In the annual Whole Life insurance dividend payout season, policyholders holding savings insurance policies often have a lot of questions with annual statements.A new problem that has emerged is,Can savings insurance (named Whole life in English) borrow money?

American Life Insurance GuideCommunity insurance financial consultant and columnist Heather xiong Invited to write a column and answered "Can savings insurance be borrowed?"This question, and through the actual insurance bill interest rate display and comparison chart, further explains the common problems about insurance policy borrowing.

What is savings insurance?

Savings life insurance, the English name is whole life, Also known asSavings insurance.Dividend insurance.

Savings insurance, Is a product on the American life insurance marketLife insurancetype.There are nearly a hundred financial companies on the market that have introduced different brands of savings and dividend insurance products to policyholders and investors.

(>>>Related reading:What is savings insurance (Whole Life in English)?Advantages and disadvantages of functional price and applicable groups)

Can savings insurance be borrowed?

Savings insurance (Whole Life in English) is an insurance product with cash value.After starting to generate cash value, the policyholder has the right to borrow money from the policy account.

Borrowing rights are an important reason for holding USD cash value life insurance assets.

It is worth noting that for savings insurance used to guarantee death claims, borrowing may result in the inability to guarantee the original death claims.

What is the loan interest rate for savings insurance?

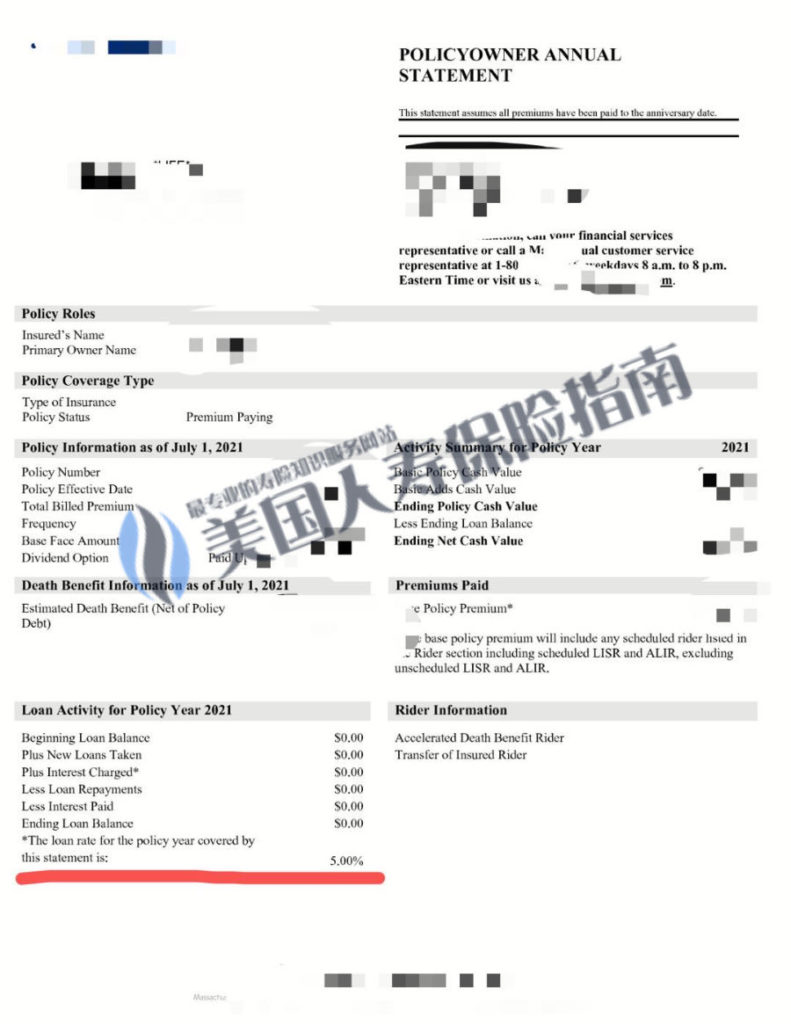

Savings Insurance (English Whole Life)The actual loan interest rate of the insured person is related to the life insurance company and insurance products.I provided a standardWhole lifeThe annual statement of savings life insurance serves as a reference for comparison.Insured persons can see the current interest rate at which we borrow from life insurance companies in the relevant part of the loan (marked in red in the figure below).

