In the past few days, school-age students and their parents have made the most trouble on Facebook, and must be all universities raising tuition fees.

On the one hand, schools kept swiping their screens to notify the tuition increase in 2017-2018, and on the other hand, students blasted their gongs and drums to protest.

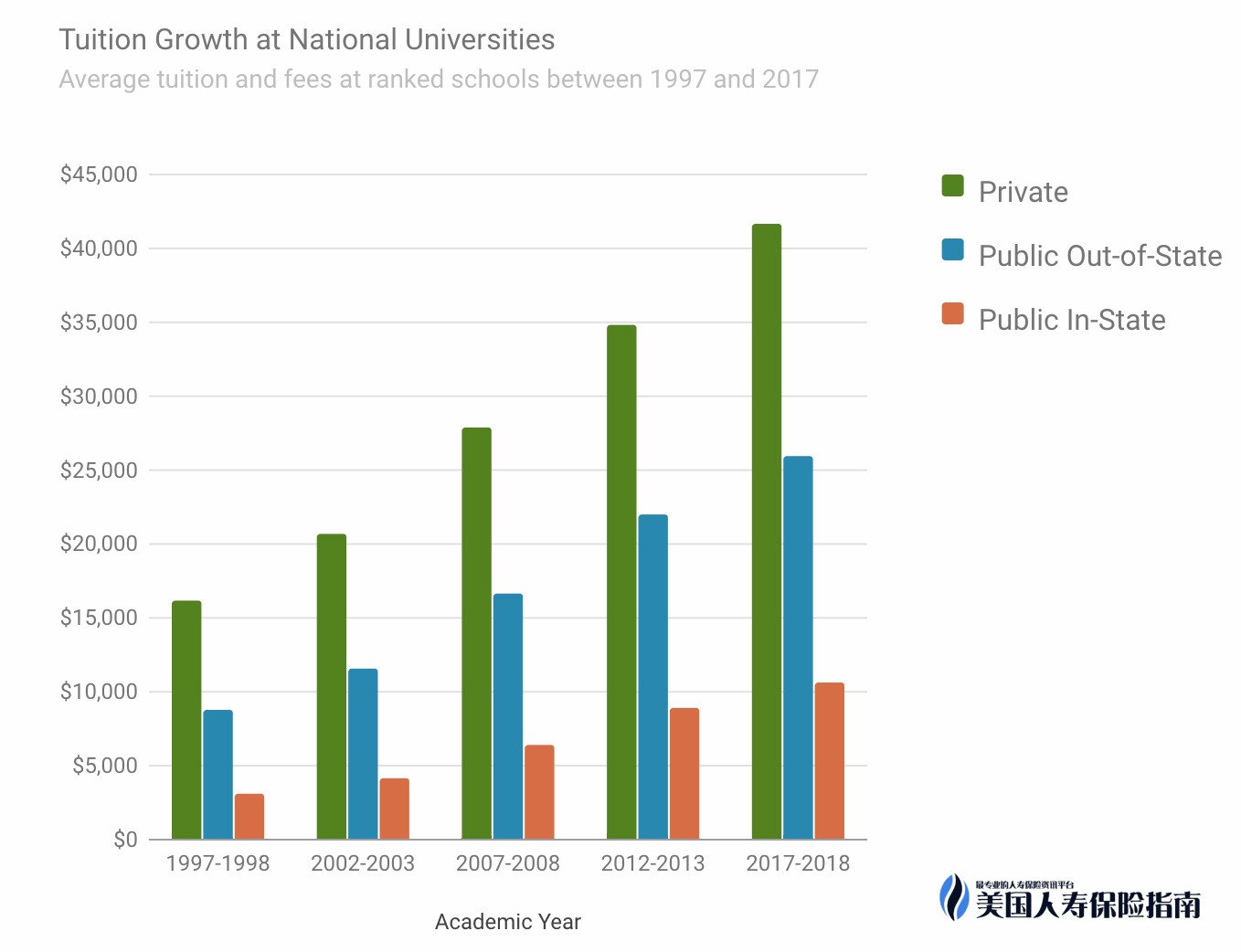

▲US News made a chart of the tuition growth of public and private schools in the past ten years.Both public and private tuition fees have almost doubled

▲On the other hand, students took to the streets angrily and demanded that the government provide more subsidies to public universities

▲10 California universities announced at the same time that they would raise prices by no less than 5%, which aroused the anger of students

▲The students asked: Is such a public university still public?This slogan really responds to a hundred responses

