American Life Insurance Guide > Life Insurance Brand > Ameritas Life

Insurance Agency Rating Form/2020 Update

A

A+

N/A

N/A

82

About Ameritas Life Insurance Company

Today we are introducing to you a Top 200 century-old financial and insurance group:American Life Insurance Company (Ameritas), Referred to as America Life.

Ameritas Insurance Group, Which has been translated as "America Life",or"Merida Life"The picture of the company's trademark is a bison.

This is a veteran co-holding insurance company with a history of more than 140 years.In the following reviews, we collectively refer to as "America Life. "

American Life InsuranceThe group's philosophy is "Fulfilling Life"-aiming to help customers achieve various goals in the life course by providing professional financial services and products.

American Life Group provides services in the New York area under the name of "New York American Life Insurance Company", and in areas other than New York, it provides services under the name of "American Life Insurance Company".

- Ameritas Life Insurance Corp. of New York

- Ameritas Life Insurance Corp.

Next is the American Life Insurance Guide©️ Comprehensive introduction and evaluation of American Life Group.Take a look nowAmerican Life GroupWhether it can be the choice that best suits our current actual situation.

History of Ameritas American Life Insurance Group

In 1887 in Lincoln, Nebraska, five businessmen discovered that there was no insurance company to provide services, so they jointly raised funds and established the Old Line Bankers of Nebraska.

This insurance company later developed into what is today Ameritas, American Life.

Today, American Life provides services all over the United States, serving more than 400 million customers, and is a "commonly held" company.

Under this corporate structure, American Life Insurance Company is directly responsible to qualified policyholders and has no obligation to shareholders or Wall Street analysts.This is conducive to America Life choosing to pay more attention to the "long-term" and "prudent" development strategy instead of making corporate decisions for the realization of short-term benefits.

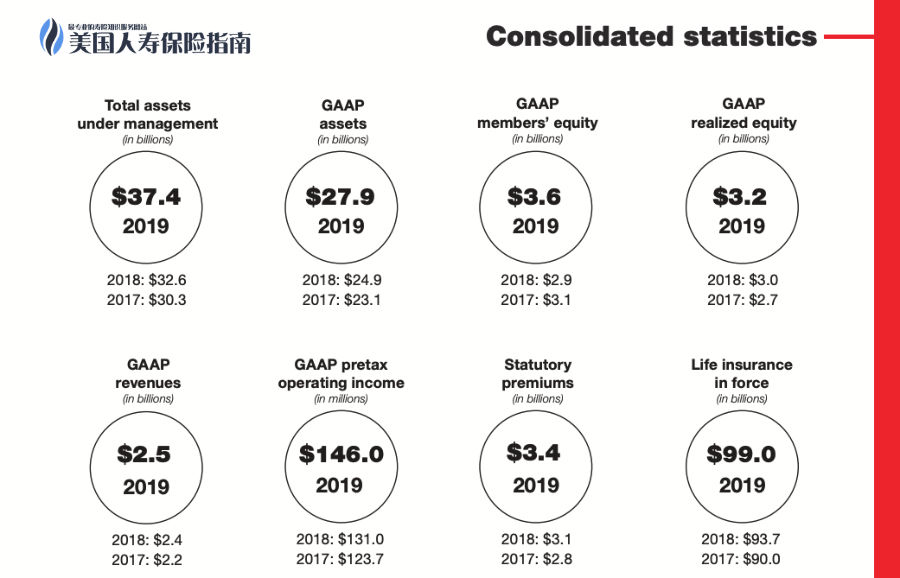

Ameritas' credit rating and financial status

At the end of 2019, the American Life Insurance Company’s total assets under management (AUM) increased to$374 billion, The effective life insurance policy contract value is$990 billion.

More than 140 years of development has built a strong financial foundation for American Life. AM Best’s rating for American Life is "A", the rating given by Standard & Poor's is "A+".

In terms of consumer satisfaction, American Life has been awarded "A+"The evaluation of high-quality service.

The following is a summary of the ratings of American Life:

- AM Best – A

- Standard & Poor's – A+

- American Business Council/BBB-A+

(>>>Recommended reading:What do the letters of the company's credit rating mean?How to interpret the company's credit rating?)

Ameritas American Life Group Insurance Products List

Personal and family life insurance businessIt is the core business of American Life Insurance Group, and its product lines are divided into:

- Index whole life insurance

- Universal whole life insurance

- Investment-based whole life insurance

- Savings Participating Whole Life Insurance

- Term life insurance

(>>>Recommended reading:American life insurance classification, insurance types, prices and comparison of advantages and disadvantages)

Index Life Insurance/ IUL

American Life has launched two index-type whole life insurances for policyholders to choose from.

