News of Queen Elizabeth's death at the age of 96 has made headlines around the world over the past few weeks.

How much is the Queen's personal property, who will inherit her wealth, what kind of wealth inheritance method she has chosen, and what privileges does the British royal family have in wealth inheritance that ordinary people do not have?These issues have also become the focus of the world's attention.

How much is the Queen's family wealth?

The family property management company of the British royal family was officially launched in 1337. It was originally established to provide financial services for the British monarch, and now it has gradually evolved to serve generations of family members of the Windsor family.

According to Fortune Magazine*, members of the Windsor family, centered around Queen Elizabeth, hold about $280 billion in assets through the Royal Corporation that operates around the world.

After the death of Queen Elizabeth, how did she pass on her personal wealth?

Wills: The Queen's Choice for Inheriting Wealth

In addition to the assets held in corporate justice, Queen Elizabeth also has a large number of personal assets.

These assets, acquired in part through inheritance from her parents, included her death home in Scotland, famous paintings by Monet, and other art collections and investments.

According to Bloomberg estimates, Queen Elizabeth's personal net worth is around $4 million.

According to media reports, the Queen made a plan before her death.Will, after her death, most of her personal assets and collections will be passed on to King Charles in accordance with her will.

40% inheritance tax?Royal Family Vs Ordinary Family

40% inheritance tax?Royal Family Vs Ordinary Family

The UK can be considered to have one of the most punitive inheritance tax regimes in the world.Inheritance tax rates are as high as 40%, according to the official UK inheritance statement.

If an ordinary British resident wants to leave a fortune of £400 million to his children or other heirs - according to British inheritance law,Heirs face paying a 40% inheritance tax - children or other heirs need to pay more than £100 million out of their pockets before they can get the property.

It is rare to be able to leave a family of up to 4 million pounds like the Queen. Does King Charles face a huge inheritance tax because of this?

As a member of the royal family, King Charles, who took up the post at the age of 70, has privileges that ordinary British people can't imagine——He inherited this huge fortune from his mother's will and will be exempt from paying any inheritance tax.

This special legal clause was agreed between the royal family and the British government in 1993.Queen Elizabeth also enjoys this royal privilege when she inherits property from her mother.

6 month payment period?

The gap between the wealth inheritance rights of ordinary families and royal families is not limited to this.

According to the British government's instructions on succession,Heirs must pay this inheritance tax within 6 months.If the payment cannot be made on time, the interest will start to be calculated after 6 months.

King Charles' special status and tax exemptions exempt him from this problem.

For heirs to other British families' fortunes, in short orderRaising such a large amount of cash is a very difficult thing to do.

A simple solution is to provide life insurance with worldwide claims.

By having life insurance as part of a family succession plan, policyholders can provide a dollar-denominated benefit to their children's heirs to cover any estate and inheritance taxes without having to sell the property. (End of full text)

(>>>Related reading:How much life insurance did the family of former US secretary of state and presidential candidate Hillary Clinton buy?)

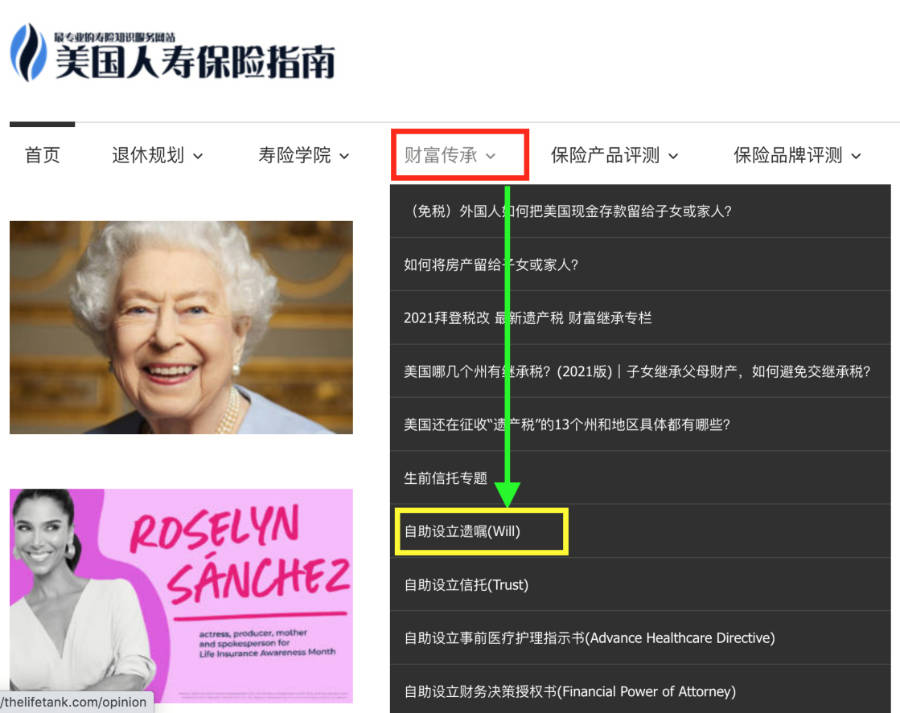

(You can click the menu bar at the top of the page to enter the "Wealth Inheritance" column of the American Life Insurance Guide. With the help of a free will service agency, you can familiarize yourself with the process of setting up a will.)

appendix

appendix

*"Queen Elizabeth II just died. Here's what will happen to her $500 million fortune", 09.08.2022, https://fortune.com/2022/09/08/who-inherits-queen-elizabeth-net-worth-will -fortune-will/