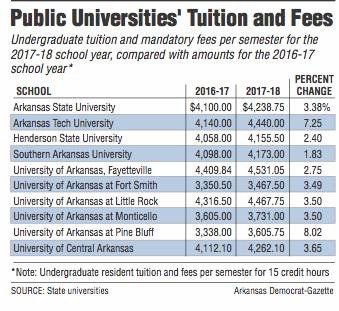

▲In fact, not only California, but also other states across the country are also rising

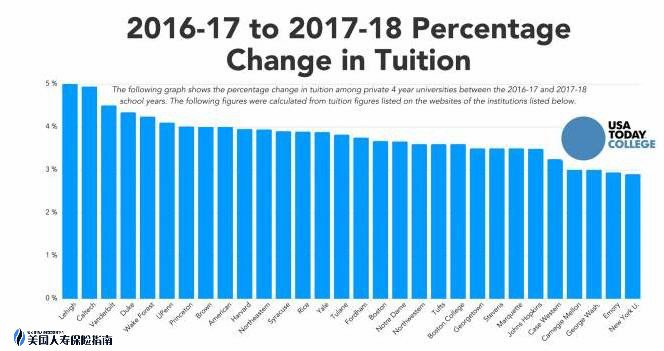

▲USA TODAY lists the overall price increase this year

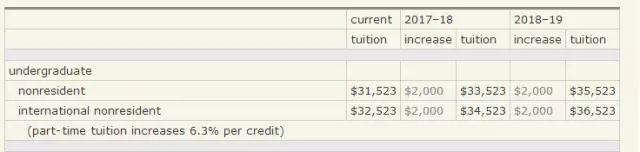

▲The University of Wisconsin-Madison simply told the university on its official website that prices have increased this year, and they will continue to increase next year, and they will still increase in the following year.

▲The University of Wisconsin-Madison simply told the university on its official website that prices have increased this year, and they will continue to increase next year, and they will still increase in the following year.

Not only are the poor students crying and unable to pay the tuition, the mayor of New York also tweeted with tears, "I can't afford the tuition for two children either."

As soon as his tweet was posted, not only did he fail to evoke sympathy, but he was annoyed by everyone: "Enough, with an annual salary of 22 US dollars a year, can you still not afford the tuition?"

The mayor really calculated it for everyone: her daughter is in high school and earns $5.5 a year. The income of 22 US dollars, after removing the high income tax and paying the daughter's tuition and fees, it is indeed difficult to pay nearly 7 US dollars in tuition and fees for his son who has just been admitted to Yale.The husband and wife were also at a loss and under great pressure.

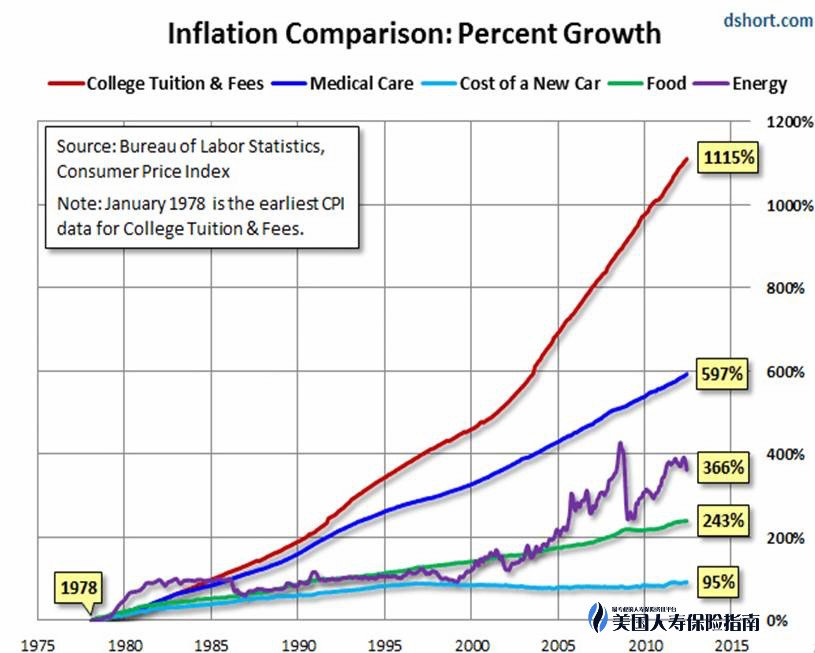

▲Not long ago, mainstream newspapers in the United States announced the level of price increase in the case of inflation

University tuition is at the top of the list, making it the most unbearable weight for middle-class people. From 2000 to 2014, American public university tuition fees skyrocketed, with an average increase of 80%, while the median household income fell by 7%.

