Americans (55-64 years old) near retirement have an average net worth of less than $17.After retirement, there is no fixed income. With the increase of age, physical functions begin to appear in different degrees.YoroIt has become a very real problem.How to do it wellRetirement planningIt is a question that we must consider when we still have the ability to earn income and accumulate wealth.The first thing this article is aboutU.S. post-retirement incomeOf several fixed sources.

1. The monthly social security income (Social Security Income) given by the government

The retirement age in the United States has changed from 62 years old to early retirement, 66 years old for normal retirement, and 70 years old for late retirement.If you have a tax filing record in the United States for XNUMX years (can be interrupted), you will be eligible to receive the government's grant after retirementSocial Security Fund.The amount of social security funds varies from $845 to $2640 per month based on your annual tax filing status (this amount will increase by about 3% per year based on the statistical inflation rate).At present, the social security benefits in the United States have been in a state of making ends meet, and may faceThe danger of not being able to pay.

Early leave age 62 years old to start receivingpension, The monthly amount received will be 75% of the normal retirement.Choose the late retirement age of 70 to start receiving social security payments, and you can receive 132% of the normal retirement age every month.

2. Another source of income is the company, which sets up company pension accounts for company managers and full-time employees (Define Contribution Plan such as 401k and Define Benefit Plan such as Pension)

The main benefits of a pension account set up by a company are as follows:

a. 公司每年提供年收入3%-12%的補助或更高。公司每年會補助給公司管理者和員工年收入的3%-12%的補助。比如,員工每年收入在5萬美元,公司將每年在員工的退休金賬戶中放入$1,500 到$6,000美元作為員工的退休後的收入來源。

b. Employees can also choose to put part of their income in the company's pension account.This part of the money put in does not need to pay the personal income tax of the year, and the investment profit does not need to pay tax.Taxes are paid at the post-retirement tax rate only when they are collected after retirement.

c. Even if the company goes bankrupt or changes jobs, there will be no loss of money in the company's pension account.When a legal dispute requires compensation, the money will not be paid to others.This is why many doctors choose to start from401 kThe money is collected from the inside, because there is a two-year prosecution period, after two years, there is no risk of being appealed by the patient for a medical malpractice two years ago.

3. The third source of income is the personal pension account (IRA, Roth IRA)

Compared with the company's pension account.In addition to the 3%-12% of the subsidy provided by the company, the individual pension account enjoys the benefits of b and c above the same as the pension account provided by the company.

4. Use life insurance as a "financial account" with retirement functions

As you may all know, the income of life insurance is not taxed when it is taken out in the form of borrowings.Therefore, those who have the conditions to purchase life insurance, especially the capital-guaranteed index universal insurance, also take their own insurance policy with the maximum capital injection as a very important part of their retirement planning.

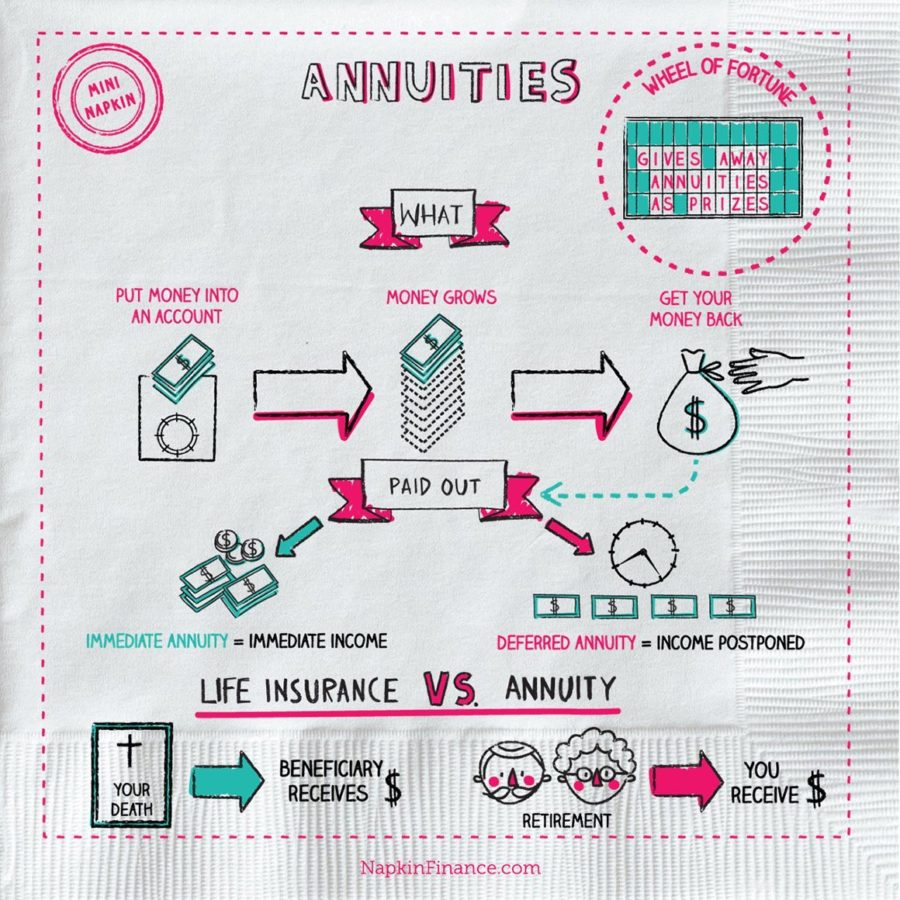

5. The last source of income after retirement is annuity

AnnuityIt is also a type of insurance. It is a financial product created by insurance companies that can generate a fixed income after retirement in order to protect investors because they live too long and their savings are not enough to meet their future lives.If you want to explain the difference between life insurance and annuity in one sentence, insurance solves the problem of "going too early", while annuity solves the problem of "going too late."

