(InsurGuru™️ Wealth Management Column) From the second half of 2018 to the present, various voices of bad news about the U.S. economy have been heard, "The U.S. 10-year bull market is about to end", "The Sino-U.S. trade war will affect the growth of the U.S. stock market", "The U.S. stock market crashed. Fear of full recession"...

U.S. stocks rose 29%

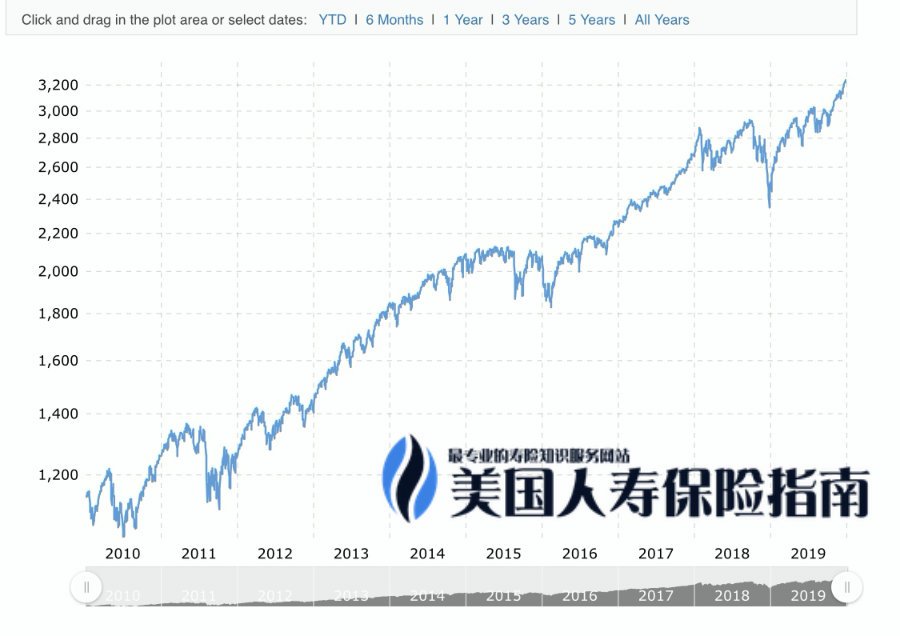

However, in the past 2019, the U.S. unemployment rate has dropped to its lowest level in nearly 1969 years since December 12.Standard & Poor's 500 Index, Also soared 2019% in 29, becoming one of the most outstanding securities investment markets in the past 10 years.

Such a strong market rise has given participants who invest in the U.S. market a share in 2019.

S&P 500 Index return 20%+

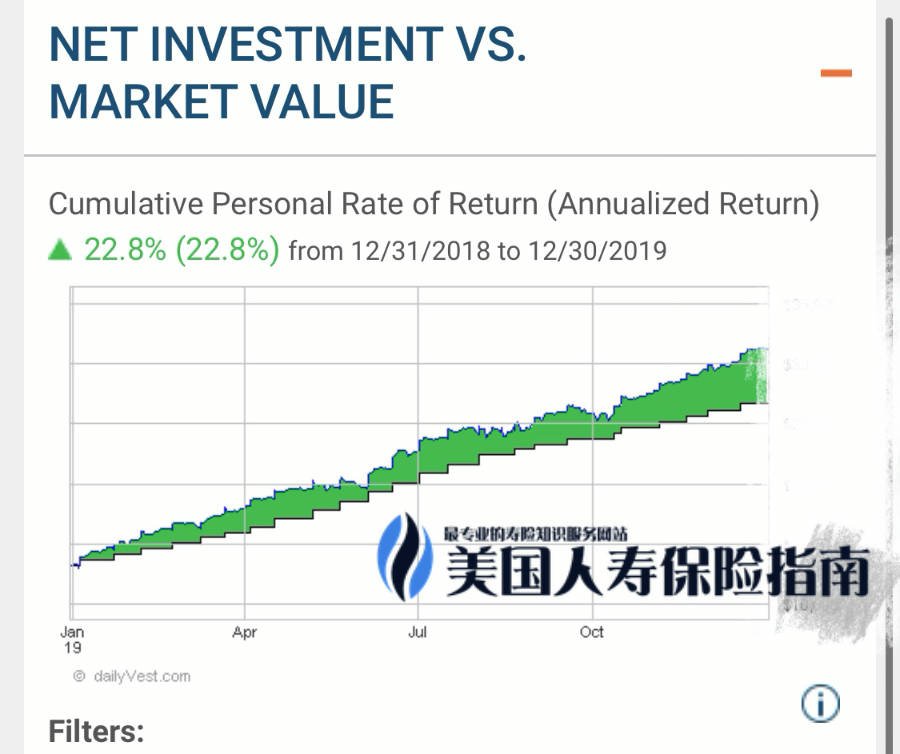

Retirement columnAuthor Ben XiangAmerican Life InsuranceGuide Network ©️ provides a copy for benchmarkingIndex insurance, Fixed monthlyStandard & Poor's 500 IndexThe account income diagram is explained.From the figure below, we can see that from December 2018, 12 to December 31, 2019, if it is divided into 12 months, a monthly fee is regularly deposited to purchase the US Standard & Poor’s 30 Index.Then the return rate for the year of 2019 is 22.8%.

In reality, the actual income may fluctuate slightly with different buying points.

Index-type policy income generally ushered in a cap

The annual rise of the S&P 500 index has also led to the tracking of the US S&P 500 index.Exponential policyIncome, according to the American Life Insurance Guide to the communitybrokerAccording to the survey, many U.S. index insurance holders will also get the capped rate of return in 2019.

The American Life Insurance Guide©️ will also share the policyholder’s information in subsequent articlesActual income bill, And contrastThe advantages and disadvantages of buying index insurance and buying U.S. stock indexes.

(Recommended reading:How to calculate the credit of index insurance, and how much is it?And how to check the policy account balance?)

Article summary

Despite the stock market crash at the end of 2018, the long-lasting impact of the Sino-U.S. trade war, the rise of the global negative interest rate era, and the confused political chaos of presidential impeachment, the U.S. economy in 2019 rebounded strongly amidst not-so-optimistic voices. Fought back the "predictions" of various financial and economic experts with facts.

From this point, we seem to have learned that in a noisy market environment, there are always voices of this kind, which make us confused and even afraid of the uncertain future.This mentality will ultimately affect our judgment and make it difficult for us to make choices and decisions.but,"Waiting" itself is a choice that requires a cost.

In the last decade, the U.S. stock market as a whole has risen nearly 300%.

In the last decade, the U.S. stock market as a whole has risen nearly 300%.

American Life Insurance Guide ©️ and insurGuru™️Insurance CollegeThe common philosophy is that whether it isBuy a house, buy and sell stocks and bondsOr PE, or buying American cash value insurance. There is no simple distinction between "good and bad" among these different investment and financial management methods, and in real life, it is not an either-or relationship.

In actual work, the registered brokers of the American Life Insurance Guide©️ will also share with the insured customers the channel method and mobile management method of "zero" cost fixed investment in US stocks that we have actually evaluated and are using for free.

The most important thing is that we have to choose what we can accept and are willing to try, and act immediately.

On the road to the construction of family wealth, whether it is cash, real estate, stocks, securities, and financial insurance policies, they will eventually become our tools.Act now, so that we have enough tools in our hands so that we can have more choices when dealing with future life and unexpected situations.

"Don't worry about tomorrow. Tomorrow will worry about tomorrow." -Matthew 6:34