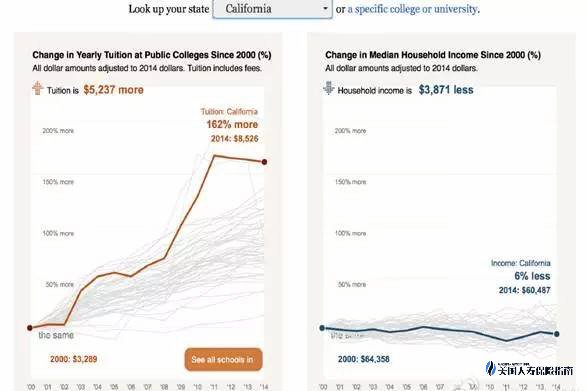

▲More serious is California, where tuition fees rose by 162%, while median income fell by 6%

On the one hand, income is declining, and on the other hand, tuition fees are rising. Higher education has become the most expensive and most expensive luxury for all American families.Is it possible not to consume this luxury item?

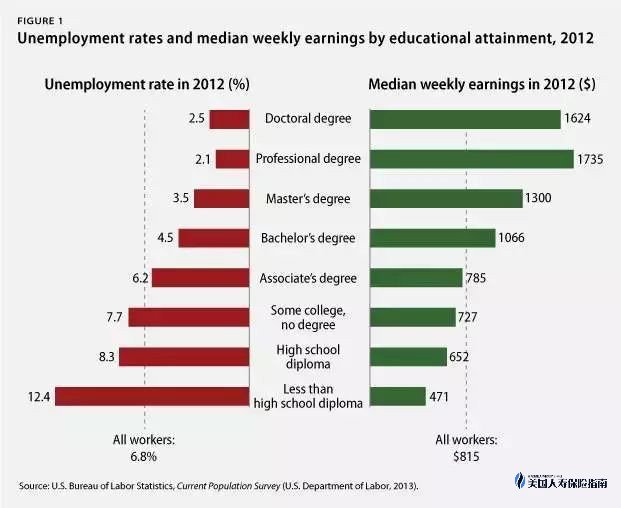

▲This form bloody reveals the consequences of not going to college

Red represents the unemployment rate, and green represents the weekly salary.The higher the education level, the lower the unemployment rate and the more weekly salary earned.At the bottom are the hardworking people who have never even attended high school. At the top of the pyramid is a doctorate.

It seems that "only high school students", there is no exception in the United States.For Asian parents who pay attention to their children's education, planning an education fund for their children in advance has become a must-do for every family.

