The US government stipulates that if each cash deposit exceeds 1 yuan, the bank must declare the source to the competent authority.At the beginning of last year, the well-known Chinese director Yingda deliberately lowered each cash deposit to less than 1 yuan, divided into multiple deposits of more than 40 yuan into a bank account, and was fined more than 17 yuan for money laundering.

Yingda's "smart" behavior caused great trouble to itself, and even carried its reputation as "money laundering".As one of the first countries in the world to formulate anti-money laundering rules, the United States has strict legal regulations and related system guarantees in the field of “anti-money laundering”. It is easy to fall into the trap of “money laundering” without understanding local regulations or tax evasion for personal reasons.

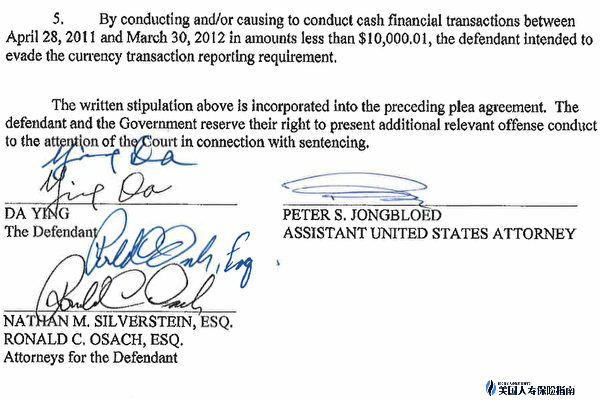

It is understood that Freetech deposited a total of US$6 in six accounts in four banks in the United States, putting him on the back of the reputation of "money laundering" and may face a maximum of 50 years in prison and a US$46.44 in prison. fine.According to the latest report from Xinhua News Agency, Freetech has signed a plea agreement with the U.S. Judiciary, pleaded guilty to accusations of manipulating deposits and evading declarations, and paid US$10 as a "civil penalty", and at the same time paid back taxes that were not paid in the past. . Freetech will accept a sentence in the United States on May 50, 17.6, and may be denied entry into the United States in the future.

As a celebrity, Yingda should not be short of this little money. He may be doing this more to avoid trouble, but he did not expect it to cause greater "trouble" for himself.According to the analysis of many lawyers, in order to avoid taxation or the trouble of filling out "cash transaction reports", it is a common practice for many Chinese in the United States to split large amounts of cash into banks, and Freetech is not the first.In fact, this law was not strictly enforced during Obama's administration. After Trump took office, he took radical measures to protect American interests and related policies were tightened. This may be one of the reasons why Yingda was unfortunately "recruited."

In fact, many regulations have existed for a long time, but the current government requires banks to strictly enforce anti-money laundering laws, especially for foreign students or foreigners. As a result, some normal transactions that consumers originally thought have become impractical.

Ms. Lin of Chinese descent recently wanted to deposit cash into a friend's bank account, but was rejected by the bank for similar reasons.It turned out that she and her friend held separate bank accounts, and the friend borrowed money from her. A few days ago, she took the cash to Bank of America to send money to her friend's account, but the bank refused.

Miss Lin said she was puzzled, because she had done this a few months ago, and the bank could help with the operation by providing the account number of the other party.However, the bank’s counter staff told her that since the beginning of December 2017, the bank no longer allowed outsiders to use cash to directly access other people’s accounts, and remitters had to prove the source of funds through cheques and other methods.

Ms. Lin learned that from the beginning of December at Bank of America, consumers are not allowed to transfer cash to other people's accounts, and must use personal checks, cash checks, or money orders through personal accounts.

It turns out that this rule is not a new one. In 2016, Chase Bank did not allow guests to send cash to others.Ms. Chen, who works at Chase Bank, said that the bank has not allowed this operation since she worked for one and a half years.This is to prevent criminals from engaging in money laundering activities. In the past, many tourists opened accounts after they came to the United States. Some banks no longer accept customers who do not have a fixed receiving address in the United States to open accounts. It points out that in the future, foreigners will open more and more accounts. difficult.It seems that Bank of America, Chase Bank, and Wells Fargo are all following the rules.

