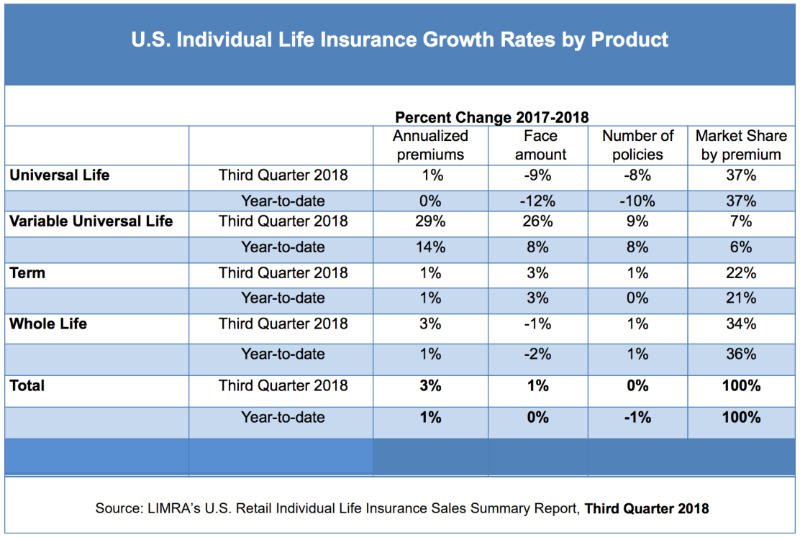

(American Life InsuranceGuide News) — LIMRA released the latestAmerican Life InsuranceAccording to the market report, in the third quarter of 2018, in the US personal life insurance market, annual new premiums increased by 3%.In strongIUL Index InsuranceDriven by sales, there was a positive increase in annual premiums for the second consecutive quarter.

Bottom guarantee against market decline has become the growth engine of IUL index insurance

"The status quo of the market continues to be positive for IUL index insurance products. IUL Index InsuranceInsurance premiums have been increasing for the past eight consecutive quarters,” said Ashley Durham, deputy research director of LIMRA. “IUL index insurance itself includes protection against market declines. This protection is characterized by accumulation of cash value. Combined, it promoted the overall sales in the first three quarters of 2018.In fact, the focus is on the accumulation of cash valueIUL Index InsuranceProduct premiums have risen by 16% during the quarter and have risen by 19% so far this year. "

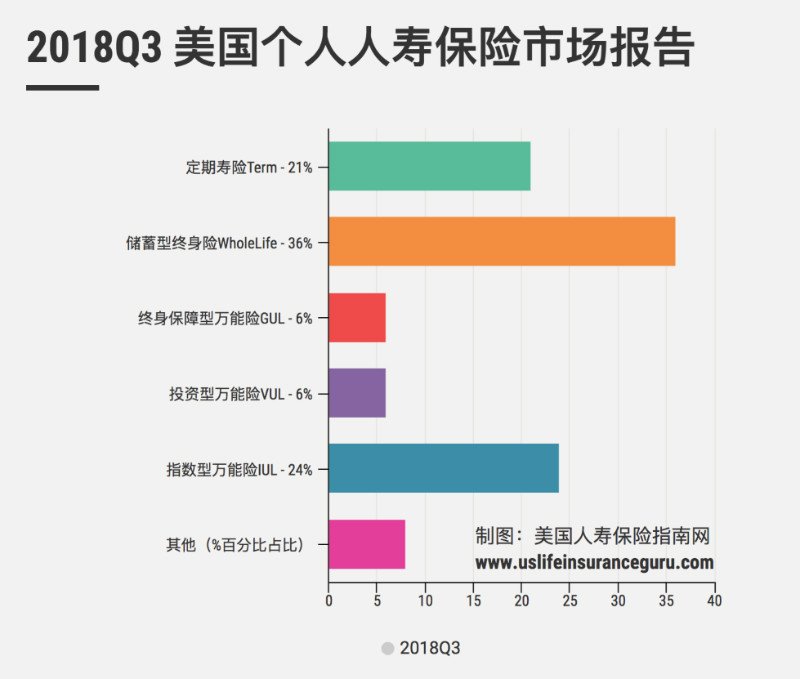

In the third quarter,IUL Index InsuranceNew premiums for New Zealand have increased by 10% year-on-year and have risen by 12% so far this year. IUL index insurance premiums accounted for 65% of all universal insurance (UL) insurance premiums, and in the first three quarters of this year, it accounted for 24% of all premiums in the US individual life insurance market.