- Ameritas Growth IUL (Download product instruction manual LI 2221 12-20 )

- Ameritas Value Plus IUL ( Download product instruction manual LI2314 5-20 )

Both products provide 4 index options, and the main difference is that the Growth product focuses on "cash value accumulation", while the Value Plus product focuses on "stable comprehensive protection."

*It is worth noting that Ameritas' life insurance product line (except for investment whole life insurance) providesMajor diseases, chronic diseases, and end-stage diseases3 items for claim settlement"Welfare"additional terms,andNo extra charge.

Universal whole life insurance/UL

American Life’s universal life insurance emphasizes “lifetime protection” more than “Value Plus IUL” and also provides comprehensivePre-mortem benefit claims.

- Ameritas Value Plus UL ( Download product brochure LI 2228 1-20 )

Investment whole life insurance/VUL

American Life's investment life insurance provides higher "cash value growth potential."In order to reduce insurance costs and pursue higher income potential, this type of insurance policy does not provide comprehensivePre-mortem benefit claimsadditional terms.

- Ameritas Performance II VUL (Product manual download LI23691-20)

- Ameritas Advisor II VUL (Product manual download PF 802 1-20)

Savings Participating Whole Life Insurance / Whole Life

Guaranteed lifetime insurance protection, guaranteed minimum annual dividends, and comprehensive pre-mortem benefits are the characteristics of American Life Savings Participating Whole Life Insurance. The 3 savings dividend products are as follows:

- Ameritas Access Whole Life (Product manual download LI234811-19)

- Ameritas Growth Whole Life (Product manual download LI 2112 3-20)

- Ameritas Value Plus Whole Life (Product manual download LI2110 1-20)

Term Life Insurance/ Term

We usually configure term life insurance for the following reasons:

- Pay for funeral expenses after death

- Provide a source of income for the entire family

- Leave a legacy

- Used to help repay the loan

- Used to pay inheritance tax

- Provide higher education funding for children

- Protect your company or SME

American Life Group’s term life insurance is divided into two product lines. The Value Plus product only provides pure death claims, while the other provides death compensation as well as additionalMajor diseases, chronic diseases and end-stage illness claims.Consumers can choose products based on actual conditions.

- Ameritas Value Plus Term Life Insurance

- Ameritas FLX Living Benefits Term

Other product lines of Ameritas American Life Insurance Group

In addition to life insurance business, American Life also provides the following financial services and insurance products to serve policyholders.Of which disability insurance

- Dental insurance

- Eye Insurance

- Ear/Hearing Insurance

- Retirement plan

- Disability insurance

- Investment Service

- Annuity insurance

- Public financial services

Comprehensive evaluation of Ameritas

More than 140 years of history, shared corporate structure, and the concept of serving the community as the cornerstone of business have allowed the low-key Ameritas Americas Life to be known to the market and grow into a trusted brand.

For term life insurance policyholders with limited budgets, Ameritas Americas Life provides different options, which is worthy of recognition.Users of American Life Insurance Guide ©️ can use the self-service quotation tool for term life insurance[Click to use], understand the price comparison of these two products.

As for whole life insurance, Ameritas has a rich product line of life products with clear classification of applicable targets. Although this approach increases the company's cost, it is more convenient for policyholders to understand and choose.

The index policy issued by American Life, the performance of the policy brought about by the four index strategies, is also in an advantageous position in the industry evaluation of the field of retirement income and wealth accumulation.As for the situation of family group insuring, Amerits American Life's underwriting is also very friendly.

Ameritas America Life is also one of the few offering freeComprehensive pre-mortem welfare protectionOne of the life insurance companies with a contract (critical illness, chronic illness, terminal illness).

"Maintenance""steady"This is our final evaluation of Ameritas Americas Life. With the appointment of the new CEO in 2020, what kind of "surprise" Ameritas Americas Life will bring to policyholders and the market, we will continue to wait and see.

Official website: ameritas.com

Ameritas Life Insurance Group is a Mutual company.Its parent company is Ameritas Joint Holding Company, headquartered in Lincoln City, Nebraska, USA, and provides life insurance and financial management services in all states, including New York. [Wikipedia]

Headquarters: Lincoln, Nebraska

CEO: Bill Lester (January 2020, 1 –)

Founded: 1887

Subsidiaries: Milford Realty LLC, Ameritas Investment Partners Inc., Security American Financial Enterprises, Inc.

American Life Insurance Guide > Life Insurance Brand > Ameritas America Life