年金储蓄 今日最佳利率 (min.$100,000)

固定收益年金保险(Fixed Annuity)

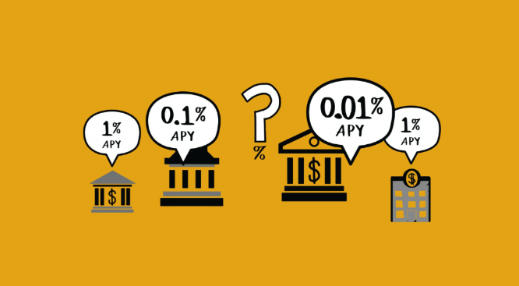

固定收益年金保险,是开设在保险公司的账户合约。投保人一次性存入一笔钱,保险公司保证每年给予投保人一个固定(Fixed)的储蓄回报率,通常高于银行定存利息。

- 利息回报有保证,同时保证不亏损本金

- 延迟纳税(Tax Deferred)的税收优惠

- 像银行定存产品,1年期到10年期任选

- 简单易懂,没有任何隐藏费用

- 提供网上保险账户系统,随时查看和支取

资金安全可靠

您的资金直接进入在保险公司开设的账户,并不经过任何中间渠道。

账户安全可靠

作为经纪服务公司,我们只提供信用等级在A/A+级别的百年保险品牌,网上账户安全有保障。

产品安全可靠

最保守和最简单易懂的年金理财类型,没有额外费用。