There are two types of annuities:Immediate Annuity and Deferred Annuity.

Let me say that the immediate annuity starts from the year you put the money in the insurance company's annuity account. The insurance company will pay you a certain percentage of the benefit from the amount you put in each year according to your age.For example, the benefit of payment for 60-somethings is about 6% per year, and for 70-year-olds is about 7%.

Withdrawal length of current annuity:

One situation is to pay until death. That is to say, if your benefit is 7% and you survive 10 years after buying this contract, then you only get back 70% of the principal. If you survive 20 years, I got back 140% of my principal, and the longer I live, the more I get.

Another situation is that the insurance company’s contract clearly states how many years you can take. If you die before that, your spouse or children will take the remaining years.For example: The fixed period in the contract is 30 years, and your benefit is 6%.Then in 20 years you can get a total of 180% of the principal.If you pass away in 30 years, your spouse or children will take the remaining years.More suitable for the combination of old and young wives.

There is also a situation where couples buy joint survival (joint survival) until both husband and wife pass away.For example, if the husband and wife are jointly insured, the benefit is 7%. If one spouse passes away after 10 years, and the other passes away after 30 years, then the family can receive a total of 30% x 7=30% of the principal in 210 years.This extraction method is more suitable for the combination of old and young wives.

Immediate annuities are more suitable for older people (because the older you are, the higher the benefits will be) or a combination of old couples and young wives.

Deferred annuity means you give the money to the insurance company. The insurance company guarantees that your principal will grow by 5%-7% every year. However, the insurance company stipulates how many years it will take for the customer to get the money out of the account (usually 7 to 10). 10 years).Before this period, a certain percentage (usually XNUMX%) can be proposed to be exempt from fines each year.

比如:10年前你放了20萬在一個保險公司的年金中,每年成長5%,10年之後你可以從保單中每年提取本金+成長部分總和的5% (每年 $16000 左右)總共20年領完,20年中共領取了 $320,000.

Deferred annuities are more suitable for those who have 10 years to retire (52-57 years old).But it is not suitable for people over 66 years old.

There are many things to pay attention to in personal annuity, the most important points are in order of importance:

a. 年金的合約長度。合約長度越長,你放進去的錢越難拿出來。舉個列子:合約長度5 年 和合約長度為15年的年金比較。合約長度5年的年金,在合約簽署後的5年就能從年金裡面拿錢了。 15年的合約要等15年後才能從合約里拿錢,如果提早取錢會有很多罰款。所以在選擇年金的時候合約長度一般選擇5到10年之間的合約比較理想,10年以上的合約就需要慎重考慮了。

b. After the contract expires, what is the maximum percentage that can be withdrawn from the contract each year?Some annuity contracts will mark 4% in an unobtrusive place.If it is 4%, the money in your annuity will take 25 years to come out.If you want to shorten the time to withdraw money, you will attach a certain amount of fines.

c. The annual fixed growth of the principal-the annual cost of the contract = the actual growth of the principal in the contract.When choosing to buy an annuity, you must carefully read the annuity contract and understand the points that need to be paid attention to in the abc listed above.

6. Before the age of 65, there is a company or individual responsible for employee or own medical insurance. After the age of 65, your medical insurance responsibility will be transferred to the government.After paying a small monthly medical insurance fee, you will get medical insurance from one of the best medical insurance systems in the world.

It is worth noting that you must remember to apply to the government when you are 65 years old, there will be a fine after time, and it is a lifetime fine.

Another point is that even with one of the best medical insurance in the world,In the US medical insurance, there is only a 90-day compensation period for long-term care. If it exceeds 90 days, it is necessary to pay all the nursing expenses by oneself.

There are many insurance companies on the market that include the option of long-term care in life insurance. This option can help pay for long-term care that needs to be paid after 90 days.However, when purchasing this type of insurance, you need to make sure that the payment method in the contract belongs to:

1) Pay the cost of long-term care by yourself and then send the bill to the insurance company, and the insurance company will credit the expenses you paid in advance to your bank account, or

2) The insurance company first credits your monthly long-term care expenses into your bank account.

These two ways.Generally, the method of 2) is better, and there is no possibility that the insurance company is unwilling to compensate or only partially compensate.

(>>>Recommended column:New crown pneumonia, 401K, IRAs, social security pensions, and the retirement dream of the American people)

(American Life InsuranceGuide net editor)

Click to view other >>>Feature articles on how to retire in the United States