Citing Yonhap News Agency, Lee Fuzhen, the "eldest princess" of Samsung Group, pledged her shares in Samsung Electronics as a guarantee, with an interest rate of 4%.A loan of 1000 billion won (approximately US$8500 million, 5.4 million RMB).The industry generally believes that this loan is used to pay inheritance taxes.

(Related reports from Chinese media)

(Related reports from Chinese media)

Public information shows that Li Fuzhen is 51 years old this year and is the eldest daughter of the late Samsung Group chairman Li Jianxi.The legacy of Lee Kin-hee, the former head of Samsung, who died of illness last yearThe total value is about 26 trillion won (approximately US$220 billion).

For the inheritors, including Li Fuzhen, they need to pay the inheritance tax before they can get the wealth.

On April 2021, 4, Li Jianxi’s family applied to pay the inheritance tax in five years.In order to raise the funds needed to inherit the wealth, Lee Kun-hee's widow and two daughters began to sell Samsung Group stocks.Li Fuzhen, the "eldest princess" reported earlier, also raised working capital through mortgage loans.

Which families also face these problems?

The U.S., like South Korea, has launched a campaignHigh inheritance tax.In the wealth inheritance column of the TLT community, the American Life Insurance Guide©️ also pointed out that in addition toInheritance tax, Some state governments also provide additional payment to family members or childrenInheritance tax.

As a small and medium-sized business owner, company share holder, or equity investor, as you grow older, you will inevitably face considerations when considering passing on your wealth to the next generation.Equity issues, wealth transfer issues, and capital liquidity are three major issues.

American Life Insurance Guide©️For business owners orShare partnershipIn the column of, introduced the use of Life Insurance’s Buy Sell Agreement toResolve equity allocationThe problem,At its core, it is also the question of not being able to get a large amount of cash at a critical time.

Life insurance provides a capital leverage solution to solve such problems.

Liquidity solutions in wealth inheritance

Use life insurance’s tax-free cash settlement to guaranteeInheritance of wealthThe liquidity problem in the process is a simple solution.

At the same time, reasonable planning and the use of time will maximize the leverage ratio of this fund.

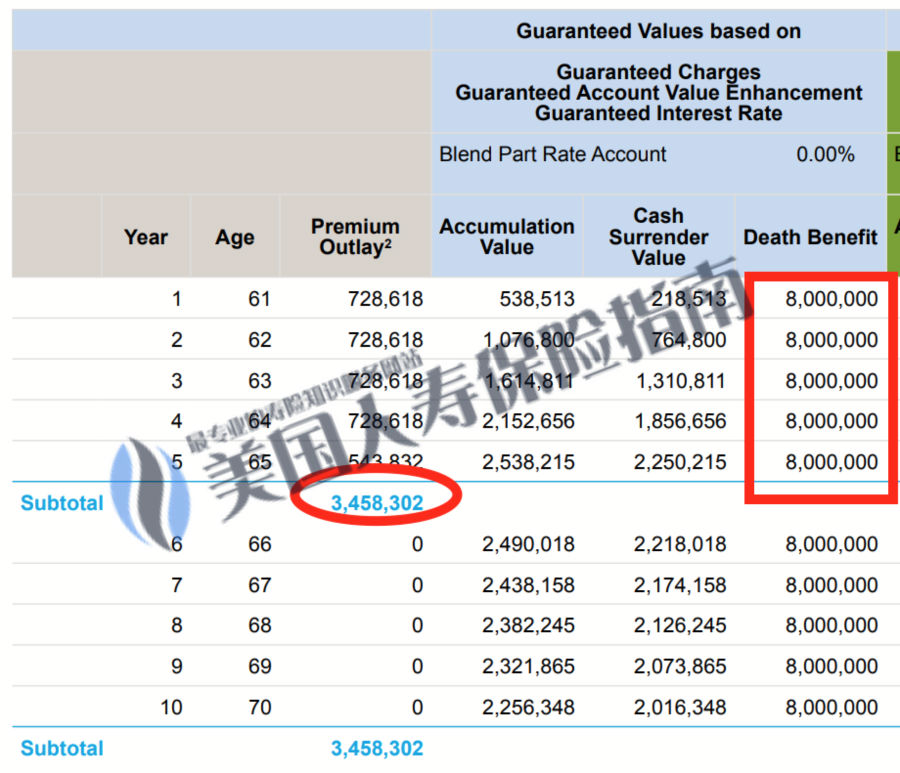

Take a 60-year-old female entrepreneur as an example, in order toTotal value of 3000 million U.S. dollarsassetinheritedFor future generations, you need to pay andPrepare about 800 million U.S. dollars in cash to pay taxes.

In this process, family members or business partners also face the lack of liquidity of assets and the inability to quickly realize them. At the same time, they may subjectively do not want to convert assets and equity into cash.

A common solution is that such families need to prepare a life insurance policy of 800 million insured amount in advance.Taking into account the factor of inflation, the accumulated input premiums of the insured family will reach nearly 350 million U.S. dollars, which will be used to leverage the death cash compensation of 800 million U.S. dollars.The column marked in the specific red box as shown below,Whether the leverage ratio of about 1:2.5 is appropriate,Different people have different opinions.

(The illustration is only for public education and display purposes, not an actual contract quotation offer, please consult a professional life insurance consultant or planner)

(The illustration is only for public education and display purposes, not an actual contract quotation offer, please consult a professional life insurance consultant or planner)

But in real life, large amounts are neededWealth inheritance planningAmong the insured families, few families buy life insurance policies in this way.

These high-asset and high-income families will seek the help of professional life insurance loan brokers and have applied for insurance premium loan projects from life insurance companies.

Under the conditions of low interest rates, the insured family can use the policy itself as collateral to borrow and borrow premiums, therebyIncrease the claim leverage of the insurance policy to between 1:5 and 1:10, To achieve no need to realize existing assets to pay premiums, and at the same time haveLarge insurance policyTo deal with the liquidity cash loopholes in the process of wealth inheritance. (End of full text)

(>>>Related reading:What is a large insurance policy?What are the advantages?)

(>>>Related reading:What is premium financing?Is it a good idea to borrow money to buy an insurance policy?)

(>>>Related reading:How to use life insurance agreement to protect equity and family when doing business in partnership?)