(InsurGuru©️Fortune Academy Column) On October 2019, 10, Nat Friedman, the 24-year-old CEO of Github, came to an abandoned mine in Svalbard, Norway, and personally represented humans all over the world. Common wealth: open source code, put aSafein.

The picture shows the Github code repository in Svalbard

The picture shows the Github code repository in Svalbard

As the head of the Github code base under Microsoft Corporation, Nat considers how to preserve and inherit the intangible wealth that represents the entire human civilization when the end of the world is approaching and the existing human civilization is completely destroyed.Choose this method to entrust the preservation of wealth and inheritance, Has great value and significance for the continuation of human civilization.

The picture shows the Svalbard Global Plant Seed Bank

The picture shows the Svalbard Global Plant Seed Bank

As individuals, especially for Chinese (Chinese) families who have accumulated huge wealth in less than 30 years, we are unlikely to choose to store all their assets in a safe in the Arctic.butFacingRegarding the inheritance of assets and the continuation of family material wealth and spiritual wealth, what are the good storage or handling methods that can effectively help us carry on the inheritance?On this issue, many Chinese (Chinese) families are also facing the same choice problem.

Therefore, insurGuru™️ Fortune Academy visited Jim, the principal of Royal Financial Net. Jim isFamily wealth and estate planning and inheritanceWith more than 20 years of experience in the industry, this article will share his personal or family use of American contract tools:trust, To help us pass on the wealth of generations, the following is the content to share.

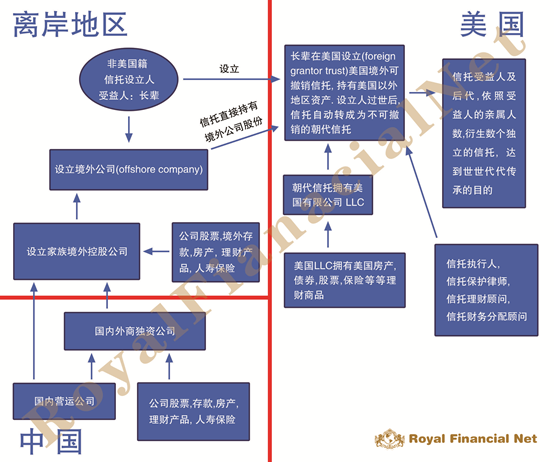

1. Use the U.S. revocable trust to hold assets outside the U.S. and pass on wealth for generations

If the trust creator is a non-U.S. tax resident, a revocable trust can be established in the U.S. This trust is called a "Foreign Grantor Trust". If the assets held are assets outside the U.S.

In this way, before the death of the trust creator, if the trust has no income derived from the United States, there will be no American tax burden, and there is no problem that the American trust must expose for holding foreign assets.

In this way, before the death of the trust creator, if the trust has no income derived from the United States, there will be no American tax burden, and there is no problem that the American trust must expose for holding foreign assets.

The place of establishment of the trust is in the United States and can be protected by American trust laws.

Once the non-US tax resident trust founder dies, the revocable trust is converted to an "irrevocable trust", which is called a "Foreign Non-Grantor Trust" (Foreign Non-Grantor Trust). Value-added,No U.S. tax is required.

The automatic increase in the value of the trust property before the founder's death (Step Up Basis) will reduce the capital gain calculated when the trust sells this property in the future, which will naturally achieve the effect of tax reduction. It is an effective method for planning the inheritance tax of the gift tax in the United States.

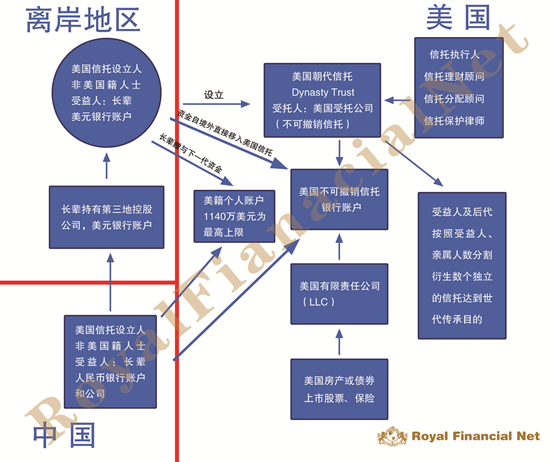

2. Utilize the irrevocable dynasty trust of the United States to hold local assets in the United States and inherit wealth from generation to generation

If the trust creator is a non-US tax resident, an irrevocable dynasty trust is established in the United States.After the trust is established, the settlor puts foreign assets or local US securities (such as US stocks and bonds) into the trust, and there is no US gift tax.

After the founder's death, because the trust is an irrevocable trust, there is no estate tax issue.

But from the day of establishment, the trust assets will be protected by U.S. law, and the income generated from the trust assets will be subject to U.S. income tax.Holding overseas assets will have property disclosure issues.

If you want to transfer foreign assets to the United States before your establishment, stay in the United States for a long time and want to pass on to the descendants of American citizens, irrevocable trusts will become the best tool for the next generation to save American inheritance taxes (gift tax, inheritance tax), and It allows children and grandchildren to avoid issues such as property contention, debt disputes, or divorce requests.

Article summary

Regarding the wealth inheritance plan and the estate planning plan, a combination of tailored use is required with the assistance of a team of professionals.Family wealthIn real life, the inheritance plan is only applicable to a small number of groups. In addition to professional service fees, time costs and credit costs are also high. We do not recommend blindly pursuing it to avoid counterproductive effects.

At the same time, using AmericanTrust deed, The inheritance of family wealth is more suitable for the combination with social charity and public welfare-our descendants not only inherit the material wealth of the predecessors, but also the invaluable family spiritual wealth and sense of social responsibility, and help future generations in material, spiritual and On the spiritual level, it can be more fulfilled and wealthy, and achieve the goal of family inheritance in the true sense.

(Royal Financial Net©️ All rights reserved. Published by the American Life Insurance Guide Network)

About Royal Financial Net©️

Royal Financial Net, the Chinese name Royal Financial Net, is an American life insurance agent based on giving back to customers and insurance brokers or companies. It represents the products and plans of 50 A-class insurance companies in the United States, and provides services outside the United States based on customer needs. Regional insurance products, tailor-made insurance policy solutions for extremely high-end customers.