(Sample of Whole Life Account Annual Statement)

(Sample of Whole Life Account Annual Statement)

From the picture above, we can see thatThe loan interest rate provided by this life insurance company to policyholders is 5%.

Is this loan interest rate good? I will make a comparison below.

(>>>Related reading:What is the annual statement of a U.S. life insurance account?How should the income be viewed?)

What is the difference between borrowing money from an insurance policy and making personal loans from other financial institutions?

Taking the personal loan interest rate on November 2021, 11 as a comparison, we analyze the personal loan interest rate of financial institutions or banks and find that even in the current low interest rate environment,The lowest personal loan interest rate is 4.99%, and the highest is 35%.

(Personal loan interest rate Top4 20211101 – Nerdwallet)

(Personal loan interest rate Top4 20211101 – Nerdwallet)

It is not easy to apply for personal loans from banks and other financial institutions.

personal loanCan approve.How much can i borrow和What is the interest rate for borrowing moneyAffected by many factors such as "personal credit score", "credit history", "annual income", "current household debt" and so on.In one sentence, it's basically an experience of "watching the face and eating".

There is a famous story in history. When the founder of Disneyland was founded, Walt Disney had been struggling with financing and borrowing, but banks and financial institutions have always been "not optimistic" about his "fantasy" and "not buying it."

Walt (Walt Disney) not only mortgaged all personal assets, but also borrowed funds from life insurance to continuously inject personal funds into the infant Disneyland, and finally the world-famous Disneyland was born.

Compare the borrowing of a life insurance company, whether it’sIndex insuranceProduct, orSavings insuranceProducts, as long as insurance products have a loan function, we canUnconditional, note that it is unconditional to borrow funds from personal insurance policy loans.

(>>>Related reading:Insurance History|Walt Disney’s Life Insurance and His Dreamland Story )

Why is there no loan interest rate on my savings insurance bill?

If there is no relevant information such as loan interest rates on your savings insurance annual statement, there are many reasons.

One reason is that quite a fewSavings insurance productsThe annual bill does not provide or show the specific details of the loan from the life insurance company. You need to actively communicate with the life insurance financial adviser.

The other situation is more serious. When this happens to your savings insurance, it is usually caused by the following three reasons:

- The insurance design plan does not consider long-term benefits

- Lack of professional insurance policy audit

- Lack of maintenance and management of policy accounts

The accumulation of these three kinds of unfavorable factors over time will result in the cash value balance of the insurance account being insufficient to cover the cost of insurance. Therefore, insurance companies cannot provide available loan lines.If you are faced with the latter situation, I usually suggest to conduct an account audit immediately and take reasonable actions to minimize the expected or loss as much as possible.

Article summary

Whole Life Insurance, the full Chinese name isSavings Participating Whole Life Insurance, Provides the policyholder with the function of cash value borrowing and lending.

As competition in the financial market intensifies, the market has evolved a new type of exponential savings and dividend insurance. This type of exponential savings and dividend life insurance has changed the traditional dividend method of savings insurance, and policyholders no longer participate in the dividends of life companies. , But has a more outstanding loan interest calculation clause.

American Life Insurance Guide©️Finally summarized this article, cash value life insurance is an evolving financial asset.Before using life insurance for asset allocation, understand your insurance loan interest rate and lock in the advantageous interest rate in advance; and in the process of borrowing the cash value of the policy many years later, through cooperation with financial life insurance professional insurance consultants, choose a reasonable borrowing and withdrawal strategy , Formulate an annual repayment plan, so as to achieve the function of maximizing the efficiency of asset leverage. (End of full text)