"A penny, a share of goods" was originally an unbreakable truth in the commercial society, but in the purchaseTerm life insuranceIn this matter, the choice of "overmarketing" and "splendidness" in American society has caused many consumers to be puzzled and start to doubt their lives.

Today I will share,Why is there so much price difference when buying a term life insurance?What is the real reason behind this price gap and the subsequent marketing methods?And how to avoid life insurance products that "cut corners".

Let's start the text with an example

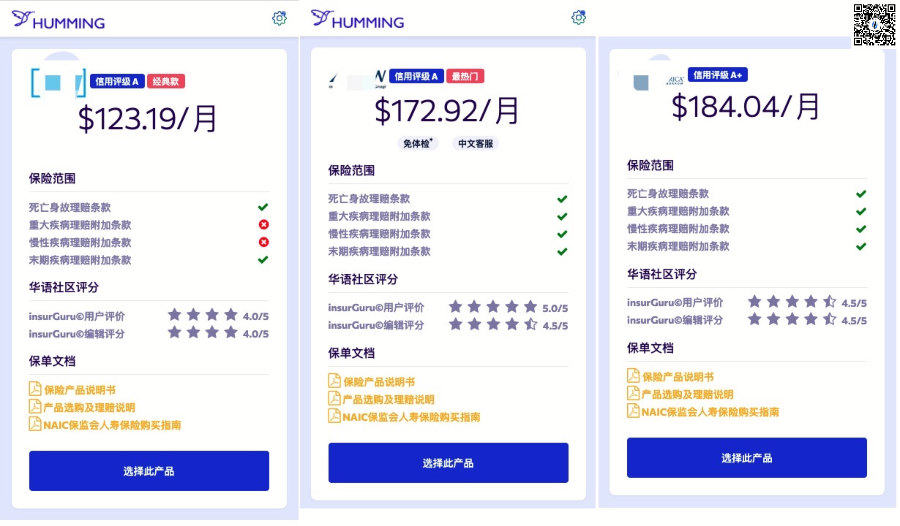

We are community member institutionsHumming Life Examples of data given by the online quotation system.

We are community member institutionsHumming Life Examples of data given by the online quotation system.

In the process of applying for term life insurance, the same 45-year-old non-smoker seeks life insurance protection for a 30-year period of 100 million death claims. The three companies respectively gave monthly premium prices of $123, $172, and $184. , The lowest price and the highest price,The monthly difference reaches $61.The price difference reached nearly 50%.Why is this?

(Price comparison chart of Hummingbird Life Insurance®️Smart Insurance System)

(Price comparison chart of Hummingbird Life Insurance®️Smart Insurance System)

We will not give a simple answer, but by sharing the following situations to help policyholders understandTerm life insuranceThe basic principle of premium price,Identified some "cut corners" insurance products that may be encountered, So that you can purchase satisfactory insurance products.

Cut corners #1: The marketing slogan of "fake big empty"

With fierce competition, especially based on the idea of providing basic guarantees (instead ofAsset management insurance company) Life insurance company, has entered the offerClaims before deathEra.People don’t have to die, they can settle claims while they’re alive, Such revolutionary progress has brought huge benefits to our consumers.

On the other hand, however, some insurance companies are in a state of difficulty in turning around, unable to self-correct the complicated and intertwined interests of the company during its century of development, and are unwilling and unable to make fundamental changes to the company’s past basic insurance model.

In order to maintain its original market share in the fierce "protection-type" life insurance market,Lowering prices, focusing on the hot spots of claims before death, and increasing marketing efforts are inevitable choices.

The most common slogan came, "Our price is favorable, and we also provide pre-mortem benefit claims. "

There is no problem with this marketing wording. "Welfare"These four words are indeed just a general term for marketing.

Comprehensive pre-mortem welfare guarantee,It can include pre-payment clauses for major illnesses and chronic illnesses.And some term life insurances that are hot spots usually only provide a "flashy"Early claim clause for terminal illness.But this does not prevent the latter from propagating that it also has the function of "pre-mortem benefits" claims, which is completely a poor perception of our consumers.

(Click on the picture to understand: What are the "pre-mortem benefits" in American life insurance?)

(Click on the picture to understand: What are the "pre-mortem benefits" in American life insurance?)

Secondly, these claims clauses have costs.There is no such thing as "free".Different claims clauses correspond to different costs.The more claim clauses, the higher the premium price.

Tips: If you want to provide comprehensive protection to your family, then you need to pay attention to the specific claims rules for the benefits during your lifetime; if you only seek claims for death, then choose products with fewer or no claims that can be settled during your lifetime. Get a more favorable price.

Cut corners #2: Cut off the function of insurance policy upgrade

From the perspective of industry insiders, one of the most valuable functions of term life insurance is to lock in the current health rating, and in the future, it can be upgraded to whole life insurance with the current health rating.

