Everyone inevitably experiences life or financial upheaval.When encountering these temporary changes, we can’t help but ask,”Can I temporarily not pay premiums for one or two years, or pay a little less premiums this year?"

With this question,The Life Tank©️Editor's Interview with Life Insurance Financial AdvisorHeather Xiong CFP®️, and started a conversation on the topic of premiums.Based on her explanation and the sharing of specific premium cases, we drew the following table and interpreted a statement of a ten-million-level insurance asset account to help policyholders understand the topic of suspending premium payments and reducing premiums. The following is Edited full text.

TLT: Which plans can reduce annual premiums, or suspend premiums?

Heather:In theory, a lifetime insurance account with cash value can temporarily reduce the annual premium, or postpone it for one or two years, and temporarily stop paying premiums.

A great progress in the financial and insurance industry is that considering the diversity of modern people's financial situation, many newType of Insurance Account, giving us flexibility in paying premiums.

| Type of Insurance Account | Can I suspend/reduce premiums? * |

| Term/term life insurance | ❌ |

| WholeLife/Participating Insurance | (I.e. |

| Universal Life/Universal Savings Insurance | (I.e. |

| Variable Universal Life/Securities Insurance | (I.e. |

| Guaranteed Universal Life | ❌ |

| Indexed Universal Life/Indexed Insurance | (I.e. |

(>>> Related reading:American Life Insurance Types Premiums and Prices and Comparison of Advantages and Disadvantages (Latest Edition))

TLT: After suspending premium payments, what are the worst consequences?

Heather : Although there are so many types of insurance, you can suspend premiums for one or two years, or temporarily reduce premiums for one or two years, but not all policy accounts can do this, and doing so has different consequences.

ComparedConsumerTerm life insurance (called Term in English) will terminate the policy contract if premiums are not paid on time.

For whole life insurance, there are many different situations where premium payments are suspended.

Worst case,If we stop paying premiums and the policy alsofail-safe, then the insurance company will not refund all the premiums you paid in the past, and we also lose all the coverage.

A more common situation is that, for various reasons, we want to suspend premium payments for one year, while also requiring the policy to continue to function normally; after one year, we repay premiums according to the original plan.

In this case, we can seek the help of a life insurance financial advisor, provide the original policy documents, design plan, account type, and annual account bills and other documents, and find a more favorable plan for reducing or suspending the payment of premiums.

(>>>Related reading:[Popular Science Post] What is the difference between wealth management insurance and consumer insurance?What are the buying tips?)

TLT: Who has the final say in suspending premium payments or reducing premiums?

Heather : Whether the payment can be suspended or not, and how much the minimum can be paid, is not someone who has the final say.Instead, it is determined according to the terms of our policy account contract documents and the current cash value balance in the policy account.

A common solution is to reduce the annual premium for the current year, which requires notifying the insurance company, using policy dividends to pay the premium, or using a policy reverse loan to pay the premium.

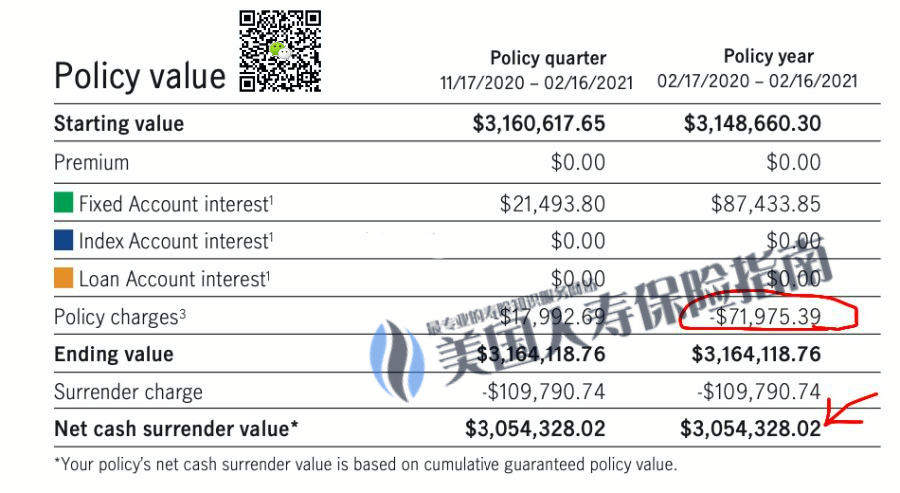

It is also possible to completely suspend premium payments for a year or two, or even stop paying premiums if there is enough cash value balance in the policy account.I use an actual operating policy account as an example (Editor's Note: As shown in the example in the figure below).

The red arrow in the figure above points out that thisPolicy accountThe balance is $305 million, which is kept in two financial sub-accounts.The amount in the red square is the current annual cost of various benefits in the insurance account.

Interest $87,433 > Cost $71,975

From the comparison of the red numbers, it can be seen that there are more than $300 million in cash value in the policy account, which are stored in different sub-accounts.inThe annual regular interest income generated by sub-account 1 is more than US$8, which is sufficient to cover the costs of the policy.

therefore,Policyholders can choose to use annual dividends, annual earnings, or principal to pay premiums.

Keep in mind that when we want to suspend the insurance payment or reduce the annual premium, we need to communicate with the insurance financial advisor about the policy account in advance.

If an insurance policy is designed reasonably at the time of purchase, it usually has more different options and solutions to deal with.

(>>>Recommended reading:What is the annual account balance statement for a life insurance account?How to interpret the insurance annual statement?)

Article summary

Through the conversations in this article, we help dollar insurance policyholders learn about the "flexibility" of modern life insurance accounts.And through this "flexibility" comes the possibility of suspending premium payments, or reducing annual premiums.

Simultaneously,Heather Xiong CFP®️Pointed out thatThe convenience of all this is supported by the cash value balance of the insurance account.

OnAccount cash valueWe can suspend premium payments, or even stop paying premiums, if sufficient.And by temporarily lowering the premium to the minimum account balance allowed by the insurance company, we can also ease the pressure on insurance payments for the year.

On the other hand, for policyholders seeking cash value accumulation or asset appreciation, suspending premium payments for 1 or 2 years will change the original planned operation of the policy account and reduce the growth potential of cash value.

For whatever reason, when deciding to suspend premium payments, or to take further action, you need to contact the life insurance financial advisor who opened your policy account, confirm the type of insurance account, and requestPolicy Plan Document, and the account balance.

Through comprehensive policy account audits and professional cooperation with life insurance financial advisors, I wish every insurance and wealth management family can achieve the goal of safeguarding their own best interests. (End of full text)

(>>>Related reading:What does an insurance formal design file (Illustration) look like?What are the controversies and highlights?)