UL universal insurance comprehensively occupies the largest share of the life insurance market

The annual new premiums of universal insurance products (UL, Universal Life) increased by 1% in the third quarter.UL Universal InsurancePerformance is mainly affected by fixed interest rate (non-index)UL Universal InsuranceProduct (Fixed Universal Life) impact.Product suspension and interest rate hikes (mainly related to continued low interest rates) continue to trouble fixed interest ratesUL Universal InsuranceProduct (Fixed Universal Life) market.In the first three quarters of 2018,UL Universal InsuranceThe premium of the product is the same as last year. The total market share of UL Universal Insurance is 37%.

Lifetime Guarantee Universal Life (LTGUL), the lifetime guarantee universal life insurance, saw sales decline for the sixth consecutive quarter, dropping by 2018% in 3Q10.Year-to-date LTGUL lifetime protection universal insurance sales have fallen 16% year-on-year. LTGUL lifetime protection universal insurance sales accounted for 17% of UL universal insurance sales and 6% of US personal life insurance premiums.

VUL investment insurance products that focus on market protection are more successful

"VUL Investment Universal InsuranceNew premiums increased by 29% during the quarter and the overall increase so far this year is 14%,” Durham noted. “Top 10 issuancesVUL Investment Universal InsuranceAmong the product underwriting companies, 8 have improved on the basis of their sales in Q2017 3, driving the growth this quarter.The top 10 underwriting companies account for 90% of the overall VUL investment universal insurance premiums in the industry. At the design level, products that pay more attention to protection are particularly successful.In fact, as people pay more and more attention to the balance between protection and protection and growth potential, (such products that focus on balanced design) they are in 2018VUL Investment Universal InsuranceInsurance premiums accounted for 50%. "

In the first nine months of 2018, VUL investment universal insurance accounted for 9% of the total market share of individual life insurance.

The Whole Life savings insurance market is stable, and the agent broker network occupies the largest premium market share

Whole Life Savings InsuranceNew insurance premiums for insurance types rose by 3% in the third quarter.Four of the top ten insurance companies reported growth this quarter.

Agent brokers and underwriters have promoted Whole Life since Q2017 3Savings insuranceInsurance sales.Sold by insurance agent brokers (including BGA)whole lifeThe premiums of savings insurance types have increased by 21% compared with the same period last year.

Although related to Whole LifeSavings insuranceInsurance premiums fell by 2% this quarter, but the agent broker continued to control the largest share (64%) of all premiums in the Whole Life savings insurance market.

From the beginning of the year to now,Whole Life Savings InsuranceInsurance premiums increased by 1%. The overall premiums of Whole Life savings insurance products accounted for 2018% of the total personal life insurance market share in the first nine months of 9.

Term term life insurance growth is flat, and most companies report growth

Compared with 2017,Term term life insuranceNew premiums increased by 2018% year-on-year in both the third quarter of 3 and the first nine months of 2018.In 9Q1, 2018% of U.S. underwriting companies that issue term life insurance reported growth, and more than half of the top 3 underwriting companies reported positive growth.

In the first three quarters of 2018,Term term life insuranceOccupies 21% of the US personal life insurance market share.

從2018年初至今,人壽保險年度新增保費較2017年前3個季度同比增長1%。保單簽發數量在第3季度保持持平,並在2018年前九個月里下降了1%。

LIMRA's research report on the sales of individual life insurance in the United States in the third quarter of 2018 reflects about 80% of the annual premium market for individual life insurance in the United States.

(American Life Insurance Guide Comprehensive report)

About LIMRA

Serving the industry since 1916, LIMRA, a worldwide research, consulting and professional development organization, is the trusted source of industry knowledge, helping more than 600 insurance and financial services companies in 64 countries. Visit LIMRA at www.limra.com.

Recommended reading:2018Q2LIMRA market report:What insurance did Americans buy in Q2018 of 2?