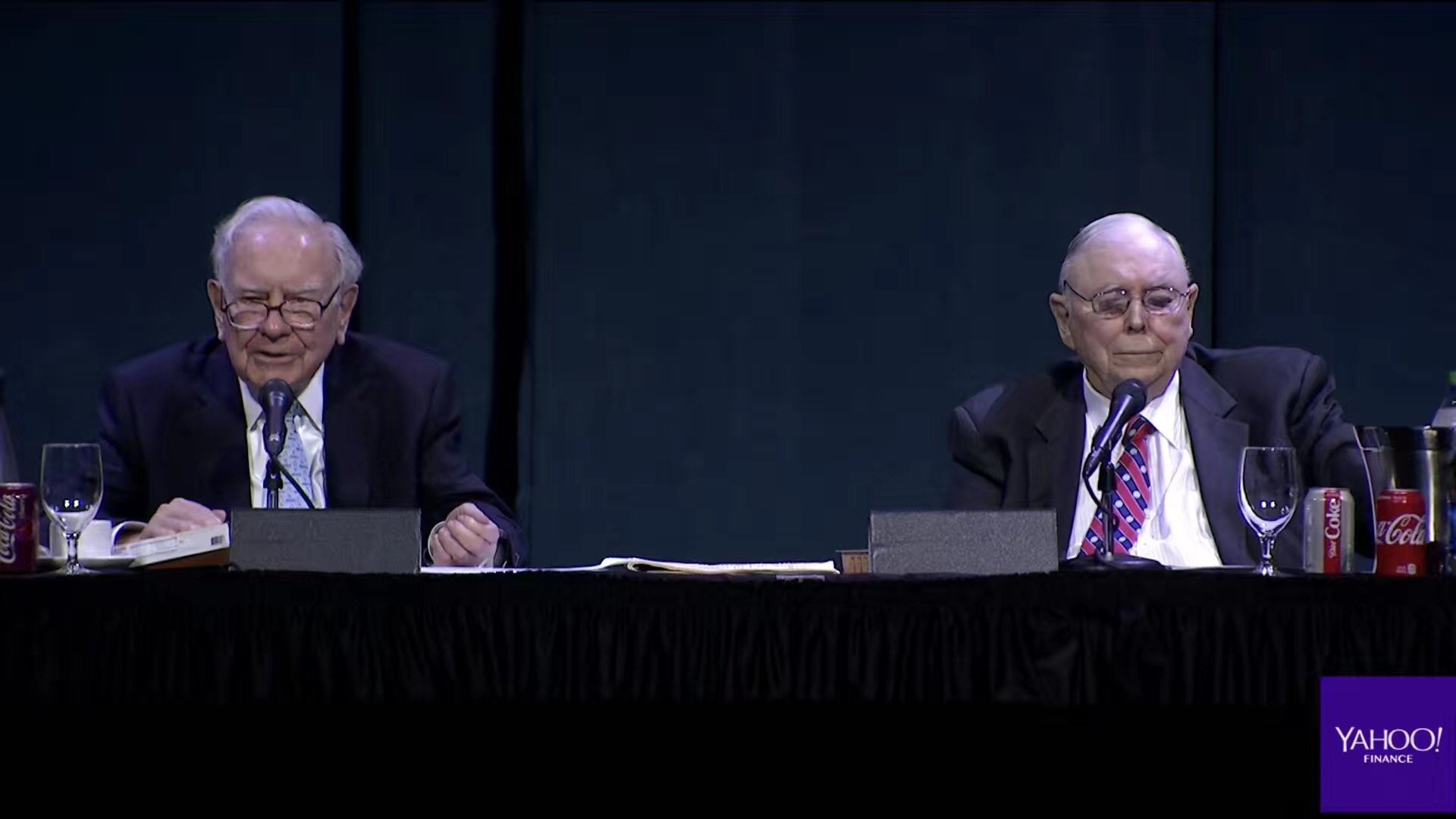

Before sharing this wonderful cartoon, let's first pay attention to the annual shareholder meeting held by Buffett.On the morning of May 2018, 5, Eastern Time, Berkshire's 5rd General Meeting of Shareholders was held as scheduled in Buffett's hometown of Omaha, Nebraska.Sitting on the podium, Chairman Buffett, 53 years old, and Vice Chairman Charlie Munger, 88 years old.

Concerned that Buffett and his partner answered more than 80 questions during the period.One of the questions is very interesting. The questioner said, to be successful today, how much does it have to do with academic background (such as academic qualifications or business school, etc.)?

Buffett responded like this:

The smartest investors nowadays, sometimes they really have this kind of innate talent.What we are doing now is not how smart you are and what kind of IQ IQ you have to be an investor, but there are some principles in the middle that must be conservative and adhere to.

When I was young, I didn’t want to go to school. I don’t know if I would not go to school after graduating from high school and I would study by myself, whether it is good or not.But when I was in school, I also met several great teachers, which also changed my view of observing the world.You can find what you really call a mentor who is beneficial to you in academia or in ordinary life, including Charlie, who is also a very good teacher for me.

