(American Life Insurance Guide Editor’s Note) With no cash account valueTerm life insurance(Term) is completely different,Whole life insuranceThe policy allows policyholders to choose Level (equal) or Increasing (increasing) death compensation amount (insurers usually call these two options Option 1 or Option 2, or Option A or Option B).

in ourPolicy design plan In the insurance policy, it will be clearly stated that the type of insurance policy is Level or Increasing.mostlyUniversal insuranceThe policy (UL) allows the policy owner to switch between Level and Increasing.

Savings Participating Policy(whole life), it’s a little more complicated. They use dividends to purchase additional death compensation protection to achieve the purpose of increasing death compensation.But policyholders can also choose to use the dividends for other purposes when applying.

No matter what you choose, as time goes by, the insurance premiums will be deposited more and more, the cash value of the policy will increase, and the death benefit of the policy will also increase.butAmerican life insurance premiumsWhich option basket to put this egg in is most beneficial to the policyholder, and it also requires strategy.This article of the American Life Insurance Guide will help policyholders understand the savings strategy that meets their needs from the perspective of policy Level or Increasing.

What does Level (equal) policy compensation mean?

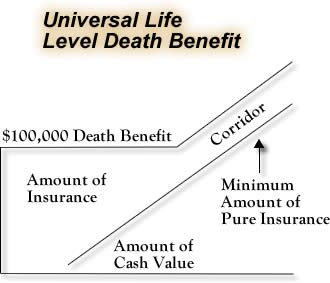

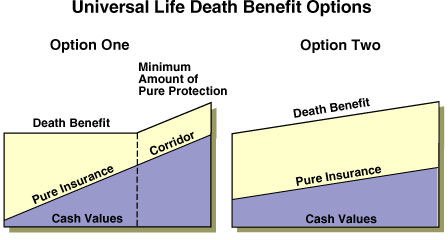

In a policy designed as Level (Flat), the death benefit of the policy is usually a fixed number in the early stages.American Life Insurance Guide 以whole lifeAs an example of an insurance policy, the cost of the policy itself is directly deducted from the premium, and the remaining part is accumulated in the cash value account.Subsequently, the cost of insurance (Cost of Insurance) is deducted from the cash value account every month.

With the passage of time, the cash value in the insurance policy has increased, and the risk coverage (Pure Insurance) that the insured purchases from the insurance company has decreased.American Life Insurance GuideUse a number to illustrate: an insurance policy with an insured size of $500,000, after two years, the cash value account of the policy has $3,000, then only need to purchase an insurance limit of $497,000.

When the insured person passes away, part of the money paid by the insurance company is the net risk coverage (Pure Insurance), such as the above $497,000; the other part is the returned cash value account amount, such as the above $3,000; these two Together, it is the overall compensation for this policy.

What does Increasing policy compensation mean?

On the contrary, if the policy is a universal life (UL) insurance type designed as Increasing.After the death of the insured, the beneficiary will receive a compensation of $500,000 plus any accumulated cash value.In the above example, it is $500,000 plus $3000, and the total is $503,000.

It can be seen from this that in the universal UL policy designed as Increasing, policyholders have beenInsurance companyPurchase a net risk coverage of $500,000.The degree of cash value growth depends on how much insurance premiums are paid.If the premium amount paid is the same as the amount paid in the previous Level (equal) policy, since the monthly purchase of the net risk coverage (Pure Insurance) remains the same, the cash value will be less than that of the Level policy. some.

In what circumstances choose Increasing (growth)?

- A higher risk coverage is needed over a period of time.In this case, it is usually to make education fund planning for the children, or the age of the insured is still relatively young (the insurance cost COI is relatively low).Policyholders can choose to switch to Level when they are older.

- An ever-increasing amount of death compensation is needed.If the policy is used for business objectives (such asSale and purchase agreementEtc.) When the business continues to grow, Level's policy cannot provide corresponding growth.

- The premium payment strategy used to supplement the retirement plan.In order to quickly increase the cash value of the policy, to deposit money by overfunding, it is usually necessary to increase the premium limit by using Increasing.

Recommendations for choosing Level or Increasing

When you need to apply for a lifetime life insurance policy, you will be faced with the choice of whether to use Level or Increasing in the design plan.American Life Insurance GuideNet believes that there are many ways to meet your needs, tailor-made insurance policy design.And an experienced independentInsurance broker, Can provide professional insight and help resources.

(End of full text American Life Insurance Guide)