The U.S. Social Security Administration released the "4 Social Security Trustee Report" on April 22, stating thatAccording to current trends, the social security pension will be exhausted in 2035.Various commentary articles surrounding the report have aroused heated discussion in the Chinese Internet community.Why was this report released?Do we really have no money to receive when we retire?What is the US government doing?Do we need to worry about this problem?American Life Insurance GuideThese issues will be briefly discussed.

What is the American Social Pension Insurance

American Social Security (Social Security) is an "insurance" project operated by the Social Security Administration under the US government.

Its premiums come from the mandatory payroll tax-which accounts for 12.4% of our income-which is divided into an employee part and an employer part, and the upper limit to be levied in 2019 is $132,900.

These premiums are invested and managed by the U.S. government in the form of trust funds, which are placed in the "Elderly and Widow Insurance" Trust Fund and the "Disability Insurance" Trust Fund.

These two funds are subject to legal restrictions and can only invest in safe government bonds. The current portfolio size is approximately US$2.9 trillion.

When Americans reach retirement age, they can "claim" benefits from the government, which will be paid by the fund account.

Therefore, the U.S. government is the largest financial and insurance company in the market with full participation.

Why is this report released?

According to the law, the Social Security Administration in the US government must publish a report on the operation of the fund to the public every year.We can understand this behavior as an insurance company that regularly issues financial reports to policyholders or shareholders.In the annual report, the insurance premium operation status, cash value income and expenditure status, andExpected elapsed time.

In this year’s reportpredictionIf the social security fund is paid in accordance with 80% of the benefits, it is estimated that the exhaustion time of the overall fund pool is 2035, which is one year longer than the exhaustion time estimated last year.If paid at 91%, the disability insurance trust fund reserves are expected to be exhausted in 2052, which is 2032 years longer than the 20 estimated last year.

Will this insurance company go bankrupt and cause no pension?

will not.

First of all, if the social security pension is completely exhausted and pensions are not paid, this happens, which means that the US government will default and bankrupt all citizens.The total loss of credit means that this country may have fallen into turmoil and even the overall collapse of the social system.

Finance and credit are the foundation of the United States, and no one in power will allow this to happen.

When we retire, is it possible that our pension will shrink?

may.

If the insurance company's poor management results in imbalances in revenue and expenditure for a long time, it may reduce the benefits of "compensation".

However, the political risks associated with long-term mismanagement are also very high. The reduction of welfare will affect the votes, and the ruling party needs to take the risk of change.Therefore, in order to cater to the votes on the one hand and improve operations on the other, what is the US government doing?

What can the US government do?

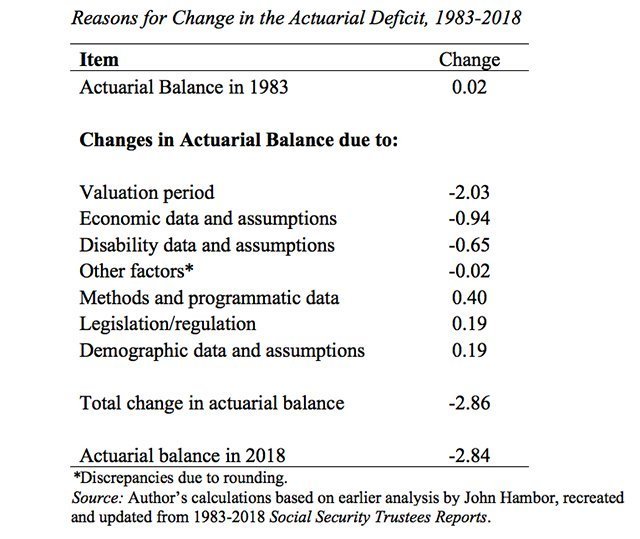

The simplest and most direct way is to increase the premium.The data points out that if the payroll tax is immediately increased by 2.84 percentage points-employers and employees each bear 1.42 points-then the US government, a "large" insurance company, can at least maintain payment while maintaining the current welfare conditions. Welfare until 2092.

But in reality, if an insurance company wants to increase its premiums on a large scale, the result is oftenGroup action, He was fined by the law class.The US government, the insurance company, wants to increase premiums. In terms of procedures, the two houses of Congress need to reach a high degree of agreement on policies. At the same time, in terms of public opinion, the ruling party will risk being opposed by the people who hold the votes.Therefore, this road is not only difficult and dangerous, but also thankless.

Another approach is to increase the employment rate, increase the basic salary, increase the fundamentals of increasing premiums, and reduce welfare expenses at the same time.From Trump’s “Tax Cuts and Employment Act” after he took office, to the overall increase in the minimum basic wage, to the recent proposal of immigration policies for non-U.S. citizens who “become a public burden” to promote large-scale infrastructure construction across the United States ,inAmerican Life Insurance GuideAccording to analysts, it is a series of effective efforts made by an on-duty CEO to establish the cash flow and a healthy financial system required for the normal operation of the company.

In addition, a series of programs such as issuing retirement pension bonds and breaking regulations to allow retirement funds to invest in high-return assets are also available tools and methods.

Summary of this article

In summary, we understand the basic operating mechanism of the American government, an insurance company, and the relationship between social security pension insurance and the American political system.Therefore, there is no need to worry about the issue of social security retirement benefits, and there is absolutely no need to worry about the issue of "exhaustion and bankruptcy" of the US government, an insurance company.

On the contrary, it is the financial system backed by the credit endorsement of the "company" of the U.S. government that has created a huge market for U.S. commercial financial insurance companies.For the public, if they pursue a more secure and quality retirement life, they can also consider supplementary commercial financial insurance companies.Retirement pension insuranceplan.

At last,American Life Insurance GuideThe reporter from Acadia interviewed two Chinese retired elders in their 70s. The old lady told her frankly that her husband had just had a heart surgery, and the millions of dollars in bills were completely reimbursed by the medical insurance. Without paying a share, the social security pension for the two is $1500/month. "If you just buy food and eat, you can't spend it at all." However, the two elderly people also admitted, "The current welfare in the United States is not as good as before. "

(>>>Recommended reading: gadgets|The American Personal Pension Smart Calculator, how much do I need to save every month?)

appendix

01. "Social Security 2019 Trustees Report", 04/22/2019, https://blog.ssa.gov/social-security-2019-trustees-report/