American Life Insurance Guide > Product Center > Wealth Accumulation Indexed Life Insurance IUL

| s | Bayesian Rating | product type |

| Company Z | A+ | IUL |

*Why not indicate the specific company name and product name on this page?

- In order to comply with US financial and insurance regulatory regulations and compliance management, this product introduction page will not mention the specific names of insurance products and insurance companies.You can make an appointment with the American Life Insurance Guide to request product materials authorized by the insurance company.

This policy product is the mainfinancial protection,Wealth accumulationAndTax Advantage Planning.

Its characteristic functions are as follows:

- Tax-free death benefit for your beneficiaries

- Supplementary riders can help you adjust your sum assured to suit future needs with additional term coverage.At the same time, the sum assured can be converted into a lifetime guarantee.

- Tax-deferred cash value growth accumulation strategy with additional earnings bonuses to increase the potential for accumulation of appreciation.

- Cash value accounts can be withdrawn at any time based on future financial needs

- Provide protection for terminal illnesses and chronic diseases

Policy Costs/Expenses

- Premium Charge: 6% of each premium will be deducted first

- Monthly insurance cost: Deduct insurance cost per month based on age, gender and risk assessment

- Monthly Policy Cost: $7.50/month

- Monthly expenses: According to age, gender and risk assessment, monthly expenses are deducted

Surrender penalty

10 years - gradually decreasing surrender penalty

Which indices are used in this product?

The product offers a total of 10 portfolios of index interest accounts in two categories and one fixed income interest account.

Exclusive Patent Index Account

The indices under this account are controlled by the S&P 500® Index (50%) and Bloomberg Barclays US Aggregate RBI Series 1 Index (50%).

Hybrid Index Account

Indices under this account consist of Dow Jones Industrial Average (35%), Bloomberg Barclays US Aggregate Bond Index (35%), EURO STOXX 50® (20%) and Russell 2000® Index (10%) composition.

S&P 500® Index Account

This index is often regarded as a benchmark for the performance of large stock markets.It is used to measure the average stock price changes of the 100 most widely held large-cap companies representing more than 500 specific industry groups.

Bloomberg US Dynamic Balance Index II Index Account

Bloomberg US Dynamic Balance II ER Index Index Account

PIMCO Tactical Balanced Index Index Account

PIMCO Tactical Balanced ER Index Index Account

Fixed income interest rate account

The product also offers a fixed-rate account if a guaranteed rate of return is sought.

How does the product work?

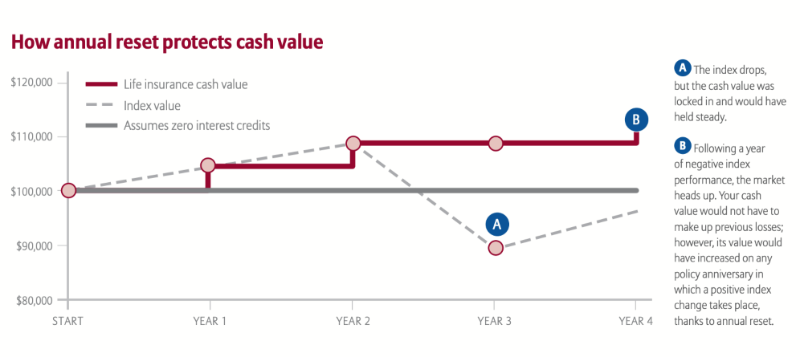

The premium you paid, after paying the insurance cost, the remaining part will automatically enter the optional "strategy account" and convert it into the corresponding cash value. You can choose to put the money into the strategy account with guaranteed income. ; You can also choose to benchmark to the strategy account of the stock index, such as selecting the S&P500 index strategy account.When put into the stock index strategy account, when the market environment is not good, the insurance company promises to guarantee the bottom line.Therefore, there is no risk of loss in the policy account of the policyholder.

Reference description:

The product policy and additional protection options*

Loan Protection Rider

Effective start-up period: 75-120 years old, to prevent short-term insurance policy caused by inability to repay the policy when there is a loan

Added cost waiver rider

This clause waives surrender penalties, cost charges, and enhanced liquidity rider charges for any additional sum assured after 11 years

Supplementary term life insurance riders

Additional term insurance that can be increased by 10 times the basic sum assured, and can be conditionally converted to lifetime coverage

Additional terms for children's term life insurance

Provides coverage of $15-$21 for children from 5,000 days to 10,000 years old, and can be converted to lifetime coverage

Enhanced Liquidity Rider

Waiver of some surrender penalties, allowing you to claim more cash value in earlier years of your policy

Additional Terms of Term Insurance for Other Covered Objects

Additional term coverage can be provided for up to 4 persons, including other family members or business partners, up to 4 times the basic sum assured

Large Premium Deposit Rider

After depositing a single larger premium, it will be deducted one by one according to the premium that needs to be deposited each year.Enjoy certain premium discounts.

Waiver of certain premium riders

Certain premiums are waived after the policyholder becomes completely disabled.The amount waived is determined when the policy is issued.Minimum monthly waiver of $25, maximum waiver not to exceed $150,000 per year

There are two loan options for this policy:

- Fixed rate borrowing: Standard borrowing at 10%-0% interest rate for 1 years

- Index lending: 5% lock-in for life (as of January 2019, determined by the public interest rate when applying for the policy)

Insurance experience sharing

I want to share

Make An Appointment

Important note | Disclaimer

*The descriptions and characteristics of various assets in these tables are for general information purposes and are provided to solve the most typical situations.There are many rules for the tax payment and calculation of all assets mentioned. You should seek the advice of a tax expert before making any changes to your existing or future retirement plans, accounts or assets.

*Cash value life insurance is subject to the provisions of the revised pension contract, and limits over-insurance premiums based on face value, age of the insured and other factors.Cash value life insurance also includes additional death insurance premiums, which will also increase the cost of this product.In addition, unless processed as a loan, any withdrawals in excess of the total premium paid are subject to tax (these payments are subject to interest charges).For more information, please refer to the policy description.

*The name, features, and compensation of additional benefits vary from state to state.

*This product webpage is for reference only. All insurance applications and all possible insurance policies or contracts are written in English only.You can request the English version of this document.If there is any objection, the English version shall be used as the official text.