(American Life Insurance GuideEditor's note) Many Chinese in the United States generally save enough retirement funds by working hard when they are young, and as their children start their own families, there will be no big expenses, and they are ready to retire safely and enjoy their old age.

As everyone knows, there is a large expenditure in the United States that most people will use, and the growth rate of this expenditure far exceeds inflation.This fee isLong-term care.

Who needs long-term care?

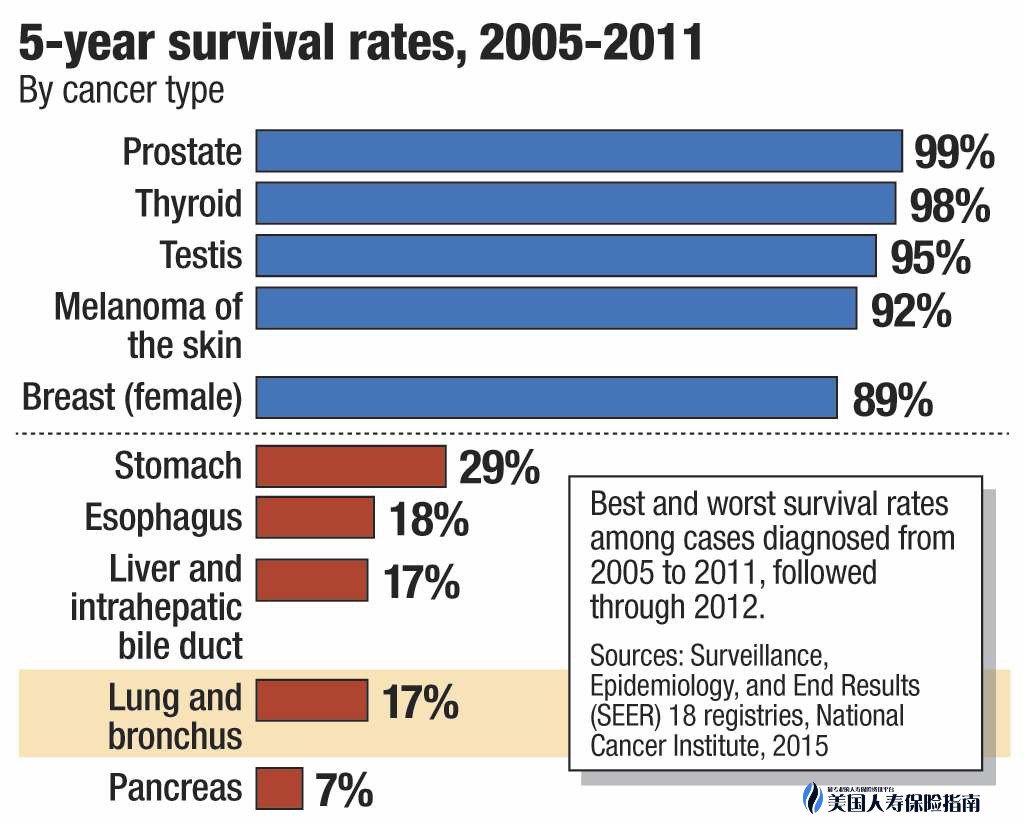

根據美國癌症協會American Cancer Society 2016年最新研究報告得出,每年美國有近160萬人診斷出癌症,其中64%的人存活至少5年。每年有近120萬人得心臟病,其中有60%的人存活下來。目前在美國有2千2百萬人曾得過心臟病,中風和癌症。

The high survival rate should be a happy thing, but many families are also worried about it. The high cost of care and medicine makes it difficult for many families to maintain or even file for bankruptcy.

Many people will ask, isn’t there medical insurance?

ironnically,78% of those who filed for bankruptcy because of large medical expenses are those who already have medical insurance.According to a survey by the American Cancer Society,More than 67% of medical expenses are actually indirect expenses (such as nursing expenses), which are not included in medical insurance, and patients need to pay out of their pockets.

根據統計,房子着火的機會是1/1200,出車禍的機會是1/240,住院開刀的機會是1/15,65歲需要長期護理看護的機會是2/5(40%),75 years old needLong-term careThe chance is 3/5 (60%).

With the increasing prevalence of aging in the United States and various diseases, many elderly people or patients are facing a very practical problem-they need to go to a nursing center or hire someone to take care of themselves at home.

What is the cost of long-term care?

If you cannot take care of yourself, there are basically 4 places to go:

- Live in a private nursing home (Nursing Home)

- Assisted Living Center

- Adult Daycare

- Invite someone to take care of you at home

Private nursing home-At present, 180 million people live in private nursing homes in the United States, another 100 million live in assisted living communities, and 760 million live at home and receive on-site services.Either way, you need to spend money. It is the most expensive to live in a private nursing home, usually 8 to 10 a year, and it is hard to find one.

Assisted living center5-6,Adult daycare2-3 a year,Invite someone to homeCome to do 4 hours a day and charge 2-3 thousand a month. If you do 8 hours a day, the monthly charge will rise to 7-8 thousand.This is just today's charging standard. In the past 10 years, the cost of long-term care has increased by an average of 6-8% per year, which is much higher than the inflation rate. If the increase continues, it will double in 10 years.

This is only the cost of one person, if both husband and wife needLong-term care, The cost has to be doubled.This huge expenditure is generally impossible for the middle class to afford on their own.

How to pay for long-term care expenses?

支付Long-term careThere are three main ways to spend:

- Medicaid (Public Medicaid)

- Use your own money

- Long-term care insurance claims

Some people will ask if there isMedicare (Public Medical Insurance)?

MedicareIt is the government that pays for acute medical care expenses for the elderly over 65 years old and people with disabilities in the United States, such as seeing a doctor, hospitalization, surgery, medication and other medical professional care, but does not include daily care such as eating, dressing, bathing, and toilet and many more.