Yes, anywhere, as long as you can find teachers who are beneficial to you, you will benefit infinitely.

Haha, doesn't this mean "three people must have my teacher"!Buffett and Charlie Munger, their hard work throughout their lives have inspired countless people.But what few people know is that the old man himself has been a mentor for teenagers, and through financial cartoons!

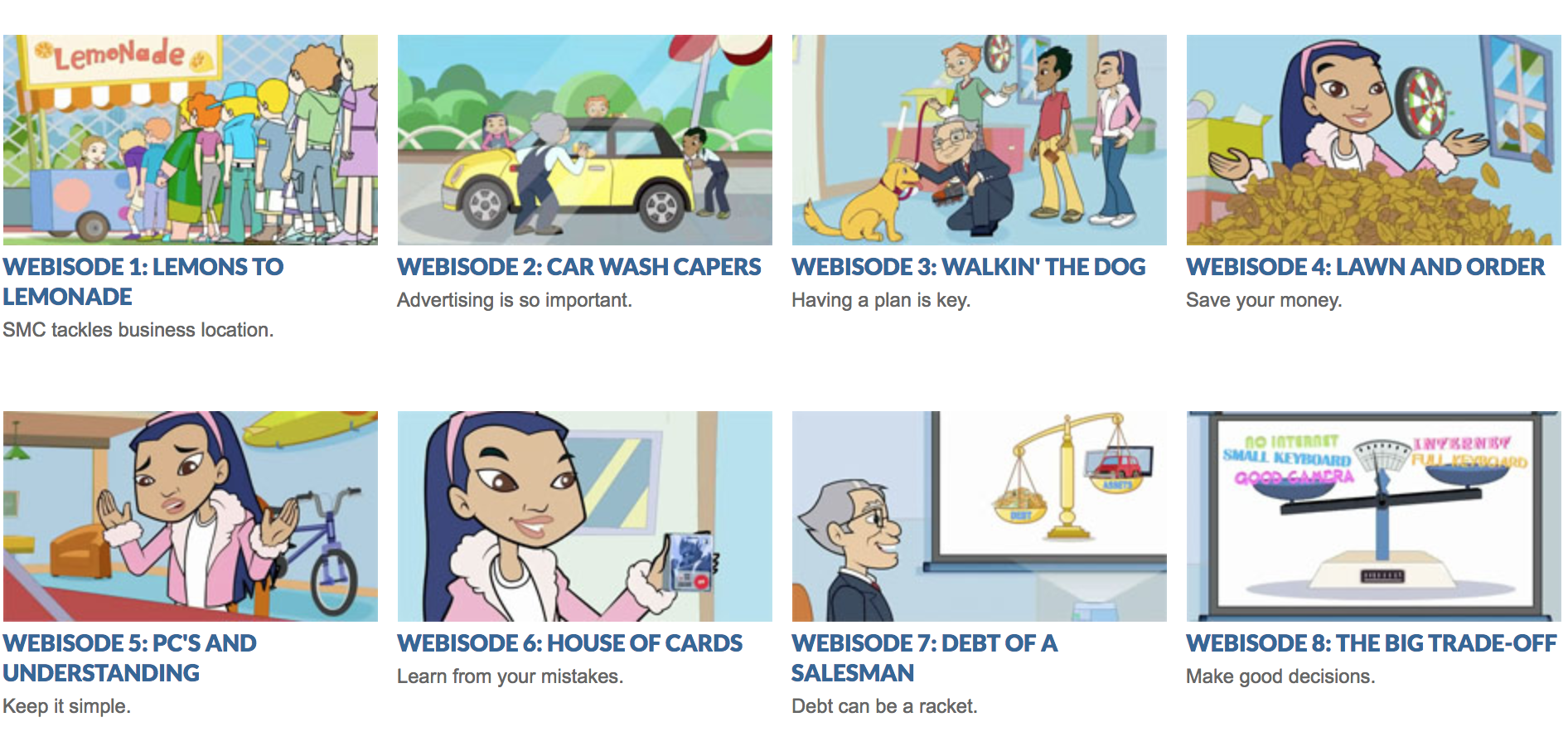

This is the Caizhi enlightenment resource that we are going to recommend today-Secret Millionaires Club ("Buffett Mystery Club"), which is a popular cartoon on the American Online (AOL) children's channel. It has aired the first season and the first season. The second season.The first season has 26 episodes, each 4 minutes.The cartoon is suitable for primary and middle school students aged 6 to 14 to watch.Both knowledge and method, humor and seriousness coexist, very fascinating.The following are excerpts from interviews with reporters when the cartoon first went live in the United States a few years ago:

Reporter: In "The Buffett Mystery Club", what advice do you give the children?

Buffett: I will give children some basic suggestions, such as "the best investment is to invest in yourself", "the more knowledge, the more wealth", "learn from the mistakes of the past, and grow from the mistakes of others", " Insufficient planning will result in failure" and so on.

Reporter: Is "The Buffett Mystery Club" just for children?

