(American Life Insurance Guide 11/12/2019 Chicago News) The United States Internal Revenue Service (IRS) announced the adjusted long-term care insurance (LTCi) premium deduction schedule in early November.

Couple's maximum tax credit is $10,860

According to the IRS document No. 2019-44, a couple over 70 years old, if they purchase qualifiedLong-term careFor insurance policies,So in the 2020 tax return, the maximum tax deduction is $10,860.The maximum tax deduction for 2019 is $10,540.

Jesse Slom, director of the American Long-Term Care Insurance Association, believes that after retirement,Long-term care insuranceThe preferential tax policy is a big subsidy.But not allLong-term careInsurance policies provide opportunities for tax deductions.

Can the premium of Hybrid or Combo policy be tax deductible?

Slom explained in a report to the public: "The special tax incentives for premiums allowed by the IRS are only applicable to qualified health-based long-term care insurance. Nowadays, more and more people buyLong-term careLife insurance and annuity contracts for benefits (Editor’s note: additional terms),Such policies are not eligible for premium tax relief. "

Insurance types for long-term care expenses

The insurance types used to pay for long-term care services currently mainly consist of the following two categories:

- Traditional Long-Term Care Insurance (LTCi)

- Hybrid or Combo hybrid contract (providesLong-term careContract with additional clauses for claims)

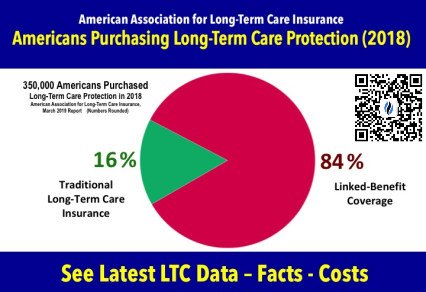

According to statistics from the National Long-term Care Insurance Association,In 2018, 350,000 policyholders purchased products with long-term care protection.Among them, 16% of the products are traditional long-term care insurance, and 84% of the products areadditional terms(Insurance) A Hybrid or Combo contract that provides "long-term care" protection in the form of a hybrid contract.

When individuals or couples purchase insurance for the first time, the tax allowance usually does not work.Slom said: "Before retirement, most people will not be able to reach the threshold of tax-deductible long-term care premiums." "However, when you stop working, you can benefit from the possibility of this tax concession. greatly increase."

Tax deduction table for long-term care premiums in 2020

We use to buy traditionalLong-term care insurance(LTCI) premiums are classified as "medical expenses", so they can enjoy tax deduction policies. The following is the 2019 tax deduction limit (per individual) just announced on November 11, 7:

>>>For more information on "Long Term Care", please click to visit "Long-term care insurance topics"

American Association for Long-Term Care Insurance

The American Association for Long-Term Care Insurance advocates for the importance of planning and supports insurance and financial professionals who provide long-term care financing solutions. To see prior year's tax deductible limits, visit the organization's website (www.aaltci.org/tax ) or call the organization at 818-597-3227 to connect with a long-term care insurance professional who can provide no-obligation and cost comparisons.