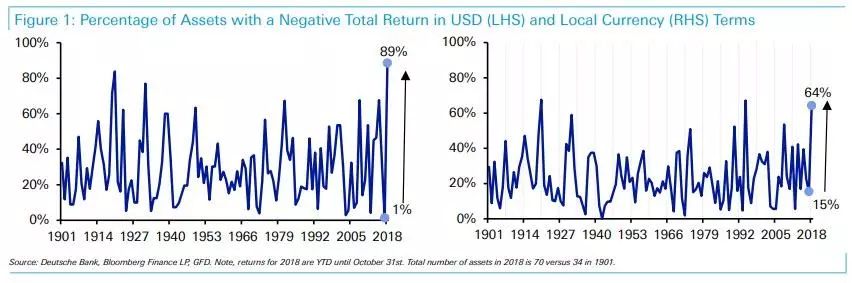

(12/28/2018 )兩個月前,德意志銀行(德銀)發布了驚人的統計發現:截至10月末,89%的資產今年累計負回報,佔比為1920年以來最高。

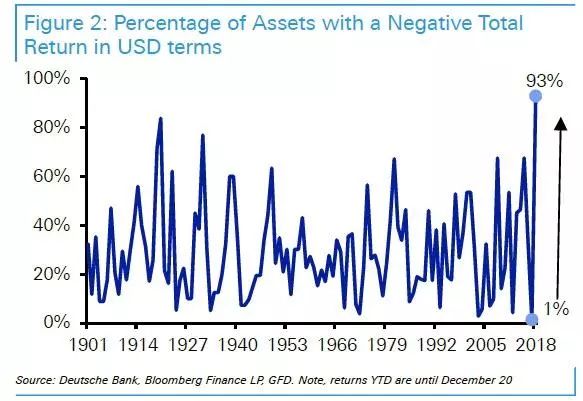

On Friday, December 12st, Eastern Time, Deutsche Bank issued a report to update the above-mentioned terrible figures: As of Thursday, December 21th, the price was adjusted in U.S. dollars.The proportion of assets with cumulative negative returns this year has reached as high as 93%.In the data on the proportion of negative returns tracked by Deutsche Bank,This is the highest percentage since records began in 1901.

Jim Reid, Managing Director and Global Head of Fundamental Credit Strategy Group of Deutsche Bank, pointed out in the report that the following chart, which records the proportion of USD-denominated assets with negative returns, is the most in demand chart this year.2018 was the worst year on record for this metric, worse than the Great Depression of the last century.

Perhaps more intriguingly, Deutsche Bank also pointed out that the performance of each asset was completely different a year ago.2017, Only 1% of assets have a negative return to the U.S. dollar for the entire year (in fact, there is only one type of Philippine bond), which is the lowest on record.Is the best year.

In just one year, the performance of assets has gone to the other extreme.Deutsche Bank believes that this may not be a surprise. It must be taken into account that during this period, the central banks of the major developed economies have shifted from the peak of global QE to wide-ranging tightening easing.

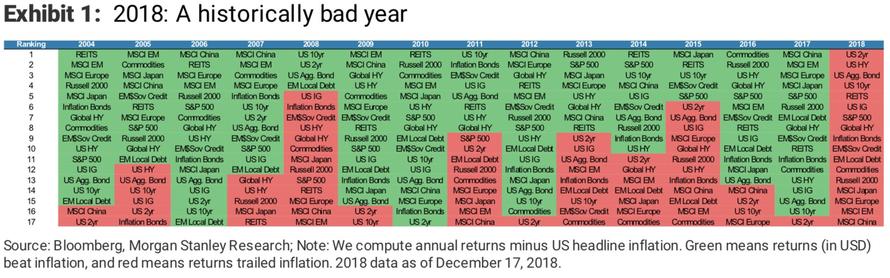

Coincidentally, at the beginning of this week Morgan Stanley also pointed out in the report that 2018 was the worst year in history, sayingExcept for cash, all asset classes are falling.He also said: "If anyone wants to figure out why it is so difficult to invest in multiple assets this year, there is no need to find any reasons.There is nowhere to hide this year. "

The following is a chart of Morgan Stanley's USD-denominated annual returns for each asset. This year's statistics are as of December 12.

In fact, after Morgan Stanley released the above chart, U.S. stocks fell sharply after the Federal Reserve announced its interest rate hike resolution on Wednesday.

S&P revenue hit a new 15-month low on Wednesday and Thursday, and the Dow hit a 14-month low for two consecutive days. The Nasdaq closed 8% lower than the end of August high on Thursday, one step away from falling into a technical bear market.

This Friday, the three major indexes opened higher, but eventually closed down collectively.The S&P fell 7% this week, the biggest weekly decline in more than seven years. The Dow and the Nasdaq both recorded their biggest weekly declines in more than a decade since the financial crisis. The Nasdaq officially fell into a bear market.

Deutsche Bank has pointed out in its October report that when the prices of most global assets are at historical highs due to extreme monetary easing, the collective plunge is what will happen later.When the tide goes out, all assets are more likely to have collective negative returns for several months, instead of turning around in feng shui, the stock market is worse than the bond market, or vice versa.

In the December report, Reid said that Deutsche Bank expects that 12 will be difficult for the same reasons as in 2018, but in the short term, the market will perform excessively and fluctuate too quickly.But nothing is scheduled.Perhaps the most likely way to extend this cycle is that the Fed made a policy error and did not tighten the currency when inflation rose, or inflation really did not rebound. If the Fed does not raise interest rates in 2019, the yield curve may become steeper, which helps Risky assets, extend the cycle.

(American Life Insurance GuideSource of Net Editing Report:Investing Channel )