Lucy is 57 years old and ready to start planning her financial life after retirement. Lucy calculated that if she officially retires from the age of 67, working40 creditsIt has already been filled up early, so there is no need to worry about the basic medical insurance after retirement.

Counting inflation, after retirement, you can receive almost $4 in pensions from the government every year.

Lucy has been saving for retirement. IRA accounts, 401k, 403b, these different retirement accounts add up to almost exactly $30.How to make the $30 an asset that can provide lifelong income and supplement the annual retirement income, this is the first problem Lucy faces.

(>>>Recommended reading:What are the 40 points for the American Chinese Pension?How to check my points?)

(>>>Recommended reading:How much government pension can I receive each year?How do I inquire about my superannuation?)

Annuity insurance provides targeted solutions

In the mature market environment of the United States,Annuity Insuranceis the solution to this problem.

Annuity insurance, also known as pension insurance (this article specifically refers to non-securities products).The principal in the annuity insurance account has no risk of loss, and there is a certain value-added interest rate every year, which has the advantage of "guaranteeing the bottom line and locking the profit".

After purchasing this type of annuity for a few years, the insurance company will provide the policyholder with a lifetime pension year by year or month by month according to the contract.Therefore, commercial insurance companies and annuity insurance are important components of retirement pensions for individuals and families around the world.

Lucy decided to transfer the $30 into an annuity insurance account to supplement her lifetime retirement income.But at this time, another problem appeared:There are thousands of insurance companies and thousands of insurance products. At Lucy's age, which specific annuity insurance product should I apply for?

(>>>Recommended reading:Understand what American annuity insurance is in 3 minutes, and who is buying annuity insurance?)

Evaluation of Three Mainstream Lifetime Income Annuities

For the age of 57, the purchase of annuity insurance,"Zero risk guarantee" is the first element.Under the premise of "guarantee", the more money that can be guaranteed to be taken away every year, the better.

Based on the above two points,TheLifeTank©️Evaluation TeamWe contacted a professional annuity institution located in Scottsdale, Arizona. Through sharing market data, we found out 3 mainstream annuity insurance products with very competitive market share and interest rate in the United States, and helped Lucy make a comparative evaluation.

How much does $30 guarantee a lifetime retirement for Lucy?

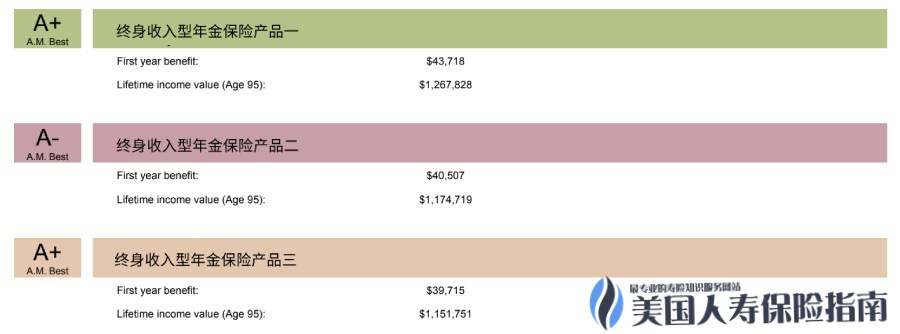

Let me talk about the conclusion first. Lucy, who plans to start receiving money from the insurance company at the age of 67,Guaranteed to receive at least $43,718 per year,Until life.

We calculated according to the life expectancy of 95 years, and the lifetime income annuity insurance product XNUMX (green) rated A+ in the figure below became the champion.The insurer guaranteed to pay Lucy a cumulative pension of $1,267,828.

Looking at total output alone, it appears that the first annuity insurance has emerged as the winner.However, if we break down the three annuity products (as shown in the figure below), we will find that the other two annuity products also have unique advantages.

