The advancement of science and technology and the improvement of the quality of life have brought about a rapid increase in the average life expectancy.In the last 30 years,The population growth rate of living to 100 years old exceeds the growth rate of the total population.Longevity, on the one hand, allows us to have more time to enjoy the happiness from family and life, but on the other hand, it also brings new financial anxiety.

In the past retirement income planning, the income cycle was usually 10 to 15 years.But with the ever-increasing average life expectancy and real life cycle schedule, for people who need to retire now and in the future, we may need to consider a 30-year retirement income cycle, or even longer.

Financial problems caused by longevity

If you are a male and you are 65 years old this year, thenYour life expectancy is 84.3 years; If you are a female and you are 65 years old this year, thenYour life expectancy is 86.7 years.This is just the latest estimate of the average life expectancy of American residents. In reality, many people may live longer.

This is a situation that has never been seen in historyTherefore, along with longevity, our daily life expenditures, as well as medical and health expenditures, have become crucial.

There is no “one-stop” or universal financial solution in the world, but each of us has the same goal:Let our money be used as long as possible, and it will not happen that people are alive but money is gone.

Therefore, the following 5 factors are worthy of consideration for you and your family.

1. Consider delaying retirement pension

Social Security Retirement AnnuityAlthough not much, its true meaning is to provide us with lifelong income until we die.

Now, at the age of 62, we can apply to start receiving this government-provided retirement annuity, but the earlier we receive, the less money we can pay out every month.If we wait until we are 70 years old and come to receive it, we can receive nearly 76% more each month.

With the increase in life expectancy, the government continues to push up the official retirement age. The earlier you want to get money, the less you get.

At the same time, we also have the social security pensionQuite a "misunderstanding", thinking that this is a "large sum of money".according toAccording to data from the Social Security Administration, in 2019, the average monthly social security pension income was only $1,461.

The Social Security Bureau also emphasized in the official document,Please don't use social security pension as the sole source of retirement income.

(>>>Recommended reading:BBC Official Tucao|When ideals do not reflect reality, how difficult is it for Americans to retire?)

2. Prepare for senior health care expenses and long-term care

Health care expenditure after retirement is the biggest financial expense in retirement.

Most people are unwilling to discuss and talk about this topic, some feel that they are still making money, and some feel offended.

Let everyone imagine that they can’t take care of themselves, it will produce a sense of powerlessness.And no one tries to show their powerlessness and vulnerability.

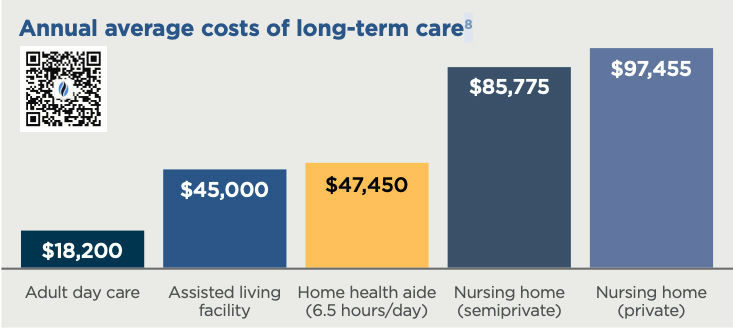

But reality is also a question of probability.Among those over 65 this year, there is a 70% probability that they will need long-term care services in the future.

(>>>Recommended reading: Popular science post: the cost and price of long-term care in the United States )

3. Use HSAs as investment channels

In layman's terms, HSA can be understood as a medical savings investment account, dedicated to medical expenditures.

The government gave the green light to this type of account. HSA accounts have three tax advantages:

- The money deposited in the HSA account can be deducted from the income;

- Secondly, the income from investment and financial management in the HSA account is tax-free;

- Finally, withdrawing money from the HSA account for medical and related expenses is also tax-free.

This kind of account is not allowed to put money into unlimitedly. 2021Individual deposit up to $3600.Family save up to $7200.Those over 55 years old can also deposit an extra $1000.

4. Look at stock investment from a retirement perspective

Although we think we are still "young", we still have a lot of time.But at this time, we have already begun to panic just by looking at the shrinking stock account, let alone really willing to spend time waiting for the stock market to rise.

