In the United States, financial investment is far less complicated than in China, because the routines are very mature and the choices are straightforward.Financial management is a method of wealth accumulation.In layman's terms, it is an addition and subtraction.With the same income,Increase investment income, reduce expenses (mainly taxation in personal financial management), and control risks.

First, make a definition of the middle class,The scope of the middle class in the United States is very wide, with an annual income of 5-20 (source: CNN Money) can belong to the category of the middle class (except for some areas such as California, New York, etc.).In addition, there is a standard:Having a car, a house, a retirement fund, and the affordability of insurance can all be counted as a middle class.Usually classified as follows:

Elementary Beginner: Personal income is between 5 and 10

Intermediate: Personal income is between 10 and 20

Advanced + wealthy:> 20

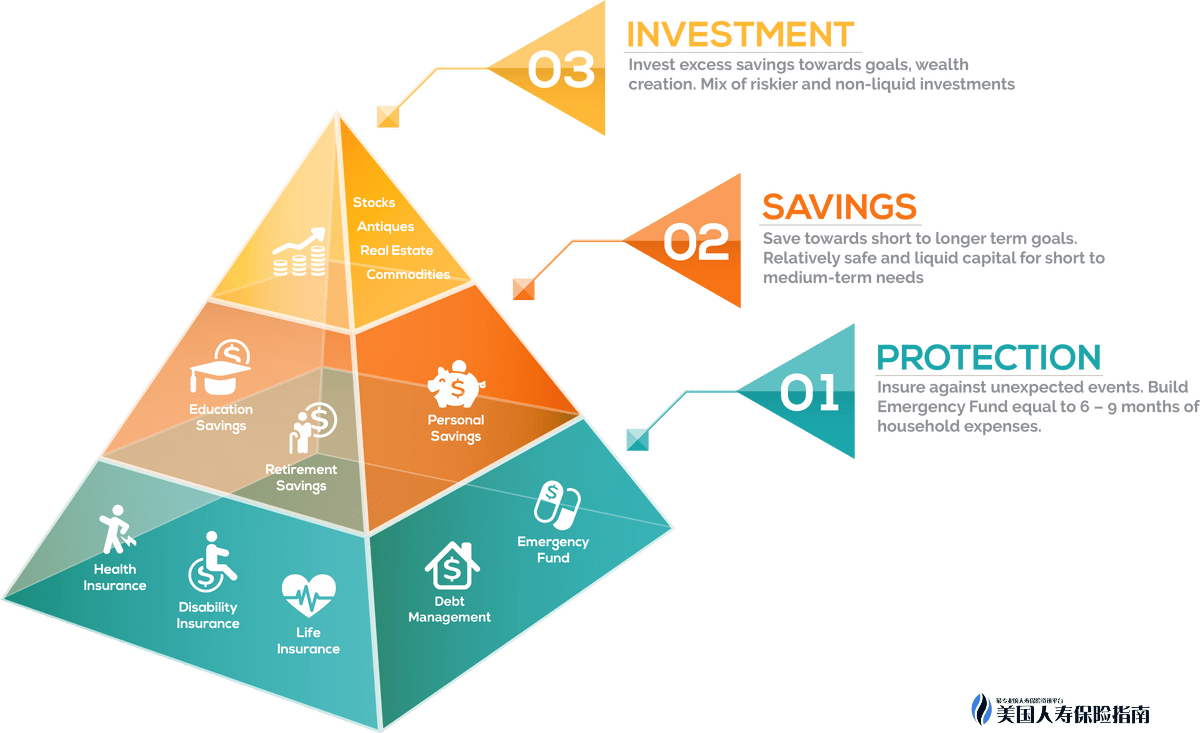

Next, introduce a "everything inseparable" financial management rule, Called "Pyramid Wealth" (Pyramid Wealth). What is called the Pyramid of Wealth.

"Pyramid Wealth' A portfolio strategy that allocates assets according to the relative safety and soundness of investments. The bottom of the pyramid is comprised of low-risk investments, the mid-portion is composed of growth investments and the top is speculative investments"

Simply put, the pyramid is divided into three stages: low-risk protection investment, growth investment and speculative investment

The following picture shows the chart:

It can be seen from the figure that everyone's financial starting point is basically the same, built from the bottom.Even high-level income groups cannot cross the basic class and invest all their money in high-risk areas.A healthy and stable diversified asset allocation can effectively diversify risks and protect families and income.

This article will focus on levels 1 and 2 (primary and intermediate financial management needs), including emergency deposits, retirement plans, real estate purchases, education funds, and protection.

