In the U.S. market, we occasionally hear "Million Dollar Project"What does a word like this mean?

"Million Dollar Project"Is it a specific product, or a specific design solution? TheLifeTank©️life insurance columnistHeather Xiong CFP®️Invited to answerAmerican Life Insurance Guide ©️questions and elaborate with a specific case.

Is "Million Baby Plan" an insurance product?

-no."Million Baby Project" is just a marketing name, there is no specificInsurance Products.

"Million Baby Plan" usually refers to the purchase of life insurance for minor children or newborns with a face value of $100 million, referred to as "Million Baby Plan".

You can choose insurance products that meet the needs of your children from among the different insurance products of various insurance companies."Million Dollar Project"Program.

What exactly is the "Million Baby Plan"?

"Million Dollar Project"It is an insurance plan for children launched by the American Life Insurance Company, which aims to provide families with economic security and protect their children's future.The plan provides three protection functions of critical illness insurance, accidental injury insurance and life insurance, and can also provide savings functions.

The following are the key features of these plans:

- Critical illness medical insurance:Provides insurance cash settlements for the occurrence of critical illnesses, includingcancer, heart disease, Leukemia and other critical illnesses.

- accident insurance:Provides insurance cash settlements for accidental injuries, including death, blindness, disability, etc.

- Whole Life Insurance:Provide lifelong insurance protection to ensure that children have sufficient insurance protection in the future.

- Cash value function:This type of commercial life insurance plan can also be used as a child's future education savings plan to help newborn babies establish education funds as soon as possible.

It should be noted that the specific insurance liability and insurance clauses of the Million Dollar Baby Plan may vary with different life insurance companies, or different products of the same life insurance company.

(>>>Recommended reading:What are the 6 important steps for smooth claim settlement when suffering from cancer, heart disease and other serious diseases?)

Comparison of the advantages and disadvantages of purchasing the "Million Baby Plan" in different age groups

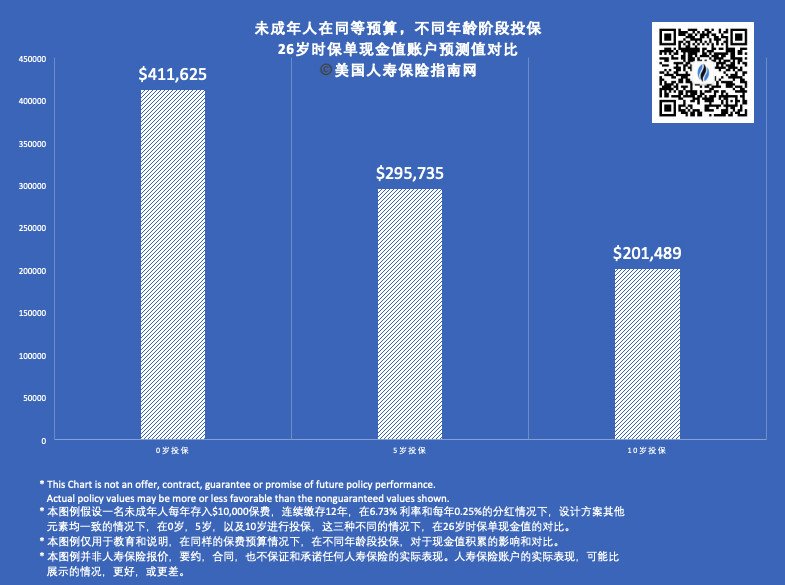

A minor child applies for insurance at the age of 0, 5, and 10, and opens 3 life insurance policy accounts in total. Each life insurance policy account deposits USD 1 per year for 12 consecutive years.When the children grow up and reach the age of 26, they are ready to take money from the policy account to payBuy a housedown payment.

At this time, by comparing the predicted cash value of the three policy accounts, it can be reflectedThe age factor of insuring and the importance of time1.

In the comparison of the above figure, we can intuitively see that the "time" for the cash value of the insurance policy insured at the age of 0 is the longest.The insurance policy that was insured at the age of 10 received the shortest increase in cash value "time".In contrast, with the same premium input, in the insurance policy account that was insured at the age of 0, the down payment that can be used to pay for the house($ 411,625), In the case of insured younger than 10 years old($ 201,489).Funding increased by 104%.

Frequently Asked Questions about "Million Dollar Project"

Frequently Asked Questions about "Million Dollar Project"

Q1: How much is the maximum annual premium deposit?

A: Every family has its own budget.It can be from a few hundred to a few thousand a month, or it can be saved up to millions. It is all parents' wishes.

Q2: Can children apply alone?

Answer: Yes.It is not mandatory for parents to apply for insurance first.

Q3: Can only children of American nationality apply for the purchase?

A: All nationalities can apply.

Q4: Can the "Million Dollar Baby Plan" be used as a college education savings plan?

答:The Million Dollar Baby Plan is not a savings plan specially set up for college education funds, but it is a more comprehensive choice for underage children of school age and families with risk preferences.In the 4-year-old column "How to save for college tuition? Which is better, the 529 Education Fund Plan VS Million Dollar Baby Plan?"In the article, the corresponding advantages and disadvantages are analyzed.

(End of the article)

(>>>Recommended reading:teenage children and newborn babiesWhat are the pros and cons of buying life insurance?)

1*This case is not a real case, nor is it a sales contract and offer. This case is an example of an existing financial design plan for the purpose of display and demonstration.You can seek professional life insurance financial advisors to understand specific products.