The 2021 US tax filing deadline for individuals and families has been postponed to May 5, leaving more time for the insured family to prepare.American Life Insurance Guide©️ Readers are advised to review last year’s column: "Before the tax season, what should we prepare?"

At the same time, as some insured families startedWithdraw cash from the policy as retirement income, Or received a life insurance company's compensation for compensation before death (such as a major illness), such families may receive a 1099 form sent by the insurance company.Then,Why did the life insurance company send this form?How do we deal with it correctly?It has become a new problem that needs to be faced in the 2021 tax season.

Next, the American Life Insurance Guide ©️ Community Life Insurance Columnist Heather, These questions will be answered and explained one by one.

Why did I receive the 1099 form from the life insurance company?

One sentence summary: Whether it’s usLoan.Surrender, Or withdraw pensions, or accept claims,As long as the life insurance company pays us a sum of money in a certain year, then we will receive a 1099 form from the life insurance company.

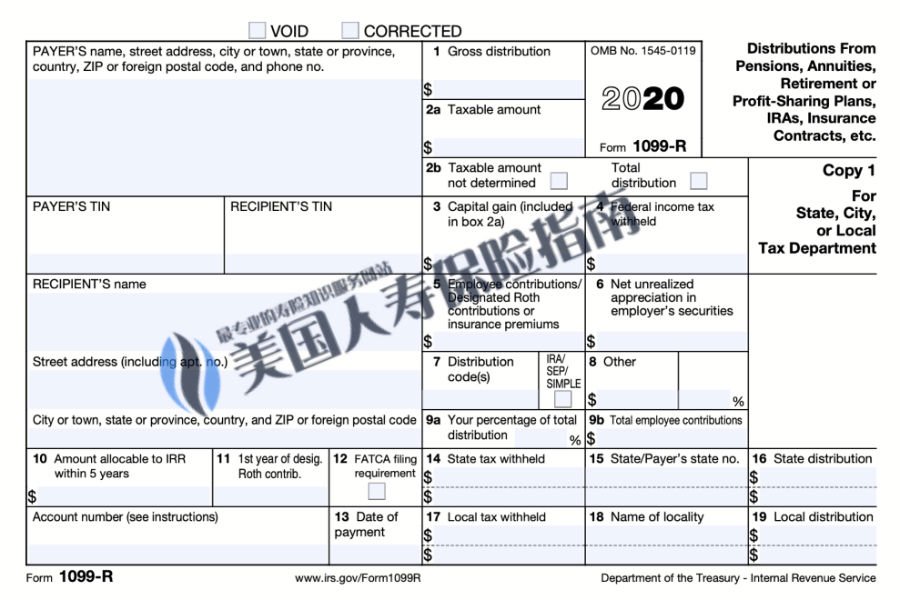

This watch looks like this:

Don't be scared, there is no inevitable connection between the 1099 form from a life insurance company and whether or not you pay taxes.In other words, even if we received the 1099 form, we might not have to pay taxes.It will be explained in detail below.

(>>>Recommended reading:Do you have to pay taxes for taking money out of life insurance for your pension?is that true? |Rumorbusters)

Do I need to pay taxes when I borrow a loan from the insurance policy as a pension?

Nowadays, people buy insurance, and a large part of it hopes to borrow life insurance as a tool.Supplementary retirement incomeChannels.When we retire, do we need to pay taxes when we withdraw money from the policy for use?

For example, if this year we borrowed 50 yuan from a cash value insurance policy of our own, to spend it as a retirement pension.So does this money need to be taxed?Not needed1.

However, at the end of January and mid-February of the second year, we will receive a copy fromLife insurance companyForm 1099 indicates that the life insurance company has reported to the IRS that it paid us 50 yuan this year, and it will also report that the money is income that does not need to be taxed.

