insurGuru™️ Retirement College Column:For a long time, whether there is enough money to help us retire with peace of mind has always been a big problem.According to economists’ estimates, millennials born between 1982 and 2000 (before the age of 37), if they want to retire safely at the age of 65, then this group of people will have to save at least half of their income, and at the same time. Will face even more daunting challenges.But there is also a bright side. Retirement expenses in some states in the United States are relatively low.

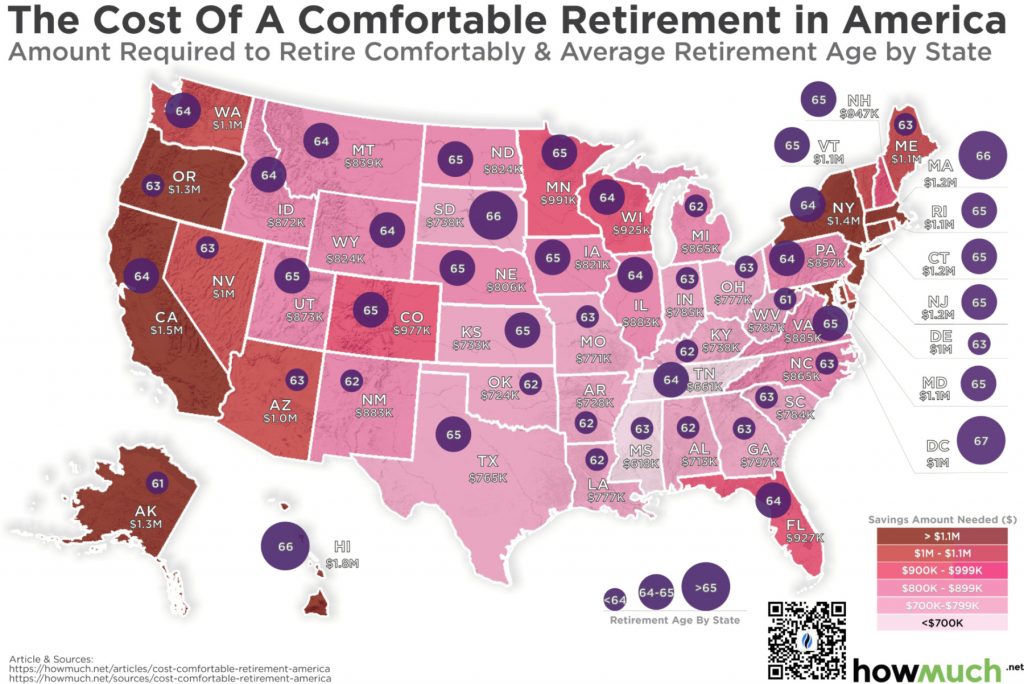

insurGuru™️Retirement CollegeIn this article, provide the "Consumer Expenditure Report"* issued by the US Bureau of Labor Statistics in September 2019, and shareThe latest chart below analyzes the average savings required for retirement in each state in the United States, as well as the average retirement age in each state.

Image authorization: HowMuch.net, a financial literacy website

Image authorization: HowMuch.net, a financial literacy website

The current state of retirement in the U.S.

- The national average retirement age in the United States is 64 years.If you look at each state separately, the average retirement age has a certain change.The lowest are Alaska and West Virginia, with an average retirement age of 61 years.The latest to retire is Washington, D.C., The average retirement age is 67 years old.

- The average life expectancy nationwide in the United States is 78.6 years.If you look at each state separately, Mississippi’s average life expectancy is the lowest, only 74.5 years old.The highest is Hawaii, The average life expectancy reaches 81.5 years.

- Nationwide, the average annual expenditure for people over 65 is $51,624.Mississippi has the lowest cost at $44,758.Hawaii has the highest annual spending, reaching $99,170.

- Considering both life expectancy and cost, the average savings for retirement in the United States is $904,452.In the Northeast and the West, you need to save more than $100 million to enjoy a comfortable retirement. The South and Midwest are the states with the lowest savings requirements.

insurGuru™️Retirement CollegeThe shared retirement map analyzes and shows the situation of this government report.Each state is represented by pink to dark colors. The darker the color, the more retirement savings are needed.Each state has a purple circle that indicates the average retirement age in the state.The larger the circle, the higher the retirement age.

Top 5 states with the most expensive retirement

1. Hawaii: $1,844,556, with an average retirement age of 66 years

2. California: $1,456,286, with an average retirement age of 64

3. New York/New York: $1,408,121, with an average retirement age of 64 years

4. Alaska: $1,341,805, average retirement age 61 years

5. Oregon: $1,335,752, with an average retirement age of 63 years

The least expensive state for retirement, Bottom 5

1. Mississippi/Mississippi: $617,661, with an average retirement age of 63 years

2. Tennessee/Tennessee: $660,870, with an average retirement age of 64

3. Alabama: $712,832, with an average retirement age of 62 years

4. Oklahoma/Oklahoma: $723,859, with an average retirement age of 62 years

5. Arkansas: $728,010, with an average retirement age of 62 years

Article summary

Not surprisingly, the state with the longest life expectancy is alsoRetirement expensesIn most states, although it is not possible to draw a sloppy conclusion that "a penny pays for a lifespan", the abundance of retirement funds is indeed directly proportional to the medical, health, and life services available.

(>>>Recommended reading: gadgets|The American Personal Pension Smart Calculator, how much do I need to save every month?)

Comparing the average income of American households according to the charts and figures of the Labor Bureau, we will immediately find thatMost American families do not have enough money to face the problem of decent retirement.Therefore, to the extent possible, plan the retirement framework in advance, start to make mandatory savings and accumulation for different retirement strategies, and use the advantage of time as early as possible to leverage the rapid growth of the comprehensive retirement income account. Only then can we truly help us realize the American dream of peace of mind.

appendix

1. 2018 Consumer Expenditure Survey, 2019.09, US Bureau of Labor Statistics, https://www.bls.gov/cex/2018/combined/age.pdf