(InsurGuru™️ Financial Management College column) Most of us will agree that after we get married and get married, it is very important to create a financial plan or savings plan from the long-term perspective of family finances.However, just like the experience of our ancestors hundreds of years ago, in the "Shangshu": "Easy to know and hard to do"--according toLincoln FinancialA research report released by the group in November 2019 stated thatIn the real world, nearly 47% of American families are deeply trapped in the quagmire of the inability to communicate financial issues with their loved ones.

We can't help but ask,How difficult is it to talk about money with your family?The column of insurGuru™️ Financial Management Institute will analyze and interpret the opinions and statistics of different American populations about talking about money with family members.At the same time, this article will analyze and point out3 main reasons why it is difficult to talk about money with your family.

Money is very important, please talk about money

"How to talk about money" is very important to family life.The research results corroborated this point.The data points out that if American families start to talk about money, especially in some links that can make great changes in their lives, then the financial results of the entire family will be improved.

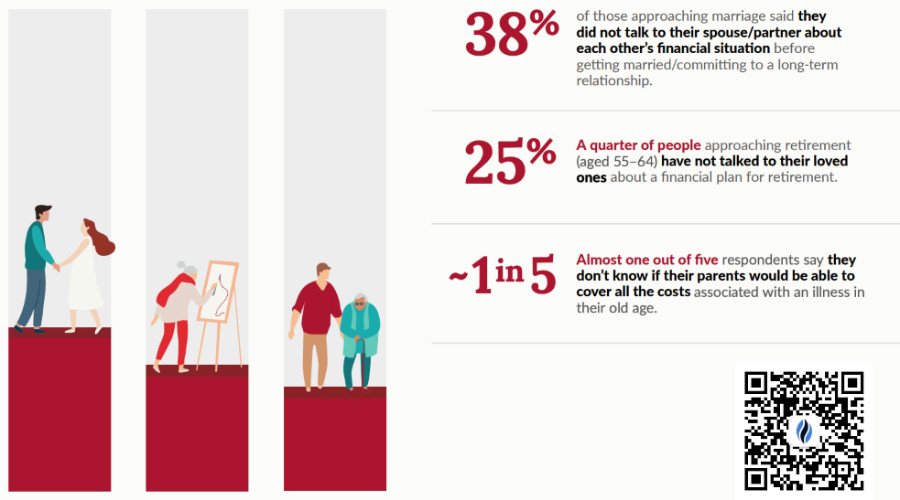

The survey found that 38% of people who are about to enter marriage will not talk to their future partners about each other's financial situation.This does not seem to be good news.

And a quarter of the people near retirement (55-64 years old) will not discuss the financial planning of retirement with their lover.

It’s easier to lose confidence if you don’t talk about money

Studies have found that people or families who usually don’t talk about money with their family members are often less likely to make family financial or savings plans from a long-term perspective.The picture below shows the results of a study of people who do not start talking about money with their families:

Among this group of people, 86% feel that they have never saved enough money to retire, 55% feel unconfident about their life after retirement, and 88% don’t know whether they have saved enough money to protect them. Yourself and lover.

Among this group of people, 86% feel that they have never saved enough money to retire, 55% feel unconfident about their life after retirement, and 88% don’t know whether they have saved enough money to protect them. Yourself and lover.

On the whole, this group is also the one who lacks the most confidence in the financial situation.

Talk about money, gain more than pay

Although it is difficult to speak, there are still many positive aspects.Afterwards, most of the people who spoke thought that the conversation with family members about money was positive, positive and fruitful.

66% recalled that the process of talking to family members about money was much simpler than expected.Less than 1% think that the process of talking to family members about money is a very difficult experience.

66% recalled that the process of talking to family members about money was much simpler than expected.Less than 1% think that the process of talking to family members about money is a very difficult experience.

So, what makes it difficult for us to talk about money with family members?The analysis pointed out the following 3 main reasons:

1. It feels awkward and uncomfortable to talk to family members about money

When discussing money with family members, it is usually difficult to avoid topics that sound uncomfortable. For example, what to do if you die, how to raise your children, pay for school, or some unforeseen illness may be harmful The more common topic is, how much money should I save for retirement?What if I don’t have enough money to retire?

Choosing to avoid talking about these slightly "heavy" topics with family members, but only discussing how to consume and holiday shopping, stems from emotionally avoiding falling into an awkward situation.From the perspective of social behavior, avoiding talking about future goals and personal financial status can also avoid the emotional discomfort that may be caused by breaking such "social taboos."

2. There is nothing to talk about

Because there may never have been a ready-made plan between the family and the family. Therefore, if you plan to start talking about money and finances, you will find that there is no specific thing to talk about.

If it is only a general discussion, it is likely that the two parties are not clear about each other's true intentions.Instead of spending time arguing about the current family's financial situation, it is more important to take the first step, analyze and formulate future goals, and first come up with a preliminary, specific family plan that can reach a consensus.

3. Talking about money with your family is a complex project

The financial situation behind each family member is different, and the specific details behind each are usually very complicated. We try to use linear language tools to describe and express a complex and multi-dimensional situation, which in itself is a very difficult thing.And each family member's growth experience and background are different. The understanding of the same sentence and the same word will produce completely different imaginations and derivations, making it even more difficult to communicate and understand each other.

Therefore, before discussing money with family members, if there is no support from various tools and resources, people are more willing to choose not to talk about money with family members.

Article summary

From this article of insurGuru™️ Financial Management Institute, we can understand that although it may be a bit difficult to talk about money with family members at the beginning, once we start discussing the family’s future financial planning with family members, we can get more benefit.

If you really find it difficult to speak directly, a professional financial adviser or insurance adviser can also be a bridge to help the spouse communicate with each other and talk about money.From the professional perspective of a third party, they can help open up some topics about family finances in a more acceptable role.The advantage of this is that it can effectively avoid some "psychological" conflicts that may be caused by directly talking about money between couples, so as to achieve the goal of gradually leading to the topic of "talking about money".