The Powerball lottery with a jackpot size of $7.3 million will be drawn this Wednesday night (January 2021, 1).This is the fifth largest prize in the history of the US lottery.

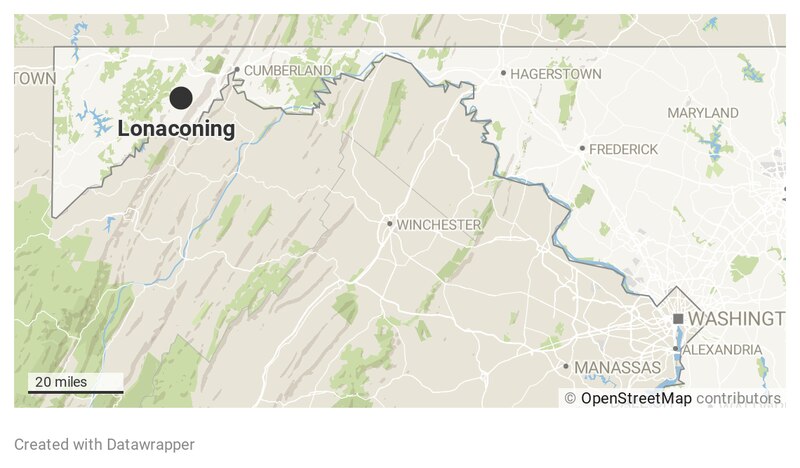

According to the Maryland Lottery Bureau, in a small town with less than a thousand inhabitants in Western Maryland--lonaconing, The first prize winner was born.This is also the first time in a few months that a Powerball lottery has won a jackpot, and the chance of winning is only one in 2.922 million.

According to the Maryland Lottery Bureau, in a small town with less than a thousand inhabitants in Western Maryland--lonaconing, The first prize winner was born.This is also the first time in a few months that a Powerball lottery has won a jackpot, and the chance of winning is only one in 2.922 million.

How is the 7.3 million bonus calculated?

When the first prize of the lottery is drawn, the winner has two ways to receive the prize, one isSingle one-time cash withdrawal.The other is annuity insurance that is guaranteed to be received in 30 years.

And the total prize amount of the Powerball lottery of $7.5 million,It is calculated based on the total amount paid for the 30-year annuity insurance.

If the grand prize winner chooses a one-time cash withdrawal, the jackpot prize is $5.46 million, which will create at least $0.5 million in state taxes for Maryland.At the same time, if calculated according to the highest federal personal income tax rate of 37% in 2021, the grand prize winner will also pay an additional $2 million in federal taxes.

From the book$7.9 billion, To $5.46 million, and then to the final estimated $2.99 million,The gap between before and after is nearly 5 million.

Income Annuity Insurance Behind Powerball

In order to get a full $7.9 million bonus, At the same time, forAvoid spending all the money after a one-time withdrawal, The grand prize winner can choose "Annuity Insurance"This kind of "income protection" method is extracted.

Annuity insurance for Powerball lottery prizes is just oneImmediate income annuity insurance products, It guarantees to pay an amount to the policyholder (winner) every year, and guarantees continuous payment for 30 years.

In order to combat inflation, this Powerball Annuity Insurance also includes an inflation index of 5%, whichThe amount of bonus paid to policyholders is guaranteed to increase by 5% every year.

American Life Insurance GuideIn About "Annuity Insurance TypeIn the evaluation, the role, advantages and disadvantages of this type of income annuity insurance were introduced.

Vinh Nguyen, the 2014 California Powerball lottery winner, won $2.28 million and choseAnnuity Insuranceextract.This choice allowed him to get the full $30 million in full bonus within 2.28 years.

(>>>Recommended reading:Comparison of prices, advantages and disadvantages of American annuity insurance types|2021 edition)

Case: How much annual income can 50 principals create for us?

The operating principle of income annuity insurance is to deposit a lump sum of money at the time of insurance, and then receive it for a lifetime.

This type of annuity is mainly applicable toPeople approaching retirement age.It is also suitable for using annuity insurance accounts to receive funds from individual retirement accounts and 401k accounts.The ultimate goal,They all create a life-long retirement income stream that guarantees payment for a lifetime.

Let’s assume that a 55-year-old policyholder is ready to retire in 5 years, hopingCreate a steady and increasing life-time guaranteed retirement income stream for yourself.

Based on the interest rate and market selection in January 2021, the insured deposits a lump sum of US$1 into the annuity insurance account and receives life from the age of 50.

The amount of guaranteed income received each year will be within a range. The worst product plan should also ensure that the annual income is not less than $30,000 and maintain growth; the best case depends on different annuity insurance plans and market trends.

There are many life insurance companies in the market that provide income annuity insurance account services.But everyLife insurance companyOf asset management capabilities vary.Therefore, putting the same sum of money in, different scheme designs will also lead to completely different effects.

How much money was received in the end, andThe insured’s risk tolerance,Life insurance company, The choice of annuity insurance product plan, and the trend of the market and interest rates,It has a lot to do.

Therefore, the American Life Insurance Guide Network proposed the insured"LYBY"Principles-before applying for insurance, learn the correct knowledge-and in professional financialLife insurance brokerWith the assistance ofManage risks and expectations through different life stages, To create an annuity policy design that suits you, so that you can purchase insurance that can truly protect yourself and your family. (Finish)

(>>>Recommended reading:Comparison|Index annuity fund annuity, which annuity insurance is better? (Version 2022))