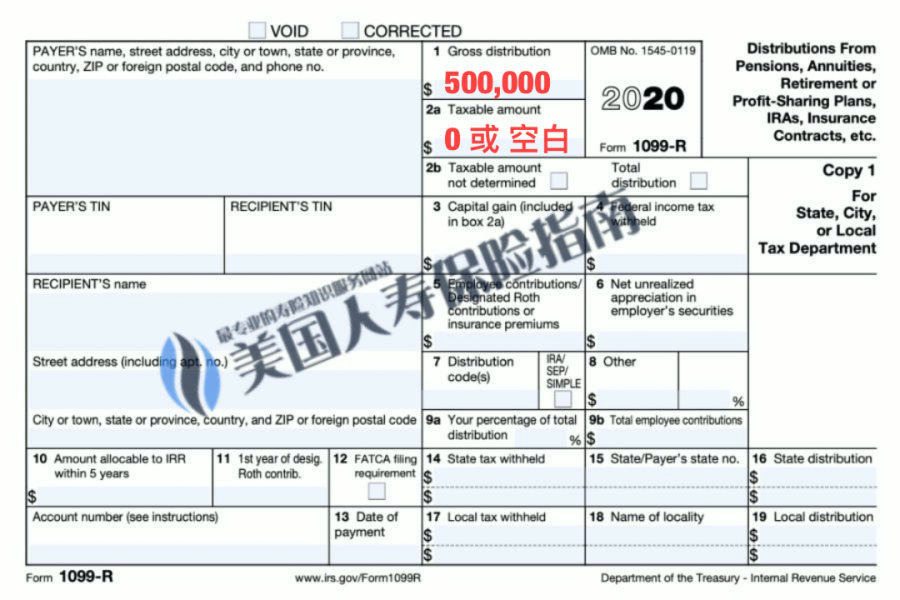

Specifically, the Box 1099 part of Form 1 indicates that the life insurance company paid us $50 (the red part in the figure below).

The Box 1099a part of Form 2 is either left blank or written with $0, which represents the annual income of $50. The part that needs to be taxed is 0 or blank, that is, no tax is required.As shown below:

For insurance claims due to major illnesses, do I need to pay tax on this claim?

According to Taxact guidelines and IRS terms2.When the insured is still alive, due to illness with ADBEarly claims before deathIn the form of payment of cash from the life insurance policy, then this cash income is not counted as the policyholder’s annual income.

Therefore, if our family members unfortunately suffer from a major illness, for example, they are diagnosed with cancer by a doctor, then we can apply for life insurance claims.

Although this money is not counted as annual income, we need to do one thing in the tax season of the coming year,It is to inform the IRS by submitting a 1099 form when reporting the annual income that we have received a sum of money, which is an ADB claim for life insurance, please make no mistake.

What should I do if an error occurs?

Whether it’s taking money from the insurance policy or applyingClaims for pre-mortem benefits,YesLife insurance companyResponsibility to calculate and fill in the various numbers, and to issue a 1099 form to us.What we need to do is to check the mailbox, accept and verify this form when the tax season comes every year, and then submit this form when filing the tax.

In a few cases,The life insurance company may miscalculate or fill in wrong.When you find these errors, you can contact to correct them.The life insurance company will send us a new 1099 form after correcting these errors.

Another "abnormal" situation is the occurrence of unfavorable "taxable income."This usually stems from two aspects. One is that a product design plan was selected when applying for insurance, and the choice was made many years later.SurrenderThe direct consequence brought about; another reason is that when the insured withdrew funds from the policy account many years later, due to lack of professional help, they chose a withdrawal method or amount that was not conducive to their own interests.This will cause the policyholder to face financial losses.

There is also a kind of favorable "taxable income" from life insurance companies, which I will introduce in a subsequent column.

Article summary

For financial wealth management products, take a cash value life insurance policy as an example.American Life Insurance GuideInsist on advocating "LBYB – Learn Before You Buy, learn more before you buy"Concept.We also provideInsurance Guide和Company ReviewsThe column is available for public inspection.

A cash value life insurance policy is a long-term holding asset.Buying and applying is just the beginning.In 10 years, even 20 years, 30 years later, you will really start to face all kinds of problems of how to manage this asset properly.Throughout the process, take the initiative to understand your policy’s asset status, and professionallyInsurance consultantCollaboration will help you effectively achieve the goal of family wealth insurance and truly protect your own interests.

(>>Recommended reading:Evaluation|New York’s life insurance policyholders’ 14-year policy account case sharing and lessons learned )

appendix

1. https://www.irs.gov/forms-pubs/about-form-1099-r There are exceptions to this situation, please consult a professional financial manager for your specific situation

2. IRC sec. 104(a)(3)