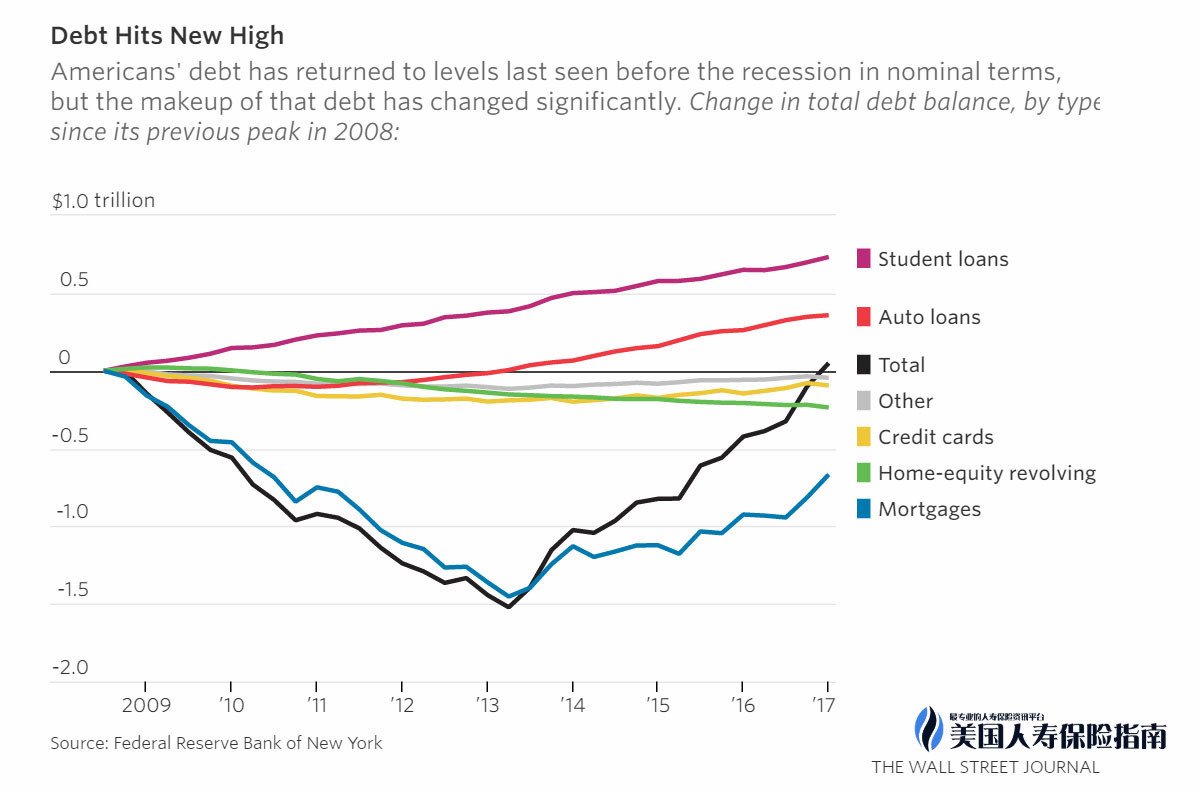

When the family cannot cope with these tuition fees, the students can only go to work, so we often see in American dramas that the students are working hard, whether they are the children of the president or the children of ordinary people.But this is just a small amount of pocket money.Therefore, of the 3 million people in the United States, more than 4 million people are carrying student loans.Has surpassed the national credit card lending and motor vehicle lending.In the 1999 years from 15 to the present, the scale of student loans in the United States has increased by more than 500%, but the average salary of university graduates has not risen but fallen, which is 2000% lower than in 10.Under this heavy debt pressure, 4 million of the 700 million indebted people defaulted because they were unable to repay their loans in time.

Even Obama sighed in public. He and his wife, Michelle, carried high tuition loans for decades. They were only fully repaid at the age of 43 and became president at the age of 47.And Asian parents, especially those of Chinese children, are generally unwilling to burden their children with huge student loans. Foresight parents are undoubtedly more optimistic about life insurance and various education funds.

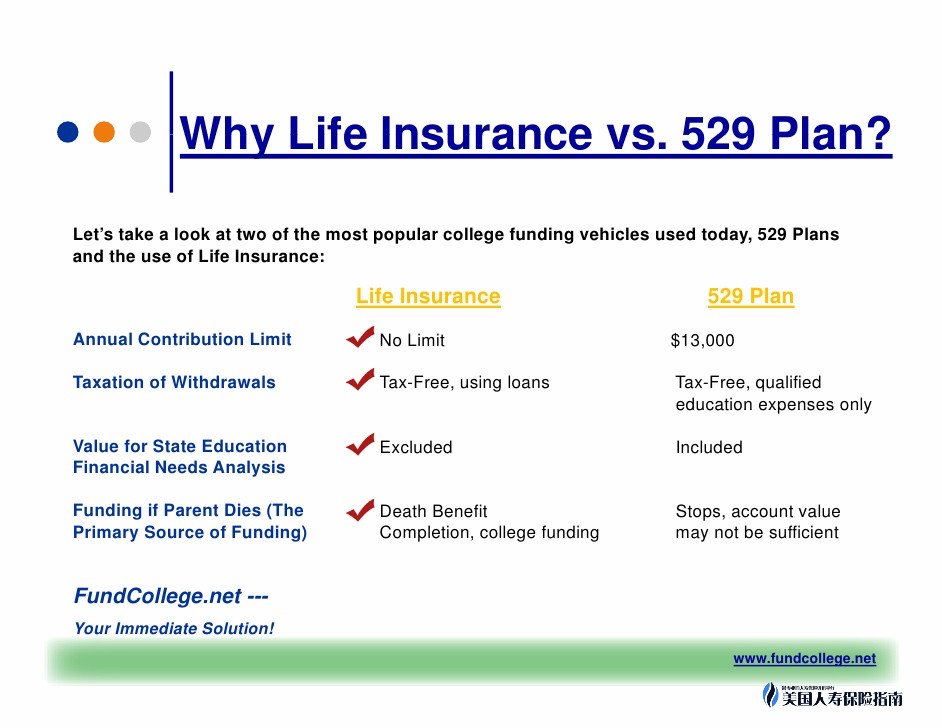

By comparison, you can find that using a life insurance policy to plan for your children not only has no upper limit on the amount of money you put in each year, but also tax exemption when it is withdrawn as education funds. Even if the tax-free tuition is available, it will not affect your child's application for other scholarships.As the most important protection function of life insurance, children have always been protected since the policy goes into effect.

