(Editor's note:A policyholder from New York State contactedAmerican Life Insurance Guide Community’S broker, and shared Ta’s insurance experience and policy account status.We discussed with the parties and after obtaining consent, we shared some of the content, hoping to help our readers or other insured persons understand and apply for insuranceSavings Participating PolicySome of the main points.The following materials were provided by the parties and were processed with aliases.The content of this article does not involve specific insurance companies and insurance product names. )

text

Ms. Li has a strong sense of insurance. In 2007, she was recommended by a friend, applied for and planned aSavings Participating Life InsuranceThe policy has an annual premium of more than 30 and an insured amount of US$XNUMX.

Thirteen years later, when Ms. Li started to take money from this policy account, she faced a series of troubles.

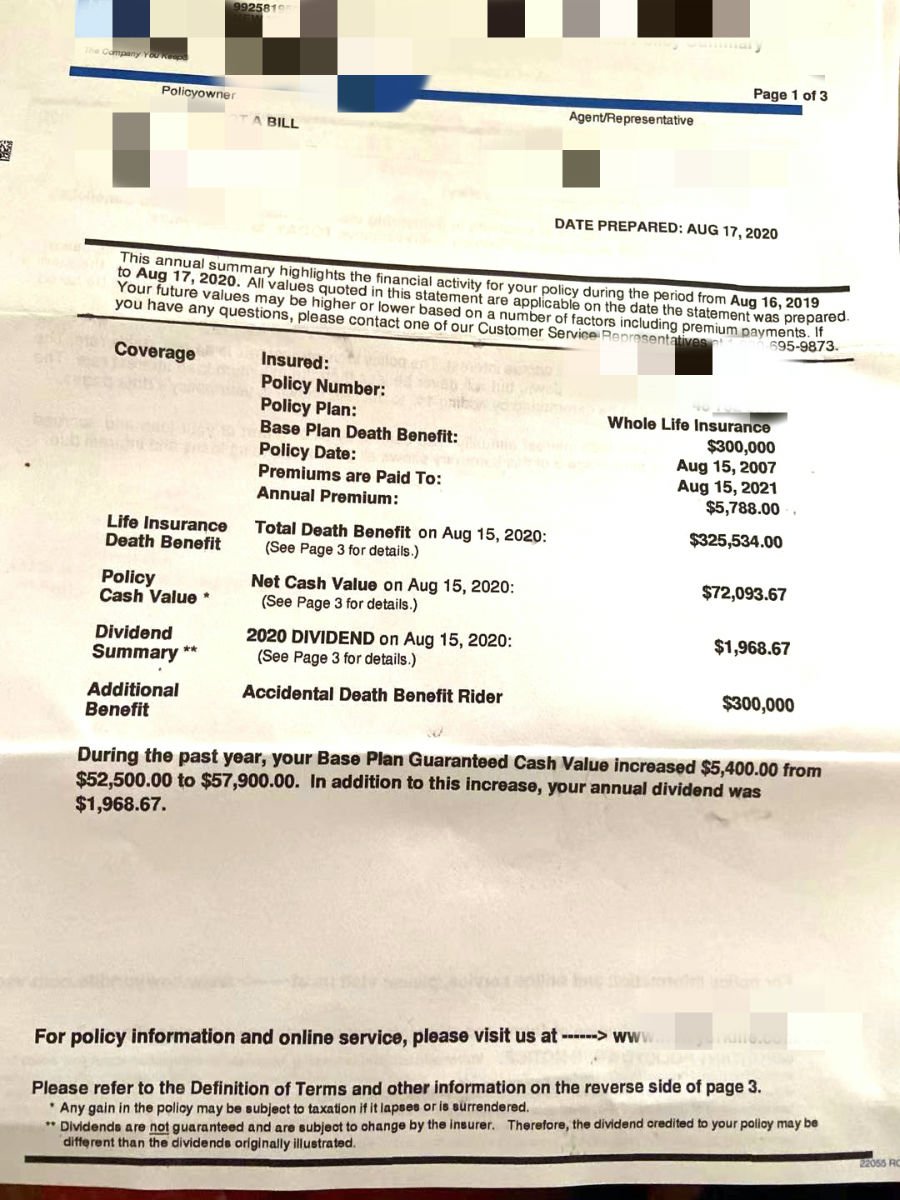

Figure 2020: Overview of the 30 policy, with a sum assured of $XNUMX.The current cash value account of the policy is approximately $7.2.

Figure 2020: Overview of the 30 policy, with a sum assured of $XNUMX.The current cash value account of the policy is approximately $7.2.

