American Life Insurance Guide > Product Center > U.S. Critical Illness Insurance (Rider) Critical Illness Protection Life Insurance Products

| s | Bayesian Rating | product type |

| Company N | A | whole life / IUL |

*Why not indicate the specific company name and product name on this page?

-In order to comply with US financial and insurance regulations and compliance management, this product introduction page will not mention the specific name of the insurance product and the specific name of the insurance company.Please make an appointment to obtain product materials authorized by the insurance company.

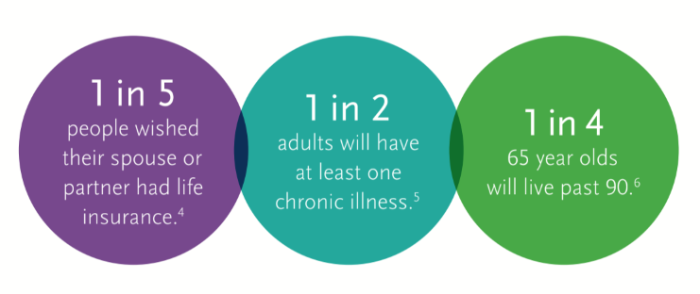

The product emphasizes the benefits that can be used before death, and provides benefits for terminal illnesses, chronic diseases, major diseases or major injuries.

Its characteristic functions are as follows:

- The death compensation part can help families get through financial difficulties

- The insured size and premium payment amount can be adjusted

- Potential for accumulation of cash value

- Protect the premium portion from market risk

- Optional additional clauses allow the policy to provide guaranteed lifetime income

- The pre-mortem benefits part provides insurance for eligible terminal illness, chronic illness, major illness or major injury

- 5 index strategies and 1 fixed interest rate account

This product is an IUL insurance policy that provides comprehensive protection for American families

This product is an IUL insurance policy that provides comprehensive protection for American families

The protection benefits of this product are not subject to any restrictions. As long as you meet the eligibility requirements, you can use the policy compensation for any reason.

What conditions are eligible?

Critical diseases include:

- cancer

- heart disease

- Aplastic anemia

- ALS

- Aortic transplantation

- Vital organ transplant

- Motor neuron disease

- blindness

- Stroke

- Cardiac arrest

- Cystic fibrosis

- End-stage renal failure

- Heart valve replacement

Major injuries include:

- coma

- paralysis

- Severe burns

- Traumatic brain injury

The compensation can be used for, but not limited to:

- family expense

- Adult day care

- Housing renovation

- Nursing home care

- Expenses to improve the quality of life

TAG:U.S. Critical Illness Insurance, U.S. Critical Illness Insurance, U.S. Critical Disease Insurance, U.S. Critical Illness Medical Insurance, Parents' Major Illness Insurance, U.S. Commercial Medical Insurance,

1. How to pay dividends for this savings dividend insurance product?

Every fiscal year, the insurance company that discovers the product publicly releases the dividend plan and dividend rate to the public.

2. Which indexes are used to calculate interest for this index insurance product?

The product provides 4S&P 500®️ IndexAn index interest account used as an income basis and a use MSCI Emerging Markets Index Index interest account for the index.

S&P 500® Index

This index is often regarded as a benchmark for the performance of large stock markets.It is used to measure the average stock price changes of the 100 most widely held large-cap companies representing more than 500 specific industry groups.

account type:

- Peer-to-peer account with cap

- Peer-to-peer participation rate account

- Peer-to-peer account without cap

- Average point no cap worth accounts

MSCI Emerging Markets Index (MXEF)

The index was launched by MSCI in 1988. MXEF covers the stock markets of 21 countries around the world, among which the American countries include Brazil, Chile, Colombia, etc., and the Asian countries include China, India, and Indonesia. The index aims to showcase emerging global stock markets. which performed.

account type:

- Peer-to-peer account with cap

Fixed income interest rate account

If you are pursuing a guaranteed rate of return, the product also provides a fixed interest rate account with a guaranteed rate of return.As of December 2018.The guaranteed interest rate is 12%.