Ms. Zhang, who went to the U.S. to give birth in April last year, opened a bank account, but since returning to China after giving birth in September, she hasn’t had any consumption records. When she was about to check the account balance on her mobile phone, she couldn’t log in. I know, there is no consumption record for a period of time, and the bank locked the account.

It turns out that in addition to the inability to directly use cash to remit money, long-term no transactions after opening an account or too frequent transactions can also cause trouble; student Xie, an international student, has encountered this.Like most international students, her tuition and living expenses come from her parents, even if it is overseas remittances.However, classmate Xie traveled frequently and returned to China every time she had a holiday, so she always brought her tuition and living expenses directly to the United States instead of remittance.

When she arrived in the United States and then deposited into her account, these seemingly normal behaviors allowed her to receive a letter from the bank one day, euphemistically indicating that she was asked to withdraw all the money in the account within the specified date, because the bank decided Closing all her accounts, including credit card accounts, is the so-called "killing the whole family."The bank also stated that it would no longer accept any of her business.She went to the bank to ask what happened, but the staff at the counter was helpless, saying that the bank was determined and she could only go to another bank to open an account.

What is even more worrying is that some Chinese small restaurants like to accept cash. Wouldn't this cash be waste paper?

Money laundering is a federal felony

Money laundering is a federal felony and is handled by multiple government agencies in the United States, such as the Department of Justice, the Federal Bureau of Investigation, the Internal Revenue Service, and the New York State Financial Services Agency.

Among them, the National Taxation Bureau bears the main responsibility.On the one hand, the IRS investigates financial transactions involving specific illegal activities (SUAs) for money laundering; on the other hand, any intentional concealment of the source and ownership of funds and merely transferring money from one person to another may be regarded as money laundering.

Taxation is the basis for preventing money laundering. The income from tax evasion is illegal income. Concealing its source is money laundering. It is the tax meaning of preventing money laundering that the majority of ordinary Chinese should pay attention to.The focus of the government's investigation of money laundering is to investigate overseas remittances and cash deposits.

In this regard, some Chinese may stray into money laundering traps due to tax evasion or ignorance, and may be fined, confiscated, or even go to jail.

Banks and insurance companies set out a lot of warning "Red Flags" to prevent money laundering: For example, customers making frequent or large transactions are not in line with past or current business or employment; customers repeatedly deposit less than $10,000 in cash ; Customers deposit and withdraw less than $10,000 in cash before and after opening the safe; many funds are transferred in integers of hundreds to hundreds of thousands; many small amounts of funds are transferred in whole or mostly out or traded and do not match the customer's business or history; large The amount of funds is remitted from foreign customers, there is no reasonable reason, etc.

When the "red flag" lights up, banks and insurance companies need to conduct further checks, and report to the IRS if they are still suspicious.HSBC and Standard Chartered Bank may have been investigated and punished because they discovered a large number of suspicious transactions but failed to report and stop them.

At the same time, judging from the above-mentioned "red flags", many Chinese current trading habits are easy to "success".For example, in order to receive low-income benefits, many Chinese have only a small amount of deposits in the bank, but put a lot of cash in the bank safe; many Chinese have long-term low-income tax returns, but have a lot of cash to buy houses and invest; or a large amount of remittance does not match their income; or accept A large number of remittances did not declare the source of income, etc.

China implements foreign exchange control, and each person can remit up to $50,000. Someone has to ask multiple people to help remit money to buy a house, which can easily be regarded as money laundering.

There is a case of money laundering: A woman in Connecticut deposited 2007 cash from 2009 to 14, ranging from more than $8,000 to more than $9,000, totaling $125,000 to avoid the bank reporting to the IRS. In 2012, she was fined $30,000 in court He confiscated all his cash deposits and sentenced him to 24 months in prison.

As a Chinese, in order to prevent being charged with money laundering charges, one must prove the legitimacy of the source of funds, and second, the legitimacy of the transaction must be proved.To prove the legitimacy of the source of funds, the most important thing is to prove that the funds have been taxed. Even if the funds are gifts or loans, it is necessary to prove that they have been taxed.