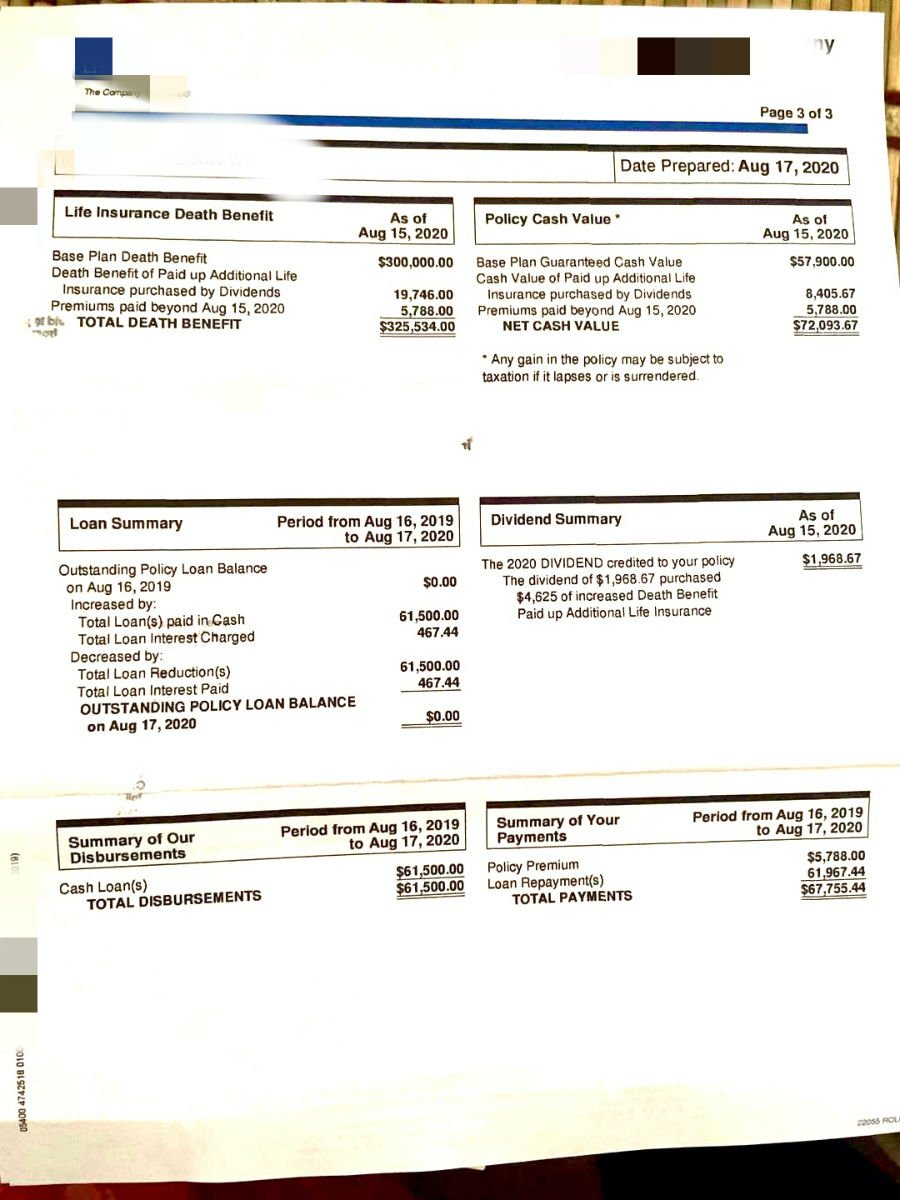

Figure XNUMX: Policy cash value, detailed bills of loans and repayments

Figure XNUMX: Policy cash value, detailed bills of loans and repayments

The lost golden decade?

From a numerical point of view, Ms. Li has invested more than $14 in 7 years, and her book assets by 5 will be more than $2020. 7-year premium insurance,The investment in 14 years has not recovered the cost.

The past decade or so has been the "golden decade" of the U.S. economy. According to data from Goldman Sachs1Report that in the past 10 years,The average market return on the U.S. stock market is 9.2%.And represents the weather vane of the U.S. economyS&P500 IndexPerformance is relatively better,The average annual rate of return reaches 13.6%.

