Different stages of life have different financial strengths and financial goals.In this growth process, everyone needs to find the correct knowledge and guidelines to achieve these goals through continuous learning and combining their wealth.A ready-made method is that we can compare the life of a typical American with a total of 5 stages of financial planning.Come to Chinese readers as a reference for their own financial planning.

Stage 18: Enlightenment of financial awareness-25 to XNUMX years old

Different stages of life have different financial goals.Young people who are just beginning to get in touch with financial concepts and build financial awareness are usually between 18 and 25 years old.The advantage at this stage is young,The biggest capital is "time", 而The disadvantage may be the mismatch between wealth status and wealth education.

If we travel back to our youth, we will find that many financial choices made during this time period may affect our life trajectory.

At this stage, we are going to decide whether to go to university, where to go to university, which university to go to, how much money we plan to spend, whether there is so much money, and how to solve a series of problems such as this debt.

At this stage, it was also the first time we came into contact with credit cards, began to borrow money, repay regularly, understand debt, learn to control consumption and credit, and establish the importance of future credit.

Therefore, it is particularly important at this stage to establish awareness of money, financial management, consumption and credit as early as possible, and to master the correct sources of knowledge.

(>>>Recommended reading:How to invest and manage money in the U.S. (Essence))

The second stage: career development-25 to 40 years old

When we enter the second financial stage of life, it is usually between 25 and 40 years old.We have to take responsibility for more important financial decisions, such as finding a job and negotiating salary income, buying a house, getting married, and having children.

At this stage, we have to gradually build a safety net for the entire family. This is the core and the most basic part.The family financial safety net includes emergency fund reserves, covering different aspects of insurance.

In addition to the above short-term goals, we also have to make financial planning for the long-term goals. The most typical goal is retirement income planning.

Therefore, when we start to enter the workplace and start earning income, a very important time is to use the company's 401(k) account and understand the company's matching system. If it is not very clear, you can seek the help of a professional financial consultant.At this stage, we have to learn how to prepare financially for retirement, what kind of retirement plan is considered a suitable investment, and it also has advantages in paying taxes.

The choices and decisions we make at this stage will have a huge impact on our future financial situation.

(>>>Recommended reading:Fidelity report: At my current age, how much money should be deposited in the retirement account is more reasonable?)

The third stage: the main income period-40 to 55 years old

After entering the workplace for a certain number of years, we have entered the mature stage of our career, and our income has risen with the tide, which is usually between the ages of 40 and 55.

At this stage, we usually have more disposable income to achieve some of our personal financial goals, or to build a road to financial freedom.

At this time, we are facing the temptation of increasing disposable income. We naturally want to enjoy the happiness of consumption, or borrow to buy large-scale goods, buy holiday houses, yachts and other consumer goods.

This will make us deviate from our previous financial goals, and a good financial advisor or financial product can continuously help us emphasize the importance of compulsory savings for long-term goals, and it can also help us "enjoy the present" and "save for the future." Find a balance between.

More importantly, "open" financial knowledge or financial management platform can help us at this stage to find better financial products or channels to achieve new goals.

The fourth stage: wealth accumulation stage-55 to 65 years old

As we enter this stage of life,Accumulation of wealthThis is the period we are mainly considering.At this stage, we are still faced with the choice of "what kind of lifestyle to choose" and "realizing the goal of saving money".

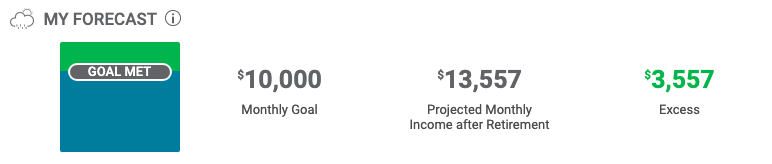

At this stage, the main goal is to prepare for retirement.At this time, we can evaluate and clarify our retirement goals with professional retirement financial planners.

Investment channels or wealth management products with retirement as the goal must be evaluated at this time to ensure that our financial planning is running smoothly according to the original plan. If it deviates from the track, appropriate adjustments need to be made.

At the same time, at this stage, any new borrowings and debts must be fully considered whether they can continue to be repaid after retirement, and the economic pressure caused by the continuous repayment of money after retirement.

(>>>Recommended reading:Bank of America: How much should we save at different ages?)

Stage 65: Retire at XNUMX and beyond

After entering 65 years old, we usually enter the "legal retirement age".At this time, we have a new choice. Have our retirement financial goals been achieved?Do we quit work and start retirement, or continue to work full-time or part-time?

Some people will continue to struggle in their careers, while others may choose to fulfill their past dreams—maybe to open a cafe, buy a sailboat to travel the world, or spend more time with their family, or choose Settle in other countries.

At this stage, "borrowing money" consumption may no longer be applicable to retired people who rely on a fixed income.Therefore, every choice corresponds to financial considerations.Is the pension we accumulated in the first few stages sufficient to support our choice?Which sources of retirement funds can be withdrawn earlier?Which sources of funds are more advantageous to withdraw later?

The order, amount and method of taking money from different retirement savings channels will make a difference in our quality of life.It will also affect how long our money can last before it runs out.

(>>>Recommended reading:[Science Post] How can I use life insurance to increase my retirement income? )

Article summary

The financial life of a typical American usually consists of the above five stages.As far as life insurance is concerned, many policyholders I serve will feel that "I don't want to buy it when I can afford it, but I can't afford it when I want to buy it" or it will cost a lot more.

Our whole lifeThe fairest and most unfair is "time", The ones that will most affect our lives decades later are oftenIt's just between the thought of "knowing or not knowing" and "doing or not doing".

If we say that people in this life are holding a boat and traveling in a river that has never looked back, the urgency of the river and the encounters along the way may be beyond our control, and what we can grasp is our thinking at the helm, which is along the way. The valuable experience and wealth tools gained.

(>>>Recommended reading:What kind of insurance should I buy at the 5 different stages of life?Buy the right insurance to solve 80% of the life dilemmas of you and your family )