Buffett: Our creation of "The Buffett Mystery Club" is indeed aimed at children, but we know that this animation will also help many adults, especially parents.You must know that not every adult makes the right financial decisions. The content in "The Buffett Mystery Club" is very practical and suitable for audiences of all ages.

Reporter: In addition to cartoons, what other interactions do you have with children?

Buffett: We unite thousands of schools and youth organizations in the United States to organize a "learn and earn" competition every year. Tens of thousands of children have shown me their business plans, and they use the " "The Buffett Mystery Club" learned knowledge, the final winner of this competition will come to Omaha to meet with me, and I will help them turn their business plans into reality. "

Reporter: What kind of feedback have you received so far?

Buffett: What makes us happy is that "Buffett Mystery Club" has aroused a strong response among children, parents and teachers.For children, they are actively using the knowledge they have learned in animation to develop their own business plans; for parents and teachers, "Buffett Mystery Club" teaches them a simpler and more interesting way to give children We popularize financial knowledge, which is exactly what we want to see.

"The Buffett Mystery Club" also pays attention to the analysis of business and economic phenomena in life, to cultivate children's independent thinking and independent choice, as well as the ability to solve problems.

Its most special place is undoubtedly the producer and the animation prototype-it is the "stock god" Buffett himself!In the animation, Buffett becomes the director of the mystery club. In each episode, he discusses a small investment or financial management issue with several children with ideas and passion.But it is not limited to the commercial phenomenon itself, but more attention to the cultivation of children's values: you can't see profits and forget righteousness, greedy petty gains, listen to gossip, and obtain legitimate benefits on the basis of "righteousness."

Uncover the true meaning of American financial business

This film cuts in from the perspective of a child. It not only emphasizes storytelling, but is also problem-solving oriented. It can mobilize children's brains and enthusiasm to think together with the animated protagonist.

For example, in the first episode, some students want to earn pocket money and set up a stall to sell soft drinks, but no one buys them at all. What should I do?In the second episode, a few classmates want to wash their cars to make money and change the school band into new uniforms, but there is no business, what should I do? ……Animation will not give suggestions directly, but let the children think slowly step by step.

One episode is about whether to inject capital into a confectionery factory in crisis or let it fall into the hands of an evil developer (the latter wants to build an apartment building on the original site of the factory).Buffett guides the children to conduct the assessment in this way:

"Children, what do you think of the candy business?"

"Everyone likes candy!"

"This one meets the criteria of a good investment project, which is very important. Now we have a certain basis."

Then, Buffett began to teach his many years of investment experience:

The process of making candies will not undergo major changes over time.There is not much room for technological upgrading. Therefore, if you can cultivate brand personality while ensuring product quality, you can have a fixed consumer group.

When consumers are emotionally dependent on a certain brand, the cost of switching to other brand products will increase accordingly, which also increases the bargaining chip for the sustainable development of the brand.This dependence is not only difficult to change, but it will also be passed on to future generations.

These investment ideas are boiled down to "durable competitive advantage" (durable competitive advantage).

This suggestion actually incorporates Buffett’s valuable experience.In reality, Buffett once invested in Mars and acquired Wrigley Sugar Co., Ltd. of the United States to become the world’s largest confectionery manufacturer. The craftsmanship of chewing gum will not undergo very big changes. However, as a chewing gum manufacturer with a history of more than 100 years, Wrigley’s "Arrow" The “shaped logo” has been deeply rooted in the hearts of the people, and the brand influence of the product is very large.This has made an excellent pavement for the success of the investment.

Therefore, in the film, Buffett also encourages children to invest in candy factories, but pay attention to the development strategy. (At the shareholders meeting in 2018, Buffett also said that even if "Silicon Valley Iron Man" Musk enters the candy industry, it will be difficult to shake him in The status of the confectionery industry).This kind of advice, even for adults, is of great benefit.

The best investment is to invest in yourself

Through interesting investment and financial management stories, Buffett wants to tell the children the most, there are three points: 1. To develop the habit of saving money; 2. To learn to be responsible for your own investment behavior; 3. The best investment is to invest Yourself.

After the "Buffett Mystery Club" cartoon came out, Buffett once said, "In the animation, I play myself and teach a few children how to deal with financial and entrepreneurial knowledge."

"I was fortunate to have learned some basic knowledge in the financial field under the influence of my parents and teachers since I was a child. This knowledge is not complicated, but if it is used correctly, success will be a matter of course. Later I discovered that not all children can actually Having the opportunity to learn these basics, this is what we want to teach children in "Buffett Mystery Club", so that they can lay a solid foundation from an early age."

Buffett also knows that some parents object to children’s exposure to business and financial management at such a young age, but he also reminds that cartoons give children the most basic advice, not to learn financial management for the sake of financial management. It is in this process to establish a correct awareness of money, "understand the possible consequences of their own decisions, only in this way, children can develop a lifelong outlook on money as soon as possible."

(>>>Recommended reading:Can children and newborn babies buy life insurance in the United States?What kind of insurance should I buy?What are the advantages and disadvantages of buying life insurance for children?)