount. Different plans charge different fees.This year, the U.S. financial sector regulator (FINRA) has already released the news through major media, and has begun to criticize major agency companies.529 planStrengthen supervision of fees.

2019 on strengthening529 planRegulatory news

Quota limit: Put in every year529 Tuition Savings PlanChina Money has a "reasonable online".This is usually the estimated cost of future tuition, with the tuition of the most expensive private university in the United States as the maximum amount.

Taxation:put into a529 planThe money in is cash after tax.If the increased income is used for higher education tuition, living, and textbook fees, it will enjoy tax exemption.

Beneficiary: The donor does not have to be the beneficiary’s family, anyone can put the money.The account is managed by an adult, and the beneficiary is usually the person who will spend the tuition.It can be changed every year.

Source: For student loans, Federal Reserve Bank of New York Consumer Credit Panel/Equifax. For savings and prepaid plans, Morningstar

Source: For student loans, Federal Reserve Bank of New York Consumer Credit Panel/Equifax. For savings and prepaid plans, Morningstar

In the above picture, we can basically see that the education fund plan and the increase in student loans are basically in the same proportion, with exceptions in 2008. The stock market turmoil and financial crisis in 2008 led to529 planWith the shrinking of funds invested in bonds and mutual funds in China, education savings have also decreased.If the child is going to college this year and the family can't spend more money, they may need to carry some student loans.

6. Cash Value Life Insurance Education Fund Program

Life insurance with cash value began to enter the market around the 40s.Later, different kinds of products appeared because of the development and evolution of the market.Which appeared after 1997Index Universal InsuranceWith its flexibility of deposit and withdrawal, guarantee function, and tax-free benefits, IUL has gradually been used in education fund planning for children.

First of all, I want to emphasize the most important function of life insurance, and the original intention of every insured is to protect the family and lover.Commercial insurance bears the burden of government medical care and pensions, and accordingly provides tax-free income and highly leveraged "returns" for policyholders and beneficiaries.

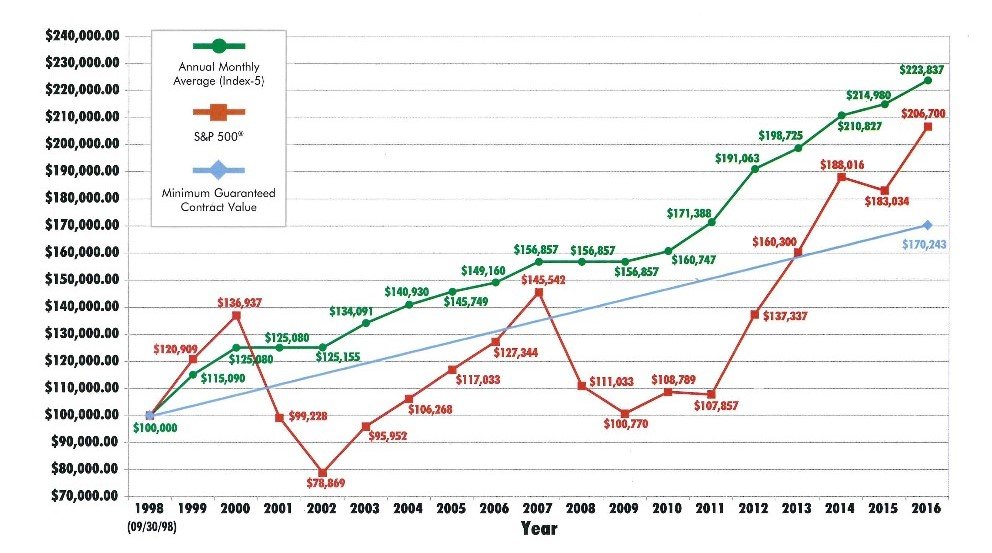

There are more than 800 insurance companies in the United States. Each company has different products and different investment strategies. It is impossible for us to compare them one by one in this article.Taking index products as an example, there will usually be strategic choices for S&P 500 and not directly participating in the market.When the market is good, revenue growth will be capped (about 10%-12%), and when the market is falling, the bottom line will be locked at 0%.

Comparison of the trend of stock market investment income and policy income, taking the deposit of $1998 in 100,000 as an example

Different ages have different policy design methods. Take a 3-year-old boy as an example:

- A company insured a policy of 100 million, starting from the age of 3, depositing $8000 per year for 15 years.

- When 18-21 years old go to school, you can spend $4 each year as an education supplement.

- This money does not affect the application for scholarships.

- At the age of 30, you can use $7.5 as a down payment to buy a house or start a business.

- From the age of 65, he can also give out more than $15 in tax-free retirement pensions every year until he is 90 years old.

- Different families have different budgets and children's ages, so they can be customized.

Quota limit: The upper limit of the deposit per year for each policy is determined by the IRS National Taxation Bureau, which varies according to the age of the insured and the denomination of the policy.The basic rule is that the greater the insured amount, the greater the amount, and the older the age, the greater the amount.

Taxation: The money put into the policy is cash after tax, and the cash value of the policy is provided that it does not exceed the maximum amount prescribed by the IRS for each policy.

Beneficiary: Before the child reaches adulthood, the parent shall be the policy holder, and it can be transferred to the child after adulthood.Insuring a single lifetime provides protection and cash value accumulation, and the death claims will be passed on to future generations at the time of death.

Function comparison of 529 plan and life insurance education fund plan

| ESA/529 Plan | Life Insurance Education Funding Plan | |

| duty free | (I.e. | (I.e. |

| Value-added income | (I.e. | (I.e. |

| Guaranteed | ❌ | (I.e. |

| Impact award/bursary application | 影響 | Does not affect |

| Persistent | ❌ | (I.e. |

| Use restrictions | will get | No |

| Major illness/injury protection | ❌ | (I.e. |

| Death protection | ❌ | (I.e. |

summary

From the Custodial Account, Coverdell Savings Account/ESAS, Education Bonds, Education Savings introduced in the previous articletrustFour ways, to the analysis of this article529 plan And using the cash value of life insurance as an education plan are relatively mature solutions in the US market.If you need to plan your children's education fund according to your family's financial situation, please seek a professional broker to understand the design plan.

Recommended reading:

01. Where is the university tuition deposited? Comparing the advantages and disadvantages of 529 plans and life insurance

02. 2018 university tuition fees have skyrocketed, how to plan for the education fund for children's universities?

03. List of Children's Education Fund Plans (XNUMX): How to avoid "dinosaur pits"