(>>>Recommended reading:Can children and newborn babies buy life insurance in the United States?What kind of insurance should I buy?What are the advantages and disadvantages of buying life insurance for children?)

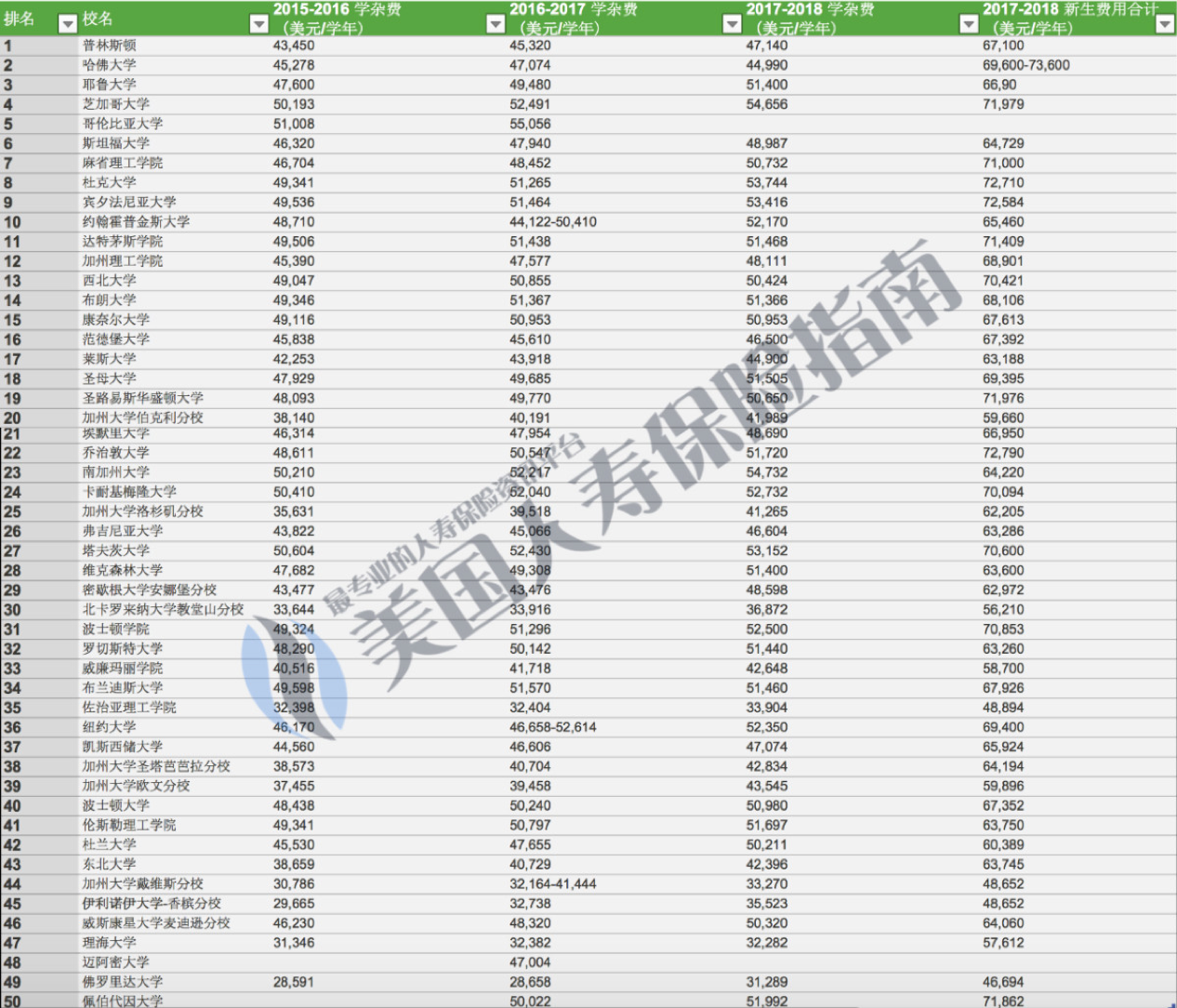

Finally, let's take a look at the changes in tuition fees of the top 50 universities in the United States in 2015-2018.