TAG:U.S. Critical Illness Insurance, U.S. Critical Illness Insurance, U.S. Critical Disease Insurance, U.S. Critical Illness Medical Insurance, Parents' Major Illness Insurance, U.S. Commercial Medical Insurance,

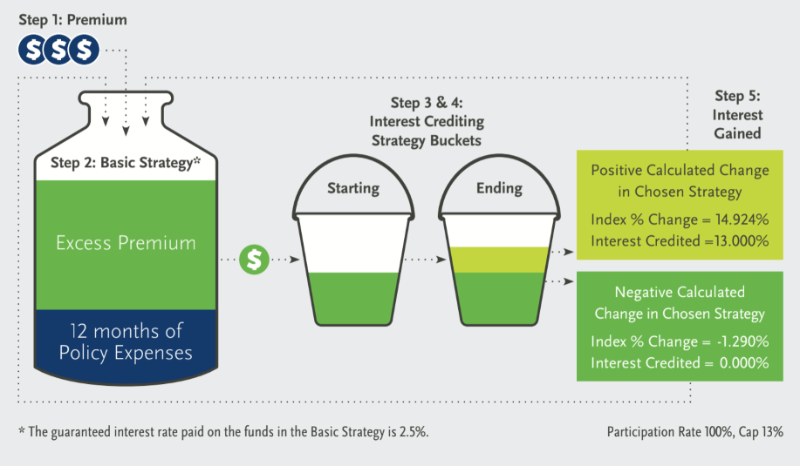

How does the product work?

After paying the insurance cost, the remaining part of the premium you paid is automatically entered into four optional "strategy accounts" and converted into the corresponding cash value. You can choose to put this money into the strategy of guaranteed income In the account, such as a guaranteed return of 2.5% per year; you can also choose to target the strategy account of the stock index, such as choosing to link to the S&P500 or MSCI index.When it is put into the stock index strategy account, when the market environment is not good, the insurance company promises to guarantee the bottom.Therefore, there is no risk of loss in the policy account of the policyholder.

Reference description:

TAG:U.S. Critical Illness Insurance, U.S. Critical Illness Insurance, U.S. Critical Disease Insurance, U.S. Critical Illness Medical Insurance, Parents' Major Illness Insurance, U.S. Commercial Medical Insurance,

The product policy and additional protection options*

Additional clauses for advance death compensation / Accelerated Benefits Rider

- Up to $1,500,000 million in end-stage illness or chronic illness benefits

- Up to $1,000,000 for major illness or major injury

- The insurance company has the right to modify but the minimum amount cannot be less than $500,000.

Additional clauses for end-stage illness advance compensation

- If the insured is diagnosed with a disease or chronic injury that will die in 24 months or less, he can pay a certain discount in advance.

Additional clauses for chronic illness advance death compensation

- If the insured person suffers from a chronic disease that meets the contract, he can pay a certain discount in advance.

Additional clauses for prepayment of death compensation for major illnesses

- If the insured person suffers from a chronic disease that meets the contract, he can pay a certain discount in advance.

Lifetime Insurance Income Supplementary Protection

- Can convert cash value into a guaranteed income stream (similar to annuity payments)

- Suitable for 65-85 years old

- Available 10 years after the policy is in force

Additional Clause for Accidental Death Compensation (ADB)

- In case of death due to some accidental injury, additional death compensation can be provided

OVERLOAN PROTECTION RIDER (Extra Loan Protection Additional Clause)

- Additional clauses guarantee that the basic insurance policy will not be invalidated due to outstanding loans

Surrender Penalty Waiver of Additional Protection

- Unemployed for more than 12 months

- Before the age of 59

Insurance experience sharing

Can this kid apply?

Can this kid apply?

I want to share

Make An Appointment

Important note | Disclaimer

*The descriptions and characteristics of various assets in these tables are for general information purposes and are provided to solve the most typical situations.There are many rules for the tax payment and calculation of all assets mentioned. You should seek the advice of a tax expert before making any changes to your existing or future retirement plans, accounts or assets.

*Cash value life insurance is subject to the provisions of the revised pension contract, and limits over-insurance premiums based on face value, age of the insured and other factors.Cash value life insurance also includes additional death insurance premiums, which will also increase the cost of this product.In addition, unless processed as a loan, any withdrawals in excess of the total premium paid are subject to tax (these payments are subject to interest charges).For more information, please refer to the policy description.

*The name, features, and compensation of additional benefits vary from state to state.

*This product webpage is for reference only. All insurance applications and all possible insurance policies or contracts are written in English only.You can request the English version of this document.If there is any objection, the English version shall be used as the official text.