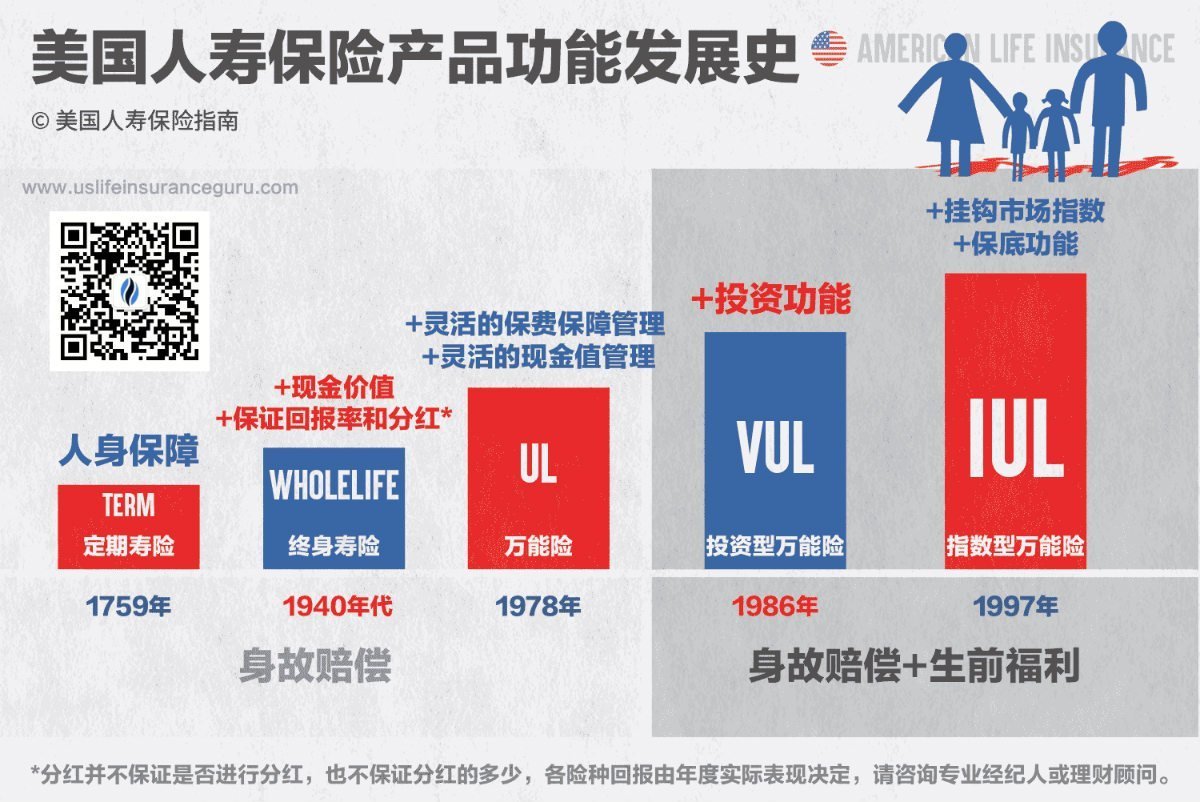

It is true that the calculation method of life insurance income is difficult to directly compare with securities investment, but in such a market environment,Savings and Dividend InsuranceThe cash value growth potential is much lower thanSecurities investment insurance,withIndex insurance.

According to Ms. Li’s account, when applying for insurance,She was told by the insurance broker that there were only two life insurance companies in the market that could insure, and there was no better choice.

Dividend rate problem of two ledgers

If we calculate the actual annual dividend rate of this individual insurance policy, use $1,968.67 and divide it by the total account amount of $72,093.67, we will get 2.7%This value.The life insurance company that issued the policy has publicly announced a dividend rate for 20206.x%.

Why is there such a huge difference?

This is actually a long-term confusionSavings Participating InsuranceA problem for market policyholders.The simple answer is that the policyholder and the insurance company are actually holding their own books to settle accounts.

The policyholder calculates the actual rate of return on the cash value account of the policy, and the dividend rate announced and used by the insurance company is called Dividend Interest Rate in English, or DIR in abbreviation.It does not refer to the rate of return on the policy, the rate of return on the policy, or the rate of return on the cash value of the policy.It is determined by the financial insurance company based on its own financial situation.The Base of the two is completely different.

Therefore, many policyholders mistakenly believe that this DIR is the rate of return of savings and dividend insurance policies.

"Can only see but not move" book assets?

In 2020, the policyholder Ms. Li needs to spend a sum of money.

From Figure 6 above, we can see that Ms. Li “borrowed” more than $20 from her policy, and then, XNUMX days after withdrawing, she returned the money to her policy account.

