Many friends are more or less skeptical about life insurance and insurance companies.One of the concerns is the ability of insurance companies to compensate.Usually we are alert when we hear the word "guarantee".There are many scammers in this society.Why should we trust the insurance company's claims guarantee?

Before delving into this topic, let’s talk about insurance companiesRefusal of claimsOf two situations.

- First of allIf the insured person commits suicide within the first two years of the policy’s effective date, the beneficiary will not be able to receive death compensation.However, the insurance company will refund the insurance money.These are clearly written in the declaration contract.

- SecondIf the insured person dies in the first two years, the insurance company has the right to investigate regardless of the reason.If it is found that the insured has deliberately concealed his health status (for example, concealing his cancer condition), the insurance company may refuse to pay.All life insurance policies in the United States have a statutory dispute period of two years.After the dispute period, the insurance company cannot cancel the policy or refuse to pay the death benefit for any reason.

Now let’s get to the main topic and talk about why the insurance company’s guarantee is reliable.

One reason: the insurance company is financially rich and is absolutely able to compensate

The insurance industry in the United States has a history of hundreds of years.Many life insurance companies are century-old stores.Today, the financial resources accumulated by insurance companies have far exceeded ordinary people's imagination.The total assets of the top five reached two trillion U.S. dollars ($2 trillian).An average of 400 billion U.S. dollars ($18 billion) each.What is the concept of two trillion dollars?The gross national product (GDP) of the United States is 18 trillion U.S. dollars ($12 trillian).So the capital of the top five insurance companies exceeds XNUMX% of US GDP.

Reason XNUMX: The US government has very strict risk requirements for insurance companies, which are much higher than those for banks

Most people don't have too many concerns about the stability of Bank of America.On the one hand, this trust is due to the government's guarantee.Most U.S. banks are mostly members of FDIC (Federal Deposit Insurance Corporation). FDIC is an agency of the U.S. government that provides insurance for banks.Deposits in personal accounts within USD 25 are insured by the FDIC.On the other hand, people in the United States are very familiar with banks.People tend to underestimate the risks of familiar things.Let's take a look at the objective data.

According to FDIC statistics, in the few years following the 2008 financial tsunami, more than 400 banks in the United States had major problems and were taken over by the government.If you include 2008, this number exceeds 430.

In contrast, only 14 American life insurance companies have been taken over.This figure is less than 3.3% of the bank's accident rate during the same period. AM Best (insurance company appraisal agency) made a 27-year statistics.The failure rate of insurance companies is one in 500.Even the life insurance subsidiary of AIG, one of the culprits of the financial tsunami, is intact.

- 2008 Lincoln Memorial Life Insurance Company

- 2009 American Network Insurance Company*

- 2009Medical Savings Insurance Company

- 2009 Old Standard Life Insurance Company

- 2009 Penn Treaty Network America Insurance Company*

- 2010 Booker T Washington Insurance Company, Inc.

- 2010 America Life and Health Insurance Company

- 2010 National Insurance Company

- 2010 Universal Life Insurance Company

- 2011 Golden State Mutual Life Insurance Company

- 2012 Standard Life Insurance Company of Indiana

- 2013 Executive Life Insurance Company of New York

- 2013 Lumbermens Mutual Casualty Company

- 2013 Universal Health Care Insurance Company, Inc.

Why is the accident rate of a life insurance company so different from that of a bank?In the final analysis, the government's requirements for life insurance companies are much higher than those for banks, almost reaching a far different level.

The Federal Reserve only requires banks to maintain their capital reserve ratio at 20%.In other words, the bank only needs to keep 20% of the deposits, and the remaining 80% of the deposits can be borrowed.If the bank encounters a situation like the financial tsunami, many borrowers go bankrupt, and the debts will not be recovered.Moreover, bank deposits are mostly short-term, while loans are long-term.This kind of essential difference will lead to catastrophic consequences if it is slightly inadequate in operation or encounters an unfavorable environment.

In contrast, the US insurance industry is super conservatively regulated.The government requires the reserve ratio of life insurance companies to remain above 100%.The average industry reserve ratio is as high as 115%.And insurance companies are not allowed to borrow money to invest, nor can they invest in high-risk products (such as stocks).Therefore, it is theoretically non-existent that American insurance companies have bankruptcies similar to the nature of the banking industry.

Reason XNUMX: The government provides necessary protection to policyholders

In addition to the insurance company's own deep financial resources and the government's ultra-conservative risk management requirements, policyholders have additional protection.

- Every life insurance company is regularly audited by the government to ensure the prudent operation of the company.

- If there is a problem with the life insurance company, the state government will take over and operate the company to ensure policy claims.

- Every life insurance company is audited by a number of independent third-party rating agencies.

- The government requires that the reserve funds of insurance companies must be used for claims and cannot be used for any other purpose.

- Each state has its own additional protection measures.

