Lead:communityLife insurance brokerIn actual work, I have encountered insured customers who started from "cheap".

In a free market economy and social system, on the one hand, we have the inertia to pursue "cost-effectiveness"; on the other hand, it is the logic that quality is proportional to the cost of payment.In the process of purchasing a non-consumable financial product called a lifetime insurance policy in the United States, the subconscious conflict between these two inertial logics is often induced.

Although the data in the comparison process will show,Low-cost products do not mean good welfare and strong asset management capabilities.But this process of expressing to policyholders may complicate the situation and cause a collision of thinking patterns among adults.

And the life insurance broker in Los Angeles, CaliforniaJeff, Shared his unique views.The following is the full text:

text

Many friends are comparingIndex Universal InsuranceThere is a habit of IUL products:Find cheap ones.

That is, in the case of the same amount of insurance, find the one that pays the least.

This choiceIULThe angle cannot be said to be wrong.

To say the least, go in the wrong direction.

The main reason for the launch of IUL products is to save more money in the insurance.The solution is the problem of financial management and tax avoidance.

If you only consider paying less, you will not only not enjoyIULThe main advantage of the insurance policy may also be terminated because the later cash value accumulation is not enough to cover the cost of the insurance policy.

If you only consider cheap, it is better to buy directlyTerm life insurance.Of course, cheap has a cheaper price. Most term life insurance products are only guaranteed until the age of 85; some life insurances that can be renewed every year and are guaranteed for life are very cheap in the early stage. After the age of 80, the annual premium will soon reach more than 10 yuan.

Share a case.

Basic customer situation

Here comes the problem,Comparing the two solutions, did you find:

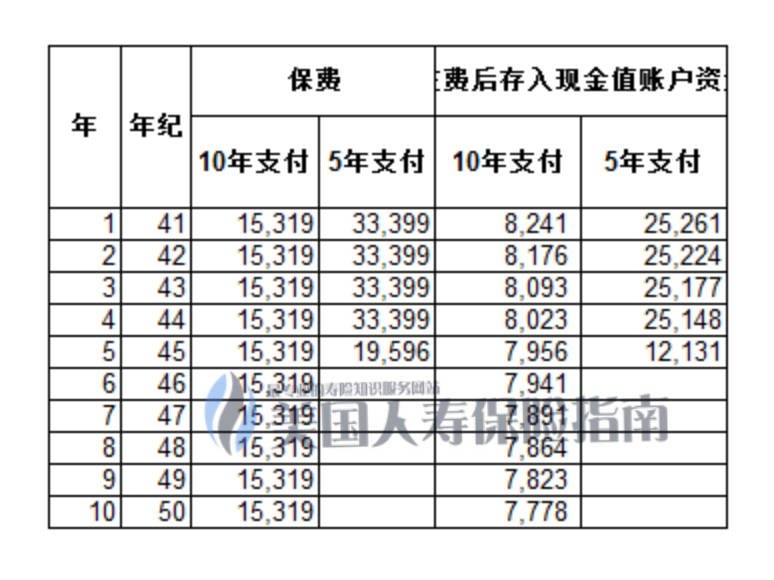

The later benefit of the premium payment plan within 5 years is much greater than the payment plan within 10 years. At 80 years old,There is a difference of 58 yuan between the two.At the age of 85 there is a difference of nearly 100 million yuan.

Knowing that there will be a difference, but why is there such a big difference?

one of the reasons

Reason two

-

10 years of payment, the total amount of funds deposited in the cash value account for the first 3 years is less than the amount deposited in 5 year in the 1-year payment plan. -

10 years of payment, the total amount of funds deposited in the cash value account for the first 7 years is just over the 5 years of deposits in the 2-year payment plan. -

10年付,10年總的現金值賬戶存入資金差不多8萬元,只比5年付方案中,3年存入額多了約5000元。 -

The 5-year plan is far better than the 10-year plan in terms of cash value account deposits.

Conclusion

-

Demo interest rate:The higher the interest rate is, the better the return. This is the best to understand and the best indicator to compare. -

Policy cost:This data insurance company generally does not show it to customers. If you want to see it, you have to ask your own broker.My understanding is that the cost of insurance policies is more complicated, without professional knowledge, and I don't understand the relationship between various costs. Moreover, the cost classification between different companies is not the same. If you don't study for a period of time, you will definitely not understand. -

Internal income:IRR, that is, the average annual rate of return at the time of profit rolling. In fact, this data is the most useful data. It represents the actual income of the insurance policy after removing the costs and expenses.Comparing this indicator with the demo rate, you can quickly distinguish the difference between products and companies.

(about the author:Jeff Tan, an American insurance broker, was born in Qinghai and now lives in Los Angeles.Contact me. )

(>>>Related reading:Knowledge Post | What does Lapse mean?averagePer yearHow many people are out of guarantee?)