In the past 10 years, the U.S. stock market has reached a historic10% per yearThe rate of return.If investors took hold of their related varieties during this time and did not move randomly, they could win such a generous return.

If you are new tofinancial insurance,especially inU.S. Index InsuranceAnd in the annuity market,Account options for tracking the S&P500 indexIs a necessary configuration, then you should understand "what is the stock market return", "S&P500 market return rate".

Average return rate reached 10%

S&P 500 Index Composed of 500 of the largest listed companies in the United States, the index is a comprehensive indicator of the annual earnings of these companies.When we say "market", such as "the U.S. market has increased volatility" and "the U.S. market is stable", the word "market" in it refers toS&P 500 Index .

According toS&P 500 Index According to the monitoring, the average rate of return of the market in the past has reached 10%.

提示: 由於每年通貨膨脹2%-3%的通貨膨脹,10%的平均回報率,經過通脹調整的年度回報率在7%-8%。

The following table compares the average annual interest rates of different types of accounts, as of March 2019.

| If it is deposited... | Then the reward is... |

| S&P 500 Index (including dividends) | Average annual return: 10% $100 investment for 10 years: $260 |

| 10-year government bond | Current interest rate: 2.69% $100 investment for 10 years: $131 |

| Current Internet Savings Account | Current interest rate: 2.20% $100 investment for 10 years: $125 |

To reap the benefits of the US market, it is a long-term investment that requires time and patience-usually this money will not be used for at least 5 years.

Market returns are not always close to average

Although the average is nearly 10%, the rate of return in a specific year may be beyond your expectations.Between 1926 and 2014, there were only 8 years between the 12%-6% rate of return.Other times, it is beyond this limit, that is to say,Volatility is an inevitable state of participation in the US market.Before participating, ask yourself, can you accept it?

But even if the market is volatile, the returns are always positive.Of course, the US market will not rise year after year, but from the perspective of time period, 70% of the year has been rising.

Will the US market continue to rise in the future?

There is no single word for "guarantee" in the market.But this 10% average rate of return has been stable for a long time.

So what kind of returns can people who enter the market expect from the market today?

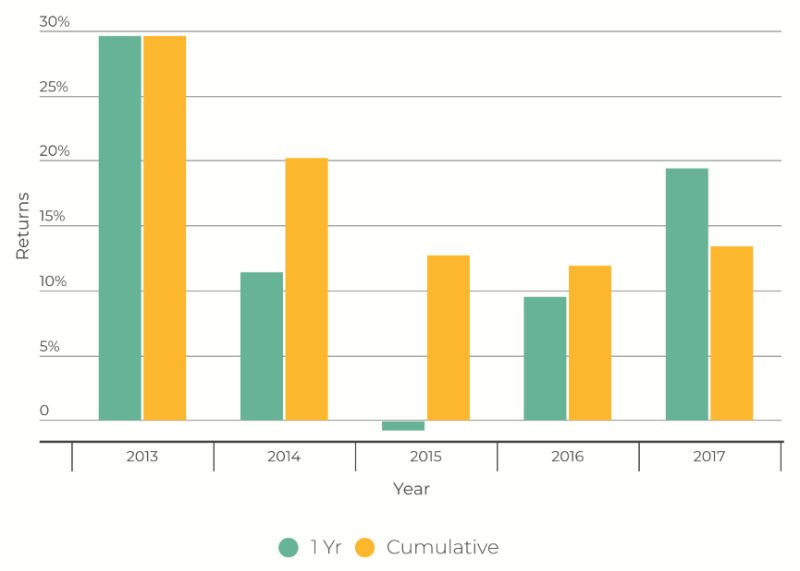

The answer may largely depend on recent events.From the beginning of 2013 to the end of 2017,The average return of the S&P 500 reached 13.4%.

S&P 500 returns: 2013-2017

In the past six years, the market has always fluctuated greatly. The year when the return rate is really close to 6% is only 10 years, but from the entire time span, the average return has reached 2%.

Image source ©️ NerdWallet

Image source ©️ NerdWalletWhat is the future trend of the U.S. stock market? No one can give an answer.

But in any case, one thing must be kept in mind:Only when you hold it for a long time can you get an average return.

>>>Interview with policyholders|"I thought the decimal point (return rate) was wrong", 2021 index insurance posted the bill, the rate of return set a new record

>>>Popular science posts | What are the 4 most common index strategies in the US index insurance and retirement annuity?

appendix

01. Opinion: Shocker: The S&P 500 is underperforming the stock market, MarketWatch, 06/26/2019, https://on.mktw.net/2FCeUrY