In insurGuru©️Life Insurance Academy, the American Life Insurance Guide©️ reviewed "Comparison of advantages and disadvantages and risks of premium financing (Premium Finance) planning", a brief analysis of the way of purchasing insurance policies by borrowing money from financial institutions as insurance premiums. This is a way of leveraging the assets of a life insurance policy. However,Is "borrowing money to buy an insurance policy" really a good idea?

We look at this question very carefully and avoid giving a simple answer. LifeTank©️Professionals in the community Ben, Showed us some data and charts, and shared some of his views-from the following excerpts, we may be able to get a glimpse of what the real wealthy class in the United States has done in the past year.

How much has the wealthy people in the United States borrowed recently?

In the field of personal credit, borrowing money and owing debts are usually regarded as the "financial devil". Various types of "financial education" also emphasize the "reduction of debt."

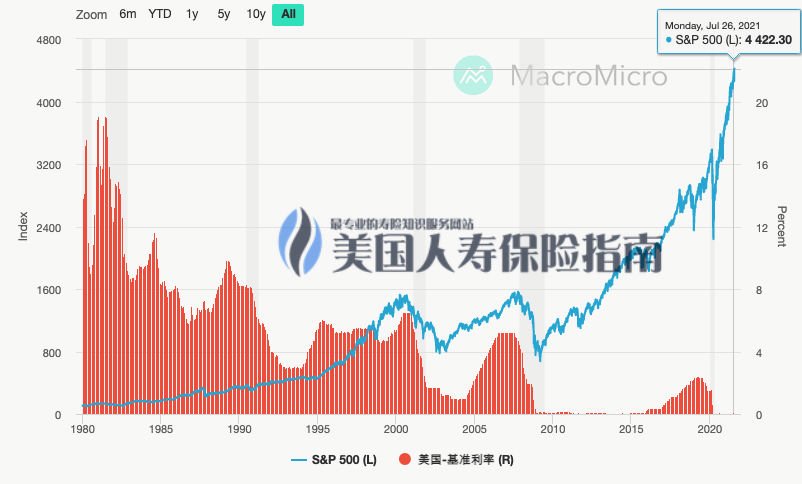

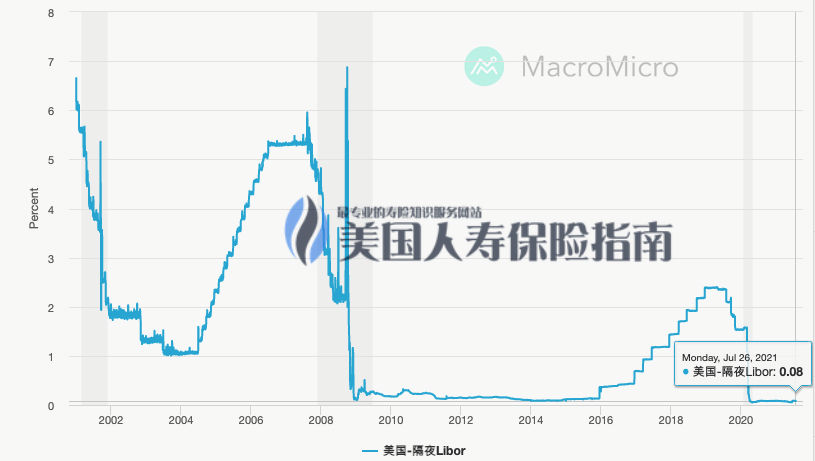

But withNew Coronavirus Outbreak, Which brought the lowest interest rate in the history of the United States. During the same period, the rapid appreciation of various assets-for the truly rich (Ultra-Rich) who hold a large amount of assets-created a huge space for arbitrage using borrowings.

According to a recent Bloomberg data report, the wealthiest group in the United States has borrowed huge amounts of personal loans from the largest investment banks in the United States.

摩根斯坦利(Morgan Stanley)的證券抵押型借貸資產在2021年第1季度超過了760億美元,比去年同期增長了43%。 美國銀行(BoA)的這類貸款達到了670億美元,比去年同期增長了43%。

Part of CitiGroup's private bank loans increased by 17%.Similar demands have also prompted loans from JPMorgan's asset and wealth management division to grow by 21%.

At UBS, securities-backed loans increased by $40 billion.

What are the wealthy people in the United States doing when borrowing money?

Contrary to popular expectations, inepidemicUnder the influence, the wealth of the US super-rich has not been affected. In 2020, the performance of the private jet and superyacht market has completely exceeded expectations. The housing prices in the top luxury housing market have also been soaring so far in the epidemic, and the overall market has exceeded expectations.

數據顯示,2020年超級遊艇銷量大增,Q2Q3這兩個季度的二手超級遊艇銷量都比2019年同期增長了50%以上。與2019年相比,80米以上的超級遊艇製造和銷售都有明顯上升。*

In the real estate market, news of all kinds of sky-high real estates sold from 2020 to 2021 is endless.The recent hot news is that Cai Chongxin bought a two-story mansion in Manhattan, New York, for US$1.57 million, the total price of which ranks third in the United States.*

OnLife insurance premium financingIn the market, just over half of the year in 2021, a top financial insurance company announced the suspension of premium financing projects in an internal notice in order to face a large influx of loan funds that exceeded the expected business quota.

The financial media in the United States also exclaimed that US banks and other financial institutions are providing a large number of loans to the rich to "fund" their lifestyle and financial investment.

Article summary

New Coronavirus OutbreakAfter the outbreak in the United States, the Fed's interest rate reached a record low."Lending" has become an important factor in the economic activities of the 2020-2021 epidemic, And the super-rich class in the United States has become the main group of personal lending activities.

Compared with ordinary families, it is easier for the wealthy to borrow, and banks and other financial institutions are more willing to lend to them.It is often not easy for ordinary individuals to obtain large amounts of personal credit from banks.

Housing loans are the only way publicly recognized that they can borrow a large amount of cheap cash from financial institutions.We have also seen that in the past year, many families around us have also refinanced housing loans, continuously reducing the cost of borrowing money.

Premium Finance loans provide individuals and companies with the same credit channels.As a financial tool in the field of life insurance, it goes beyond the traditional cognition of buying insurance.From the perspective of risk management, compared to securities-backed borrowing, policy-backed borrowing is more resistant to risks in the face of financial crises. It is suitable for mature investors with certain investment experience.

And forPremium financing(Premium Finance) View-there are a thousand Hamlet in the eyes of a thousand people-at different ages, different life experiences, and different era backgrounds, everyone has their own unique insights.But for 99% of American households, whether they can actually borrow large amounts of cheap funds from private banks may be the real problem. (End of full text)

appendix

*"Interpretation of the 2020 Global Superyacht Market Report", Sohu, 2021.07.14

*"Billionaire Joe Tsai is the'mystery buyer behind $157 million Manhattan apartment deal", CNBC, 2021.07.19