At the time of retirement,What we are concerned about is no longer the growth potential of capital, but the source of income that needs to be "guaranteed".The latter is the foundation of retirement financial security.

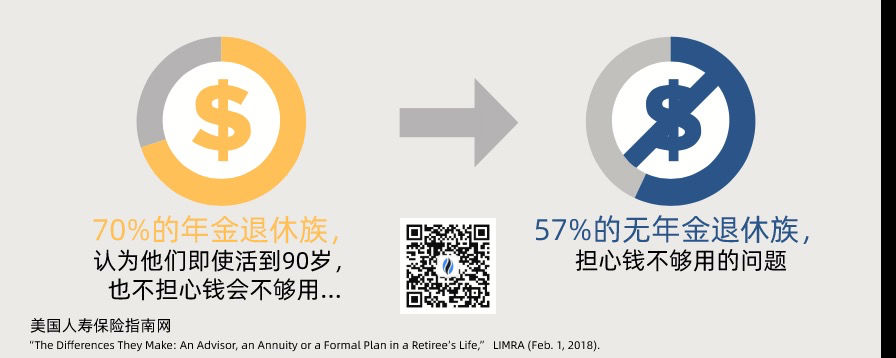

Social security retirement annuity is a guarantee of lifelong incomeAnnuity Insurance.We can also invest in commercial annuity insurance to supplement the guaranteed source of income for life.

Social security retirement annuity is a guarantee of lifelong incomeAnnuity Insurance.We can also invest in commercial annuity insurance to supplement the guaranteed source of income for life.

After constructing our own guaranteed source of retirement income, we can continue to "hold" our stock assets with more confidence.

(>>>Recommended reading: What is a retirement annuity?Who are buying retirement annuities?)

5. Take your significant other into consideration

For most of us, considering the cost of the absence of the other half is another difficult topic.So many people choose to avoid talking about it.According to the “National Health Insurance and Long-term Care Consumer Survey” conducted in 20181The conclusions provided,70% of adults have not discussed retirement expenses with their spouses.

Statistically speaking, women have a longer life expectancy than men.Here is the conclusion of the survey directly: "In 48% of families, after the death of their spouse, another family member will live alone for 10 years or longer."2

Therefore, family members must make it clear that no matter who goes first, how the remaining one can live comfortably, and do not have to worry about money when they are old.

The 4 general methods are:

- Social security pension annuity switch:If the deceased spouse’s retirement annuity income is higher, family members can give up their pensions and choose to receive a higher pension.

- Set up beneficiary of HSAs account:Leave HSA account funds to family members

- Use joint annuity insurance: Use the names of the husband and wife to apply for annuity insurance, and the annuity guarantees that the annuity will pay the income of both people for life.

- Risk management of accidents: Use life insuranceClaims, Provide enough cash for family members after the accident.

Article summary

Longevity inevitably changes the social retirement system, and it also impacts the usual concept of "retirement" in our minds.

Through the sharing of this article, we have learned about the basic retirement strategies we can adopt in the future environment to help us build a financial foundation that "the elderly can rely on and the sick can be treated".

American Life Insurance Guide©️Encourage every reader and his family to have an open and honest retirement planning communication, through continuous learning and understanding, and with the assistance of professionals, to draw up a family’s mid- and long-term retirement plan, and build a financial safety net suitable for their family. Ensure life-long income and cash flow, and achieve the goal of longevity and happy retirement. (End of full text)

(>>>Recommended reading:Comparison|Index annuity and fund annuity, which annuity insurance is better? (Version 2022))

appendix

1. “2018 Nationwide Health Care and Long-Term Care Consumer Survey,” conducted online by The Harris Poll on behalf of the Nationwide Retirement Institute. The fourth annual survey was taken Feb. 5-22, 2018, among 1,007 US adults ages 50 or older who have a household income of $150,000 or more ("affluent adults"), and 522 US adults ages 50 or older who are or have been caregivers.

2. "IRI Fact Book 2016," Insured Retirement Institute (2016).

8 “Long-Term Care Insurance Statistics,” LTC Tree (August 2018).