(Discount promotion? It may be at the expense of insurance benefits)

(Discount promotion? It may be at the expense of insurance benefits)

The younger you are, the better your physical condition tends to be.As we grow older, our bodies will have more or less problems. These problems will cause us to be unable to insure, or the price of insurance is very expensive.

Term life insurance with policy upgrade function,Can lock in our current health status at the time of purchaseIn the future, as we grow older, even if our health deteriorates significantly, we can still upgrade or switch our insurance with the rate of the health rating of the year.

Finally, enjoy the benefits of the policy upgrade,It is the standard configuration of a normal term life insurance policy, not a "patent" or "privilege" of a certain insurance company in the marketing caliber.This kind of welfare also has a cost, and the term life insurance that "cut corners" will cut off this core function.

Low-priced secret #3: Underwriting by insurance companies with low credit ratings

A life insurance company is a financial and wealth management company. Through the issuance of life insurance policies and corresponding benefits, it collects savings from the public and conducts investment and wealth management business.I personally think that for ordinary consumers, there is not much difference between a life insurance company and a bank.

The question is, if you have a large sum of money you want to deposit in a bank, would you choose a large bank with a wide reputation and stronger financial strength, or a bank with a local nature and a credit rating rated as "a certain risk"?

By the same token, in the United States, life insurance companies that conduct business globally will have higher credit ratings and stronger solvency.But the price is not necessarily more expensive.And some small and medium-sized life insurance companies, in order to attract users in the fierce market competition, the prices must not rise.

Faced with such “cheap” life insurance, we may need to inquire and consider thisLife insurance companyThe credit rating, which reviews are bought with a lot of money (such as our most common commercial reviews such as JDPower, USNews, etc.), and which are relatively objective scores given by third-party professional rating agencies (Standard & Poor’s, Moody’s).

Everyone understands these principles, but in reality, they still can't stand the temptation.For example, the author's mother once bought an electric footbath for an electric footbath from a financial institution that does not pass through, and immediately bought a 5-year deposit insurance plan.You see, it's like this:

(This picture does not violate peace at all, on the contrary, it is extremely profound)

(This picture does not violate peace at all, on the contrary, it is extremely profound)

You see, I don't know if it is a German-quality footbath, but when it comes to dealing with the aunts, people are professional and the children are amateurs, so they often have to be caught off guard.

Recently, I also encountered Chinese policyholders holding B-class life insurance company policies for consultation, and I was a little surprised. Is the market like this now?Generally speaking, the lower the credit rating of the insurance company, the cheaper the product price, but the higher the risk of repayment.

(>>>Recommended reading:How to check and interpret the credit rating and financial strength of American Life Insurance Company?)

Article summary

The price of life insurance is also reflected in the quality of service.If we need faster service, immediate response underwriting, and stable claims service customer service, then we need to pay a higher cost to enjoy these corresponding services.

Due to fierce market competition, American insurance companies have chosen two paths in order to attract depositors and capital inflows.One is to attract customers by improving service levels, such as providing Chinese services, or explicitly increasing the benefits of insurance policies.This kind of tangible development and progress has not only increased our insurance benefits, but also brought a better service experience.

I personally agree with the above development model with both hands.

And the other is through "Price discounts, cut benefits"The way, more focused on relying on the marketing model, rather than essentially improving benefits and services to attract customers. This model will not be commented.

Turning the topic back, is it expensive or good?This is obviously wrong.

I have also complained about a friend. Her attitude is, "Only buy the expensive ones, don't choose the right ones."However, this method has also gone to extremes in value selection, and as a result, it has also paid a lot of unjust tuition fees in the allocation of family insurance.

Finally, to sum up, in a normal market environment, the service of any product is directly proportional to the price.Any "cheap" is the need to give up paying the corresponding benefits,And what we should really pay attention to is that the "cut corners" mentioned in this article will cause future financial losses to our family..

Our original intention was to provide our family with comprehensive financial security and protect the people we love.Buying insurance is not as complicated as building a rocket. As long as we deal with it rationally, understand and learn some basic knowledge before buying, and combine our own actual situation, I believe that we will soon buy products that we are satisfied with.

After reading this article, you can draw inferences and recognize that the article started fromHummingbird Life InsuranceWhy is there a price gap for the 3 different product quotations provided? (End of full text)

About LifeTank©️ – LBYB

LBYB-Learn Before You Buy, is a guiding concept for individuals and families to configure life insurance proposed by TheLifeTank.com-American Life Insurance Guide©️.In view of the diversified financial instrument attributes of cash value life insurance in the United States, its application in the field of wealth accumulation and inheritance has surpassed consumer insurance products that consumers can understand in the traditional sense.The lack of corresponding basic knowledge education and the impact of one-sided education may cause harm to your rights.Before applying for an insurance policy, the American Life Insurance Guide©️ encourages consumers and investors to learn and understand the basic operating principles and functions of such financial products in advance, so as to obtain solutions that can truly protect their families and wealth.