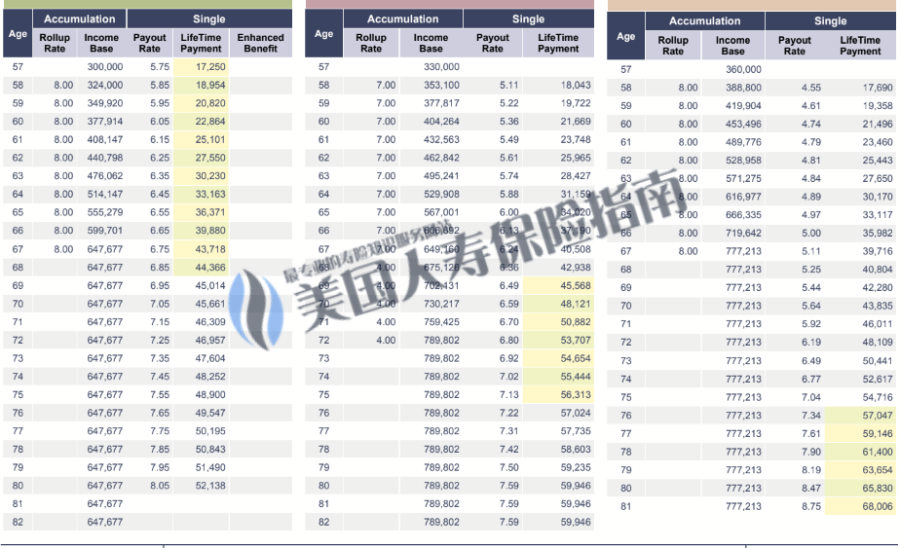

The yellow part of the icon below indicates that if Lucy starts to withdraw her lifetime income between the ages of 57 and 67, then the first annuity product is the best choice.After the age of 68, the annual pension withdrawal amount of the second annuity product exceeds the performance of the first annuity.After the age of 75, the annual pension withdrawal amount of the third product became the champion.

This proves once again that in the U.S. insurance market where product competition is extremely fierce and market segmentation is very specific,There is never the so-called "best" product, only the product that is most suitable for your actual situation and specific needs.

*This presentation is hypothetical and for education only; it is not a quote, contract, or guarantee of future performance. It is based on our understanding of the product at the time and is subject to change. The rate is at 2023/01/ twenty three.

*This presentation is hypothetical and for education only; it is not a quote, contract, or guarantee of future performance. It is based on our understanding of the product at the time and is subject to change. The rate is at 2023/01/ twenty three.

From the comparison of the three mainstream annuity insurance products above, we can see that the first annuity insurance product and the third annuity insurance product have a higher impact on the lifelong withdrawal of pensions from accounts.Offers a guaranteed interest rate of 8% p.a.*.The middle annuity insurance productGuaranteed annual interest rate of 7%.

The insurance company's "guaranteed interest rate" promise, the ultimate benefit for the retirement family's money -If the money in this type of annuity insurance account does not rise by more than 8% in a year, the insurance company must guarantee to make up to 8% in accordance with the contract.

Article summary

"How to turn risky and loss-making assets into risk-free and stable value-added assets?","If IRA, 401k, 403b, Pension, personal savings, become an asset that can provide lifelong income and supplement the annual retirement income?" .This is the first question faced by people approaching retirement after the age of 50.

In the U.S. market, lifelong income-type annuity insurance that provides a minimum guarantee provides a mature solution.

In the process of helping Lucy choose and evaluate, we also pointed out two reference indicators for people who are close to retirement age to choose:

- "Zero risk guarantee" is the first element.

- On the premise that the insurance company is stable and "guaranteed", the more money that can be guaranteed to be taken away each year, the better.

If there are any disadvantages, it is that this kind of life-income annuity insurance product with special interest rate must hold a green card or be a U.S. citizen to apply for it, and foreigners cannot apply for it yet. (full text)

*The guaranteed rate applies to the income account of the annuity insurance that provides the policyholder with lifetime income, that is, PIV: Protect Income Value.