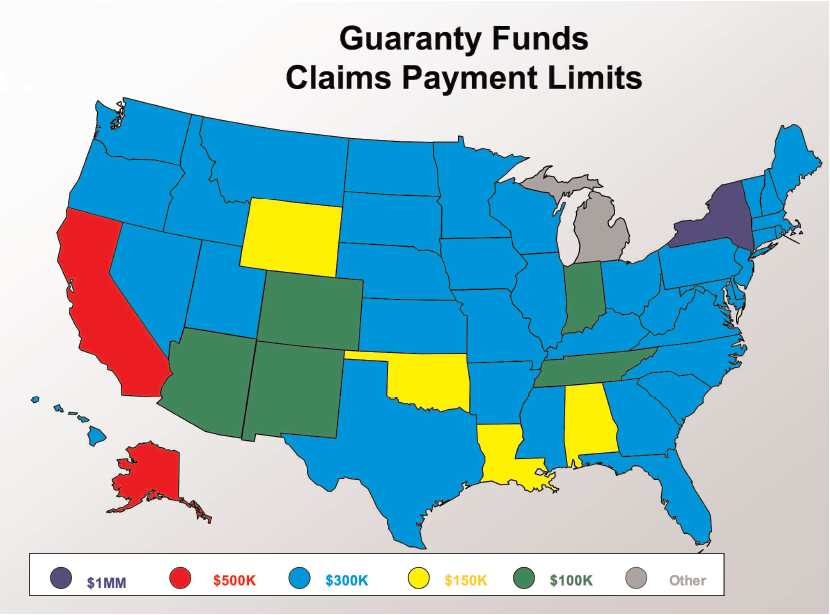

Insurance companies are supervised at the state level, and the state insurance guarantee association IGA provides reinsurance to policyholders.When the insurance company defaults or becomes insolvent, the SGA policyholders of the state guarantee fund will compensate.

(The insurance bond associations of each state will reinsurance and settle claims on the insurance account of the insured person. The above picture shows the upper limit of claims for each state ©️insurancejournal)

(The insurance bond associations of each state will reinsurance and settle claims on the insurance account of the insured person. The above picture shows the upper limit of claims for each state ©️insurancejournal)

In general, life insurance companies are not only regulated by the government, but highly regulated by the government.Industries with this level of regulation are rare in the United States and almost non-existent.

There is a strange phenomenon in the American insurance industry.To protect consumers, the government strictly prohibits life insurance companies from promoting the guarantees provided by government agencies on insurance policies.In fact, every state has an Insurance Guaranty Association (Insurance Guaranty Association).Their job is to provide sufficient funds to ensure that the policy will not be affected if the life insurance company encounters trouble.The source of funding for these government guarantee agencies is provided by all life insurance companies operating in the state.Much like the way FDIC operates.The strange thing is that all the banks advertise that they are members of the FDIC.The life insurance company never mentions a word about the guarantee agency of the state government at any time.

The government’s logic is as follows: If it is mentioned, consumers may be too assured of life insurance companies.The government's philosophy of managing life insurance companies is super conservative.Therefore, the government strictly prohibits insurance companies from promoting the safety of the industry or themselves to consumers. (Similar to this strange phenomenon can also be seen in the illustration of the insurance policy).

In addition, there is a national government organization in the United States called National Organization of Life and Health Insurance Guaranty Associations (NOLHGA).It is the general assembly of guarantee agencies in the 50 states of the United States. NOLHGA further provides protection against bankruptcy of multi-state insurance companies.

Reason XNUMX: Life insurance companies buy reinsurance (reinsurnace) to diversify and manage risks

Reinsurance (reinsurnace) is the insurance that the insurance company buys for itself.The reinsurance industry is not mentioned much among ordinary consumers, but it is an industry of considerable scale.Buffett has a soft spot for this industry.His Berkshire Hathaway holding company has two major reinsurance subsidiaries, Berkshire Hathaway Reinsurance and General Re.

Many life insurance companies, such as AIG andAllianz Life(Allianz Life Insurance Company), all use reinsurance to reduce or transfer risks to the insurance policies issued by themselves.In compensation, the life insurance company and the reinsurance company share the compensation.This has two advantages.First, the financial responsibility of life insurance companies has been reduced.Second, life insurance companies can more actively expand the market and provide more competitive insurance policies.

How is AIG?

Many friends often mention AIG.Think AIG is a classic example of life insurance company accidents.In fact, the opposite is true.

During the 2008 financial tsunami, AIG was a super international financial holding company.If it falls, it will cause a series of chain blows to global finance.The consequences will be disastrous.For this reason, the U.S. government (Federal Reserve and Treasury Department) assisted.The above is familiar to everyone.But the rest of the story is little known.

A statement issued by the National Association of Insurance Commissioners said: Each state's senior insurance regulatory agency in the United States explained the actual situation of AIG. AIG is more than just an insurance company.

"AIG is an international financial holding company with business scope from aircraft leasing to investment services to insurance business." The statement went on to explain that if you hold AIG life insurance, then it is issued by AIG's subsidiary insurance company.These insurance companies are financially sound. … The AIG subsidiary insurance company is financially able to pay the claim. The financial problems faced by AIG occurred due to the parent company’s investment in risky mortgage-backed securities. "

The official website of the Massachusetts Office of Consumer Affairs and Business Administration issued the following statement in late September 2008 to take it seriously:

“AIG’s troubles are mainly caused by AIG’s non-insurance parent company, which is not subject to state supervision and therefore does not meet the same investment, accounting and capital adequacy standards as state-supervised insurance subsidiaries. Insurance subsidiaries are currently solvent. Able to perform its obligations. The national regulatory agency ensures that the company’s assets are protected from the parent company’s troubles and can pay compensation claims. The national insurance agency closely monitors the financial status of the insurance companies under its supervision."

Simply put, the parent company of AIG acts irresponsibly like a child, hijacking money arbitrarily.At the same time, its subsidiary (the insurance company it owns) follows the rules, maintains reserves, and acts responsibly. The AIG parent company tried to ask the court to allow the “borrowing” of the reserves of its subsidiary insurance company to pay for debts caused by the parent company’s irresponsibility.The basic meaning of the court decision is that the parent company cannot use the money of the subsidiary company. AIG's insurance companies are partly good because they are insurance companies and are regulated by all states.On the contrary, the parent company is not subject to such regulations.

The lesson of AIG is really a good objective example: if you are looking for a safe and protected place to put your money, it is difficult to find a place that is more reliable than a well-run life insurance company.

Source: Bozhi Financial

Recommended reading: "Will the insurance company go bankrupt?"