(American Life Insurance Guide Network 11/11/2019 Irvine News) Every November, isNational Long-term Care and Care Month(Long Term Care Awareness Month).

National Long-term Care and Care MonthFounded by the American Long-Term Care Insurance Association in 2001, it aims to let the American people knowLong-term careIt’s important to make full plans and preparations before the age of 65.

During the one-month public education,American Life Insurance GuideNet will help readers in the Chinese community understandLong-term careThe status quo and the importance of long-term care insurance.

Problems that more than 50% of retirees will face

Many people over the age of 65 need assistance in their daily lives, such as helping with bathing, eating, or dressing.According to data from the U.S. Department of Health and Human Services on aging,Men need about 2.2 years of assistance on average, while women need about 3.7 years of assistance.

Many retired people rely on the voluntary care and assistance of their children or family members, but:

-

More than one-third of the elderly live in nursing homes.According to the "1 Nursing Cost Survey Report" released by Genworth, the median annual cost of a single room is more than $3.

-

40% of people choose to receive paid care at home, and the median annual cost of such health services is more than $50,000.

-

According to research by Vanguard and Mercer Health and Welfare, more than half of people over 65 will haveLong-term cares expenses.15% of the group will spend more than $250,000 on long-term care.

Status of community survey results

As the National Long-term Care and Care Month is approaching, Genworth conducted a follow-up survey of 1,200 adult residents in communities across the United States, and there are some notable new findings:

- 62% of respondents don’t knowLong-term care insuranceWhat circumstances will be paid.

- Two-thirds of adults hope that the government can partially or fully cover the cost of long-term care services, but 2% of respondents are confused about Medicare and Medicaid, or admit that they don't know the difference between the two.

- Only 20% of adults have taken various degrees of financial action to prepare for the cost of long-term care.

- The post-70s generation is the least willing to spend money on this, but they are the group most worried about not having money to pay for long-term care services.

- Post-80s are the most pragmatic group-they are the group that least expect the government to bear their long-term care-related expenses.At the same time, the post-80s generation is the group most likely to take action now for future long-term care expenses.

Insurance types that pay for long-term care

The insurance types used to pay for long-term care services currently mainly consist of the following two categories:

- Traditional Long-Term Care Insurance (LTCi)

- Hybrid or Combo hybrid contract (providesLong-term careContract with additional clauses for claims)

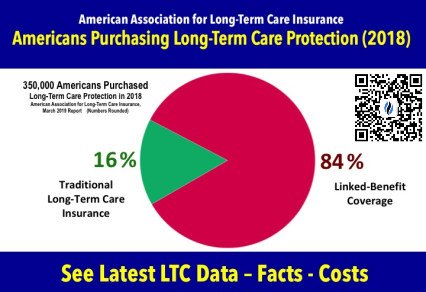

According to statistics from the National Long-term Care Insurance Association,In 2018, 350,000 policyholders purchased products with long-term care protection.Among them, 16% of the products are traditional long-term care insurance, and 84% of the products areadditional terms(Insurance) A Hybrid or Combo contract that provides "long-term care" protection in the form of a hybrid contract.

2020 tax deduction for long-term care premiums

We use to buy traditionalLong-term care insurance(LTCI) premiums are classified as "medical expenses", so they can enjoy tax deduction policies. The following is the 2019 tax deduction limit (per individual) just announced on November 11, 7:

>>>For more information on "Long Term Care", please click to visit "Long-term care insurance topics"

American Association for Long-Term Care Insurance

The American Association for Long-Term Care Insurance advocates for the importance of planning and supports insurance and financial professionals who provide long-term care financing solutions. To see prior year's tax deductible limits, visit the organization's website (www.aaltci.org/tax ) or call the organization at 818-597-3227 to connect with a long-term care insurance professional who can provide no-obligation and cost comparisons.