American Life Insurance Guide > Life Insurance Brand > OneAmerica Life Insurance Company

Insurance Agency Rating Form/2021 Update

A+

AA-

N/A

N/A

95

Introduction to OneAmerica

OneAmerica Insurance Company is an insurance financial group with more than 140 years of experience.In the historical background of the establishment of the Knights, there seems to be a veil of mystery for policyholders.

For the past 30 years, OneAmerica has been the leading brand in the US long-term care insurance industry. What about OneAmerica, an insurance company and its products?What are the historical background and product advantages behind it? LifeTank©️ will help us further understand.

OneAmerica's total claims expenditure in 2019: $60 billion

The historical background of OneAmerica Insurance Company

The origin of OneAmerica dates back to 1877, when the Knights of Pythias established a life insurance project internally.

In 1899, the project developed into the American Central Life Insurance Company (American Central Life Insurance Company).

In 1904, the American Central Life Insurance Company founded the reinsurance department and is currently the oldest reinsurance company in the United States.

In 1910-1926, the division of the Knights of Pythias, the Grand Lodge Knights of Indiana established an insurance department.

In 1926-1936, the Knights of Pythias separated the insurance department from the Knights of Rocky and founded the United Mutual Life Insurance Compan.

In 1936, the American Central Life Insurance Company and United Life Insurance Company merged to form the American United Life Insurance Company (abbreviated as: AUL).At that time, he managed $4600 million in assets.

In 1994, AUL and The State Life Insurance Company formed a life insurance alliance.

In 1998, Pioneer Mutual Life Insurance Company joined the AUL/State Life Insurance Alliance.

In 1999, assets under management reached $106 billion.

The alliance uniformly uses the OneAmerica®️ brand trademark.

After more than 140 years of evolution and development, OneAmerica has developed into a nationwide provider of life insurance and financial solutions, and has become a leader in the field of long-term care insurance.

Organizational structure of OneAmerica Insurance Company

OneAmerica is a "Mutual" insurance company jointly owned by policyholders.This "mutual assistance" structure may be more beneficial for policyholders who need long-term care.

In an ideal situation where all conditions are the same, choosing between a listed company and a mutual aid company to choose a long-term care policy issued by a mutual aid insurance company may benefit us even more.Mutual insurance companies will bear full responsibility for policyholders, while joint-stock companies need to meet the requirements of shareholders to create profits.

Credit Rating of OneAmerica Insurance Company

OneAmerica is headquartered in Indianapolis and currently manages more than $800 billion in assets.Its insurance companies include:

- The State Life Insurance Company

- American United Life Insurance Company® (AUL)

- Pioneer Mutual Life

The Asset Care product line in the field of long-term care is composed ofThe State LifeUnderwriting.

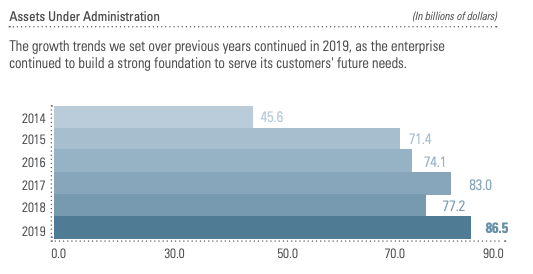

OneAmerica's total assets in 2019: $865 billion

With a long history and financial strength, OneAmerica Insurance Company has been unanimously affirmed by international independent credit rating agencies.

AM BestCurrently givenA+ (Superior)Rating., Standard & Poor’s givesAA-(Very Strong)Rating.The Comdex composite index score of OneAmerica (State Life) is95/100.

The above score means that OneAmerica is classified as a first-classLife insurance companyRanks. (Click to learn how to interpret credit ratings)

The following is a specific list of ratings:

- A+: AM Best.

- AA-: Standard & Poor's/Standard & Poor's

OneAmerica's long-term care insurance product introduction

In the past few decades, new insurance companies have continued to enter the long-term care field, and old insurance companies have continued to leave the market, or constantly adjust and change their products.However, since OneAmerica's Asset Care product was released in 1989, it has not changed its promise of life-long unlimited long-term care claims.

One America Asset Care

Asset Care insurance under OneAmerica is a Hybrid long-term care insurance product.It combines the characteristics of life insurance and long-term care insurance-if long-term care claims are not used, then we can choose to pass on as an inheritance to the beneficiary, or return the premium.

Compared with traditional care insurance, the biggest advantages of this type of long-term care insurance are:Guarantee that the premium will not increase.

The three major advantages of this product are:

1. When a situation that requires long-term care occurs, the product can settle claims for life.

2. The husband and wife can jointly insure a policy.

3. Allow the use of funds in IRA and 401k to pay premiums.

you canClick Here , Find the official English documentation.

OneAmerica product line at a glance

The products and services of OneAmerica Insurance Company are divided into three categories (Chinese manual description), respectively

XNUMX. Life insurance

• Whole life insurance

—— Fixed contribution whole life life insurance

• Asset-based long-term care products

• Fixed term life insurance

• Universal Life Insurance

• Fixed annuity

—— Lump-sum payment of the immediate annuity

—— One-off deferred annuity payment

—— fixed index annuity

XNUMX. Lifetime subsidy

• Voluntary life insurance

—— Term Life and AD&D

—— Lifetime

• Voluntary disability insurance

—— Short-term and long-term disability insurance

—— One-time disability insurance

• Traditional collective life and AD&D

• Traditional collective disability (short-term and long-term)

• Small business solution (choice of employers who insure term life and AD&D disability insurance for 2-99 employees)

• Employee assistance program (EAP)

• Family and Medical Leave Act (FMLA) management services

• Travel assistance service

XNUMX. Retirement services

• 401(k), 403(b) and 457 plans

• Fixed benefits

• ESOPs

• Exemption plan

• Plan design: Safe Harbor and new comparability

• Additional and non-additional management services

• Open building trust and collective annuity

• Retirement transition support

• Local service model for 26 national offices

• Custom communication

• Cooperate with fee and commission-based financial professionals

• Support custom allocation models created by Registered Investment Advisors (RIAs)

LifeTank©️ Final Evaluation

More than 140 years of history, strong financial structure, and the company philosophy of directly serving policyholders are all bonus points when it comes to life-long claims.

If a husband and wife jointly buy an insurance policy, OneAmerica's products are competitive.If you apply separately, it has a price advantage for male policyholders.

In one sentence, if you want a Hybrid long-term care insurance, then OneAmerica should be included in your consideration.

Official website: oneamerica.com

OneAmerica Financial Partners, Inc. is a U.S. Mutual Holding Organization (Mutual Holding Organization) that provides life insurance, retirement and employee benefits across the United States with three major financial services.Its office is located in OneAmerica Tower in downtown Indianapolis, Indiana. Wikipedia

Customer Hotline: 1 (800) 249-6269

Life Insurance Hotline: 1 (800) 533-3522

Corporate Headquarters: Indianapolis, IN

CEO: J. Scott Davison (Apr 1, 2014–)

Company employees: 1,900 (2015)

Subsidiaries: American United Life Insurance Company, The State Life Insurance Company, more

2019 Annual Financial Report[Check]

American Life Insurance Guide > Life Insurance Brand > OneAmerica Life Insurance