Specifically, the patient must have been in the hospital for at least 3 days and be accepted by a Medicare-certified long-term care center within 30 days in order to enjoy the care discount. Medicare provides up to 100 days of professional nursing services. The first 20 days are covered by Medicare, but the cost from 21 days to 100 days must be borne by the patient. The maximum deductible is USD 161 per day (2016 standard).If the patient still needs care after 100 days, he needs to pay the full amount at his own expense.

The US government’s low-income Medicaid program (Medicaid) can provide some elderlyLong-term careWelfare, but the conditions are very harsh, and middle-class families are generally excluded.Therefore, if patients or elderly people need long-term care, they will have to take full responsibility for the high cost of care.

Medicaid does not work. The second way is to pay for long-term care with savings, investment or retirement money.

How much this will cost is difficult to estimate, depending on when you start to needLong-term care, What kind of care is needed.Do I have to live in a private nursing home, or just hire a part-time worker to come home, how long it will take, and how long the cost of long-term care will increase in the future, etc.

With a conservative algorithm, you have to prepare hundreds of thousands of cash or liquid assets, which is a heavy burden for the middle class.After you retire, you will not work and have no new source of income. You will rely entirely on social security, 401K, IRA, and personal savings and investments to maintain your retirement life.Long-term careThe need of the day.

Frankly speaking, most of the middle class will be very difficult.Unless you have accumulated millions of assets, you must consider the third way, which is to buyLong-term care insurance, The insurance company will pay for your long-term care when needed.

The fact is that more than one-third of Americans over the age of fifty have not yet begun planning for long-term care.

The fact is that more than one-third of Americans over the age of fifty have not yet begun planning for long-term care.

What is long-term care insurance?

Maybe for many Chinese,Long-term care insuranceStill very unfamiliar.But in fact, many American families have taken long-term care insurance as their support in their later years.

Traditional long-term care insurance is a kind of consumer insurance..Therefore, generally everyone would not choose it.

In recent years, some insurance companies have launched several new products. These insurances are not singleLong-term care insurance, But an all-in-one insurance product.This type of policy takes long-term care insurance asRider, Combined with life insurance.

You buy insurance with a sum assured of 100 million from the insurance company. If you pass away, the insurance company will compensate your family with 100 million; if you can't live by yourself, the insurance company will give you the benefits of nursing insurance, which will be paid on a monthly basis.If you don’t use it up, you will pass away. If you don’t use it up, you will be paid to your beneficiary.

This kind of insurance is guaranteed. You can choose how many years to pay (paid-up), and you will benefit from it for life.Moreover, if you don’t use it or use it up during your lifetime, you can pay to your family. This is better than traditionalLong-term care insuranceExcellent place.

ClickLearn about long-term care Rider in life insurance

Claim method

The amount of life insurance claims depends on the death certificate, andLong-term care insuranceA certificate issued by a doctor stating that you have impaired several functions and can no longer take care of yourself, such as daily activities such as dressing, eating, toileting, urinating, etc., if you can’t complete certain items independently for more than a certain number of days You can apply for claims from the insurance company.

What you need to know isLong-term care insuranceThere are 2 ways to settle claims, they are:

- One is reimbursement (reimbursement)

- The second is allowance (indemnity)

Reimbursement-You take the invoice to the insurance company for reimbursement, or the insurance company sends the money to your private nursing home based on the amount of the bill.While life insurance provides such pre-death benefits, or long-term care Rider claims, the insurance company directly pays you a sum of money, and you decide how to use the money.

Generally speaking traditionalLong-term care insuranceMost insurances are reimbursed, Reimbursement to the insurance company with receipts every month, but according to regulations, the insured’s monthly claim amount cannot exceed 1 U.S. dollars, and a certificate must be issued by a properly licensed nursing home institution.This is a restriction for Chinese friends who want to ask caregivers or relatives to take care of them.

And now, a life insurance with long-term care Rider that meets the conditions, after meeting the claims requirements, the insurance company can send a check directly every month, and the insurer can freely spend the money without receiving various restrictions on long-term care insurance.

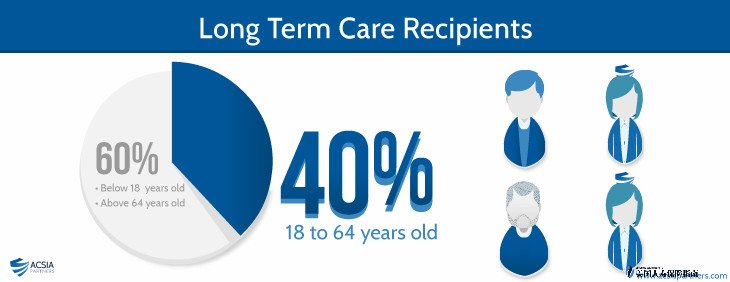

in factLong-term care insuranceNot only for the elderly, if people of any age have physical disabilities that require care,Long-term care insurance即可發揮作用。根據統計,年齡在18-64歲之間的人有40%曾經用到長期護理,同時65歲以上的人有48%未來可能需要接受專業護理中心的長期護理的照顧。

For people, the most important thing is to plan ahead and arrange the best protection for themselves and their families.Just imagine, let alone the backbone of the family, even if any family member has an accident, is unable to work, needs long-term care, and pays high expenses, it is a heavy burden for the family.

Long-term care insuranceThe types are numerous and complicated, and everyone’s situation is different.If you want to know more aboutLong-term care insuranceOr for life insurance design, please contact a professional life insurance broker.

Before that, we recommend that you read the insurance guide:Introduction of long-term care insurance in the United States, price, advantages and disadvantages and the best age window for insurance. (Finish)