Regarding the question of "why the money was returned to the policy so quickly," Ms. Li said frankly that when she applied for the policy, she was only told that the policy could save and take money, but she did not tell the consequences of taking the money.When she really took the money, she was clearly told that the cash value figure "can only be seen but not taken", otherwise the insurance policy will have serious consequences.

On this point, the American Life Insurance Guide Network reminds that for this type ofSavings Participating PolicyAt the moment of application, the premium payment cycle, the death compensation of the insurance policy, and the cash value can indeed be "guaranteed", and the salesperson's statement is indeed no problem.

But if, like Ms. Li, he really starts to take money after many years, then it is another situation-at the beginning, the policyholder applied for a savings and dividend policy account precisely because of many "guarantees". At this time, these The original "guarantee" part may no longer be guaranteed.

How to deal with and the possible ending

If you surrender the insurance at this time, the 14-year investment in exchange for negative income, the surrender money you get is less than the premium deposited by the policyholder.This solution is what we strongly oppose,"Not only lost funds, but also lost the most precious 14 years of the policyholder’s time. "

(>>>Recommended reading:American Life Insurance Strategy (XNUMX) Common Misunderstandings )

Ms. Li also proposed the idea of transferring this kind of insurance policy, but 14 years later, Ms. Li's age is already the retirement age of more than 60 years old. At this time, the cost of redesigning a new insurance policy is much higher than 40. Year-old costs, and the most precious accumulation time has been lost.

In addition, the risk tolerance of the retirement age group is completely different from that of the 40s. Therefore, considering the risk and cost, as well as the actual situation of the individual, we no longer recommend that Ms. Li apply for this type of insurance policy.1035 conversion, Or apply for a new life insurance policy.

After full analysis and communication with life insurance brokers in the American Life Insurance Guide community, our advice is that this policy will be paid in one year, and after the payment is paid, it will be reserved for inheritance purposes.If you have spare money, you can increase itLong-term careOrAnnuity InsuranceSupplements.

In this way, theSavings Participating PolicyThe account can at least guarantee that if the insured person passes away, a guaranteed amount of money is left to the beneficiary.And this is exactlySavings Participating PolicyAccount is used forEstate planning areaCore competitive advantage.

Our summary and recommendations

From this case sharing, we can put forward some insurance suggestions to the insured.

First of all, please keep in mind that it doesn’t matter in the market"Best insurance company"."The best insurance product"These are just marketing words.

As policyholders, the problem we face is not a lack of choice.A rational policyholder is faced with fierce market competition, an excessive marketing environment, a dazzling array of life insurance products, and sophisticated solutions for market segments.

For policyholders,Our real dilemma is that there are too many choices, or even too many.This is a life experience that did not exist in the past resource-poor social environment.

Therefore, when preparing for insurance, the most important point is to clarify what you want and what goals you want to achieve through life insurance.

Secondly, for life insurance with "cash value", use"Opening a Life Insurance Policy Account"This way of expression is better than"Buy Life Insurance"This way of expression is more reasonable.We hope to convey to consumers that this type of life insurance is a financial product and a standardized "consumer product."

From the perspective of financial management, there is essentially no difference between investing in such policy accounts and investing in stock accounts, bond accounts, and IRA accounts.The different types of life insurance policy accounts represent different risk appetites and application areas.

Therefore, policyholders need professional and meticulous help when applying for a cash value life insurance policy.To fully understand the financial attributes of such products, And contrast with the traditional concept of "insurance".

Once the insured chooses a product that does not meet his needs,It’s actually a "blind bet"——If you are lucky, everyone is happy. If you are not lucky, you are bound to face depression and anxiety.But this way of watching the sky and eating is completelyIt deviates from the foundation of using life insurance policies for "risk management".

Finally, the American Life Insurance Guide website has always advocated"LBYB" principleAnd provides onlineInsurance College和Case evaluationFor reference to policyholders.Before you are ready to apply for a cash value insurance policy account, please be sure to learn and understand the functional characteristics and applicable fields of this type of product.Life insurance brokerWith human explanation and assistance, make rational cognition and decision-making.

After fully understanding the different historical stages, the market interest rate environment, and the advantages and disadvantages of different life insurance account solutions, we hope that every insured can find a policy account product and structure solution that suits him and his family. (End of full text)

(>>>Recommended reading:Evaluation|Insurance income is $186 million more!Comparison of professional planning insurance cases )

appendix

01. "S&P 500 returns to halve in coming decade – Goldman Sachs", Brian Scheid, 06/15/2020, https://bit.ly/3kPon1x