(American Life Insurance Guide 10/29/2019 Irvine) As the market is optimistic about the international situation and the Q3 earnings season of the US stocks, the US stock market opened higher on Monday and then fell slightly, then resumed its upward trend. The three major stock indexes rose by the close.The S&P 500 Index hits a record high today.According to data monitoring by the American Life Insurance Guide, the index insurance strategy account linked to the S&P 10 index at the end of October will generally usher in a return rate of more than 500x%.

Three major stock indexes rise together, boosting US economic growth

As of the close, the Dow rose by 132.66 points to 27090.72 points, an increase of 0.49%;S&P 500 IndexIt rose 16.87 points to 3039.42 points, an increase of 0.56%; the Nasdaq rose 82.87 points to 8325.99 points, an increase of 1.01%.

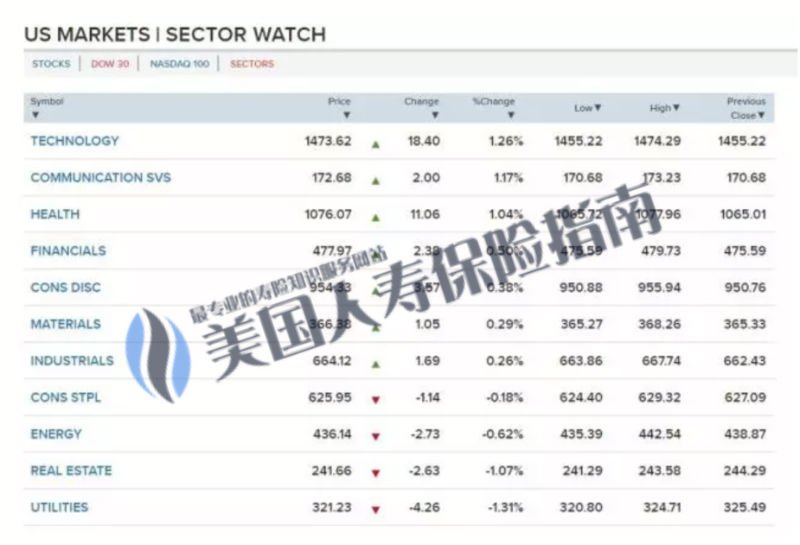

S&P 500 IndexOf the 11 sectors, 7 sectors rose and 4 sectors fell.Among them, the technology and communication systems sectors led the gains, while the utilities sector led the declines.

Index policy point-to-point strategy accounts will usher in a bumper harvest

What is IUL index insurance?

IUL insurance, Which is what we usually sayIndex insurance, It is a life insurance account product with cash value, and it is a financial insurance product unique to the US market at present.

IUL insuranceProvide a savings and investment function, just like you opened an investment "account" in the "bank" of an insurance company, but this "account" has a professional term called "Cash value. "

After paying the insurance cost, the remaining part of the premium we paid is automatically entered into several alternative "strategy accounts" and converted into the corresponding cash value. We can choose to put this money into the strategy of guaranteeing income In the account, such as a guaranteed return of 2.5% per year; you can also choose to target the stock index in the cross-border account, for example, usually choose to linkStandard & Poor's 500 Index(S&P500 index), Nasdaq 100 and so on.When it is put into the stock index strategy account, when the market environment is not good, the insurance company promises to guarantee the bottom. Therefore, the policy holder of the policy account has no risk of loss.

Did your index policy hit its cap today?Welcome to the American Life Insurance Guide to share your insurance story.

(Reported by the editor of American Life Insurance Guide Network)