Biden's tax reform background

In August 2021, the U.S. Senate and House of Representatives passed a $8 trillion infrastructure expenditure budget resolution, and the task of filling this expenditure was handed over to the Ways and Means Committee of the House of Representatives and the Finance Committee of the Senate.

In September 2021, the House Ways and Means Committee, which was the first to hand over its work, announced a partial tax fundraising legislative proposal that would pay for the Biden government’s $9 trillion infrastructure plan, starting the "Biden tax reform" legislative process.This is also the source of the widely circulated "Biden Tax Reform".For this legislative proposal, we will call it "Biden tax reform plan 1.0. "

By logging into the Lord’s White House, I first affirmed the tax reform plan approved by the House Ways and Means Committee."Is a critical step", then expressed that the strength is far less than Biden's early proposal in early 2021, and hopes to continue to work towards "high-income and high-net-worth groups."

In addition to the above comments, the White House subsequently released an analysis report to the media on the 23rd, stating that between 2010 and 2018, the 400 richest families in the United States contributed US$1.8 trillion in wealth and income.Only paid an average of 8.2% federal income tax,Intended to keep beating*.

During the period, the Senate Finance Committee also handed in homework, and the focus of the proposal was "High net worth investors and large corporations".The specific content of the proposal is far less influential and disseminated in the Chinese community than the more concerned "Biden Tax Reform Plan 1.0".

The specific content of the Biden administration's tax reform will continue to be discussed through the game of the two parties.The final version, signed and approved by President Biden, will officially become law.

Above are"Biden Tax Reform"A big background.

Irrevocable Life Insurance Trust under the Impact of Tax Reform

ILIT, an irrevocable life insurance trust, is commonly used by high-income and high-net-worth familiesInheritance of wealthOne of the methods is to divest our large policy assets by default, so that life insurance will not be included in the inheritance, thereby avoiding the issue of inheritance tax on large policy assets.

Generally speaking, insurance policies with a level of 1000 million dollars and above, because they have exceeded the upper limit of the inheritance tax exemption, will be held by ILIT trust by default to achieve the purpose of reducing the size of the inheritance and realizing the effective inheritance of wealth.

And the tax plan proposed by the House Ways and Means Committee,Elimination of the current means of reducing inheritance taxes that are currently used for wealth inheritance, Which will have a huge impact on most families holding irrevocable life insurance trusts.

Will my irrevocable life insurance trust be affected?

Due to the existence of the exemption clause, if your irrevocable life insurance trust (ILIT) clause is well prepared and established before the law comes into effect, it will "may" be exempted.

The reason for using the word "possibly" is that most irrevocable life insurance trusts (ILIT) are Funding in accordance with the annual cycle to pay the annual premiums of the life insurance for that year.

According to a 9-page explanation issued by the House Budget Committee on September 27"Biden Tax Reform Plan 1.0"The report document (see Appendix P.2371 of this article) pointed out that this type of trust,It is very likely that they will not be exempted, thus losing the original intention of setting up an irrevocable life insurance trust, divesting personal assets, and avoiding high inheritance taxes.

in conclusion,If your Irrevocable Life Insurance Trust (ILIT) is in"Biden Tax Reform Plan 1.0"It is done before it becomes a formal law, and all premium funds have been put into this trust (Full Funded), then it will be exempted.

How to achieve the exemption of ILITs

If your ILIT Insurance Trust is facing this issue, you may need to considerBefore the relevant provisions of Biden's tax reform plan 1.0 formally become law, all the premiums required for this life insurance in the future will be injected into the ILIT trust at one time to obtain exemptions.

And this will lead to a core problem:The financial liquidity dilemma of insured households.

The possible cost of seeking an exemption: the liquidity dilemma

Families who use ILIT for wealth inheritance usually put a share in this trustLarge life insurancePolicy assets.

Take a 10-year Funding's $1000 million life insurance policy asset as an example.

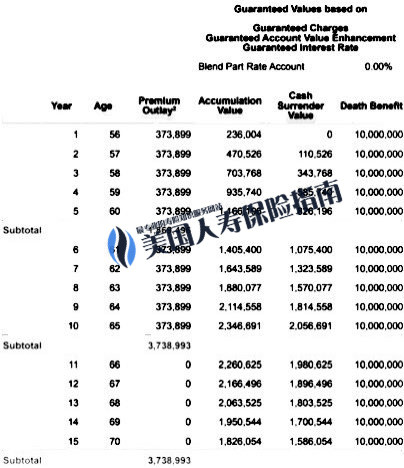

A 55-year-old male policyholder designed a copy forInheritance of wealthThe whole life insurance, the payment period is ten years.The basic situation is shown in the figure below.

From the picture above, we can see that the trust needs$37 paidAround the premium, cumulativeThe total premium is around US$370 million.

For insured families, the benefits are obvious-in addition to achieving life insurance asset isolation and avoiding life insurance asset elevationInheritance taxIn addition to the dual goal of the insured family, the insured family will achieve a wealth inheritance leverage of 25 times + in the first year.

If we cooperate with the company under the family's name to operate, it will have the effect of "icing on the cake".

however,Once Biden's tax reform 1.0 becomes law, it will completely disrupt the family's original wealth inheritance goal plan.

Under the current situation, in order to seek 100% exemption and avoid inheritance tax, insured families willHad to choose a one-time Funding to this trust.

If the insured family has just established a trust for less than three years, then such funding,Need to withdraw 300 million US dollars in cash at a time.

This is a heavy liquidity burden for any high-income or high-net-worth family, and it is also the dilemma that Biden's tax reform plan 1.0 brings to some insured families who use ILIT for wealth inheritance planning.

Epilogue: Money and time race

With the advancement of the direction of the Biden administration's tax reform, it is getting closer and closer to plugging some historical "loopholes" that existed in the past.In the field of large-amount life insurance, there is not much time left to react to the actions of families holding such ILIT insurance trusts.

HummingLife's private insurance consultant Heather xiong, ReceivingT.L.T.(TheLifeTank.com, Chinese name: American Life Insurance Guide Network )’S telephone inquiry believes that completing the ILIT exemption before the law takes effect is a race between funds and time, and professionals are indispensable.If actions are taken properly, there are still low-cost channels to help high-net-worth families solve the liquidity problem of premium funds.

Simultaneously,T.L.T.It will also continue to pay attention to the advancement of Biden's tax reform bill and its impact on life insurance and annuity insurance in the field of wealth inheritance. (End of full text)

(>>>Recommended reading:Biden Tax Reform in 2021|"Use it or Give Up", Wealth Inheritance and Inheritance Tax under the Influence of Biden's Tax Reform )

(>>>Related reading:How big is a large insurance policy?What are the major advantages of this type of life insurance?)

Welcome to discuss and leave a message

appendix

*"REPORT OF THE COMMITTEE ON THE BUDGET HOUSE OF REPRESENTATIVES TO ACCOMPANY HR 5376 together with MINORITY VIEWS BOOK 3 OF 3", U.S. House of Representatives Budget Committee, 09/27/2021, https://www.congress.gov/117/crpt /hrpt130/CRPT-117hrpt130-pt3.pdf

* "Biden pushes back at Democrats on taxes", NAOMI JAGODA, 09/19/21, https://thehill.com/policy/finance/572817-biden-pushes-back-at-democrats-on-taxes