If the overseas gift exceeds $100,000, form 3520 must be filled in.Investment immigrants or overseas property holders can also use Form 8938 to declare their overseas assets, and there is a basis for tax declaration when sending money back to the United States.

If a large amount of cash income is checked for tax evasion due to various reasons, please promptly ask an experienced certified public accountant to amend the tax table, and pay taxes and fines, and do not wait until the Criminal Investigation Team (CI) of the Internal Revenue Service (CI) intervenes to investigate the major money laundering matter.Prove the legitimacy of the transaction, that is, the transaction must be legal and supported by documents.

In order to avoid paying taxes, many people in the United States will directly use cash to conduct transactions. If there is too much cash in hand, they are afraid of insecurity, so they secretly deposit in batches in the bank.But when you thought it was a perfect fit, you were targeted by the IRS a long time ago!

Bank of America tellers will notify federal authorities of the transaction when they receive a single deposit of more than $1.So many people know: Don’t make more than $1 in bank deposits each time.But many people don't know that when you deposit more than 4 times a month, you will be marked by the banking system and become a group of people to follow.When the accumulated amount of your deposits over many years is too large, the IRS will definitely check it out.

No more deposits or more withdrawals!

Can't deposit often, what about withdrawing money often? NO, no!

Withdraw money more than 3 times a week, and each time the amount exceeds $1000. In this case, your account will be targeted by the IRS.

How to settle the cash in hand will not be a problem?

1. Each deposit is less than US$2000, and there are no more than 4 small deposits per month.

2. If you have more than 10000 US dollars of legal cash to deposit, you may wish to tell the bank directly and deposit it after filing honestly.

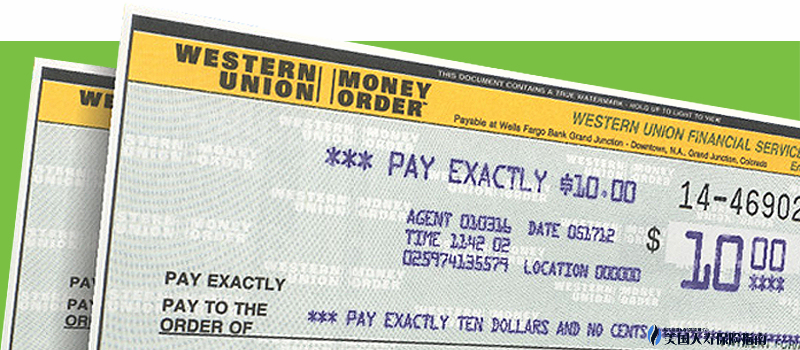

3. Exchange with an acquaintance, give cash to a friend, and he writes a check to you, the deposit and withdrawal of the check will not cause trouble.

4. Go to the post office to buy a cash check Money Order, which is divided into two types: domestic cash check and international cash check. There is no expiration date, and it can be reissued if it is lost.The maximum denomination of domestic (US) cash cheques is US$1000, and each charge is $1.6-2; while the maximum denomination of international checks is $700, and each charge is $4.75. You can send international checks to anyone in the world. , Local bank cash out.

The Internal Revenue Service announced in October 2014 that if there are no signs of illegality, just a series of cash transactions of less than 10 yuan, it will no longer pursue separate money laundering cases.However, the IRS is still processing multiple cases in which more than 2007 taxpayers have been confiscated of 600 million yuan since 4300.Moreover, once the IRS checks you, freezing assets and confiscation of real estate also often happen.

In the United States, the Internal Revenue Service is an awesome institution.The Internal Revenue Service must not mess with tax evasion and tax evasion. Long-term tax evasion will be targeted sooner or later.

The IRS has been monitoring, and I suggest that everyone should be cautious and make reasonable deposits of legal income to reduce unnecessary trouble. Otherwise, once the investigation is carried out, the house will be ruined and jailed!

Pay special attention to those who earn cash, and the same goes for sending money.If you send money to China every month, you should also pay attention. If you don't report your income, the tax bureau will also check it.The confiscation figures show that there are too many people in the United States who are selling such things, and you must be careful.