Basic financial management-for all groups:

1. Emergency saving【Emergency Deposit】

A more common practice is to store 12% of income or 6-9 months of living expenses in a liquid checking account to protect against emergencies such as hospitalization, unemployment, etc.

2. Retirement plan 【Retirement plan】

For the middle and lower middle class, "financial management" is actually almost equivalent to "old care".A sadder thing than "dying too soon" may be "living too long".If you can adequately reserve your pension and diversify your pension plan, you can basically rest assured.

Common retirement planning accounts are: 401lk/403b, Annuity (annuity), Roth IRA and life insurance (life insurance).There is no tax on income from the latter two.

3. Education Saving【Education Fund】

教育成本的增長率大約是每年 6% – 8%。根據2015年數據表明,常青藤大平均4年花費(不包括生活費和住宿費)是13.4萬。2033年,也就是18年以後, 4年學費大約需要32.3萬。人壽保險以其出色的靈活性可以用作免稅教育基金的規劃。

supplement:

Retirement plans and education funds are relatively large expenditures in a person's life.The government encourages people to save their own pension and education funds.A lot of policy concessions are given, mainly tax concessions.Generally speaking, there are two categories: Tax deferral (tax deferral) and Tax advanced (prepaid tax)

Tax Deferral refers to an account that uses pre-tax income to invest. For example, your annual income is 7, and 5% is deposited in 401 k, and the remaining 95% of the income is taxable.The value-added part of the account needs to pay value-added tax in the collection of money.Common tax-deferred wealth management products are 401k/403b; IRA/SEP-IRA and annuity

Tax Advanced (prepaid tax) refers to the after-tax income deposited into the account, and the value-added part does not need to be taxed.Such as Roth IRA and life insurance

The most effective method of legal tax avoidance is to combine the two types of tax preferential accounts.

Summary: Education and retirement funds mainly start from three aspects:when, which, how.

-When to save

– What products are stored

– How to optimize your investment portfolio

4. Home【Own House】

From the perspective of financial management, planning a real estate career mainly revolves around three factors: down payment ratio, repayment period and interest choice

5. Protection【protection】

For a middle class with an annual income of 5 to 10, in addition to pension and education funds, all that can be done is various insurances.Because in the United States, a small accident may cost you a whole year of income or even a lifetime of savings, and it is much easier to keep one million than to earn one million.

a. Medical insurance: People who have been in the United States for a long time know that being sick without insurance is equivalent to using their savings or salary for a year or even a few years as a bet.The current law stipulates that if you do not purchase health insurance as required, you will be fined according to the month.

b. Car insurance: mandatory purchase.Optional semi-guarantee or full-guarantee.

c. Housing insurance

d. Term insurance: Generally speaking, it is mandatory to buy term insurance when you need a loan to buy a house. An insurance premium of 20 – 30 knives/month corresponds to an insured amount of 100 million, which protects the lender in the prime of the year. The beneficiary will not lose the property because of his inability to repay the loan.The other recommended period for buying term life insurance is the period from pregnancy to the 18th birthday of the child

When the lower-level structure is built, in addition to stocks and real estate investments to the upper-level targets.You can continue to add the basic part

1. Buy yourself one or two large-value restricted insurance policies and overfund them as much as possible in excess of the basic insured amount.The index universal insurance currently on the market has the nature of savings and investment, with mid- to long-term income above 7%.And there is also a very complete free pre-mortem benefit contract, so that the insured can leverage the insured amount according to his needs while he is alive, and raise cash to fight serious illness, disability, most cancers, and terminal diseases.

2. Mutual fund, ETF, REIT, etc. with relatively low investment risk.Warren Buffett repeatedly suggested that fragmented entry stock investors should use high-quality ETFs as their first choice for investment

3. Real estate investment: Most asset planners will not recommend that you invest money in real estate.In the United States, individual real estate investment is not encouraged by the government.In other words, when investing in real estate, the government not only refuses to give you preferential policies, but it also punitively increases the tax code.However, in fact, no matter how many professionals will give you the pros and cons in the middle, real estate investment is still hot.Because real estate investment has a reputation for thousands of years, a good real estate is a guarantee of life.Except for several big real estate bubbles, there have been basically no major problems in investing in real estate.In the United States, the main function of investing in real estate is to preserve value, with little liquidity and poor maneuverability.

Asset planning is like building a house. Life will not be smooth sailing. Only a strong building can resist all kinds of wind and rain.